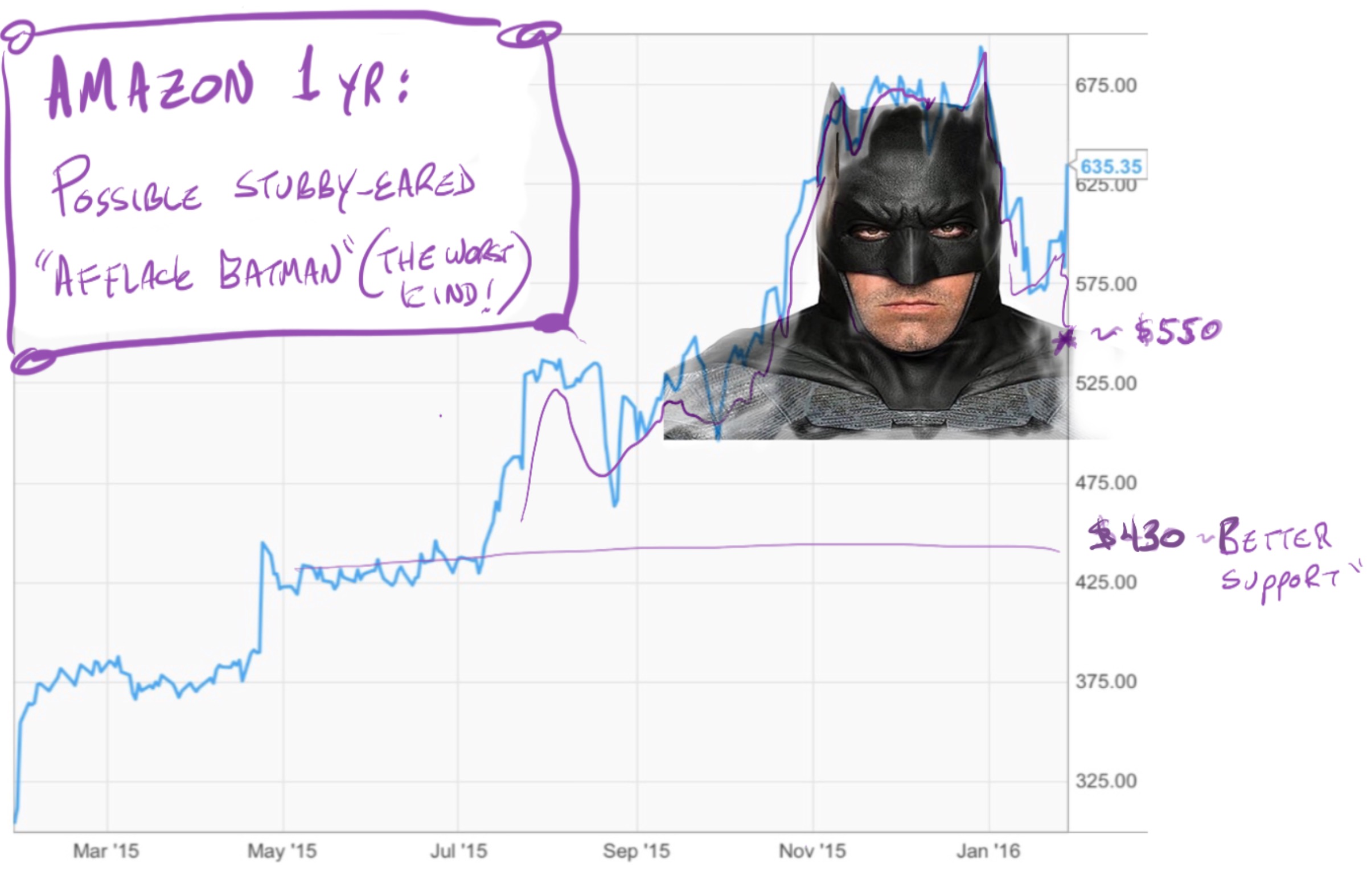

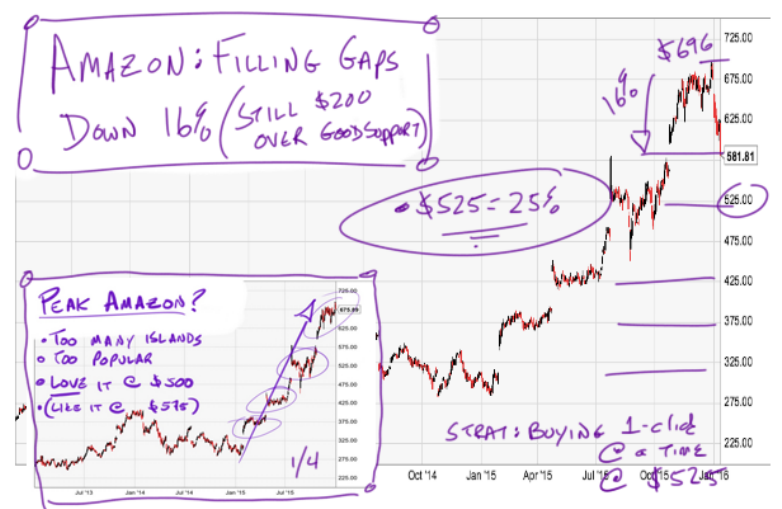

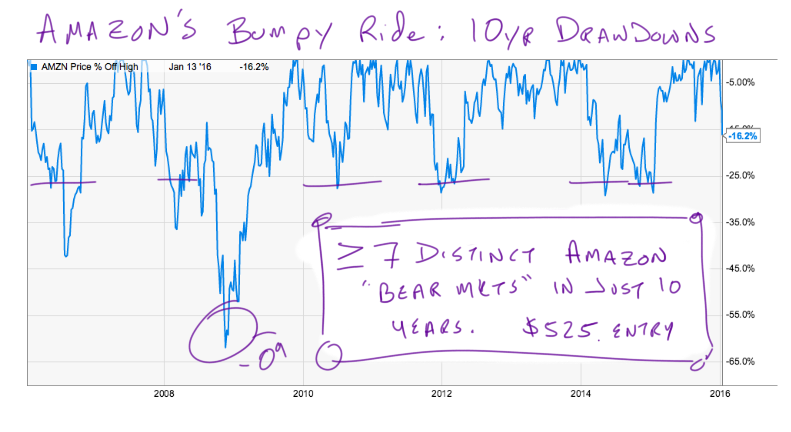

Yesterday I said Amazon’s chart was forming a “Brooding Affleck Batman; the worst kind!“.

Because this is the Internet someone had to take this the wrong way and start whining. In this case that was awesome because what the person was upset about had nothing to do with Amazon or stocks at all. @Hero_Spin on Twitter was upset at me for besmirching the reputation of the upcoming Batman vs. Superman: Dawn of Justice movie.

This gave me the rare opportunity to mix film and stocks while using my basso profondo “I’m Batman” hiss for the voice of my inner monologue. I was an accidental film studies and Psych dual major in college. I unwittingly took all the required electives required for a degree, just because I love movies.

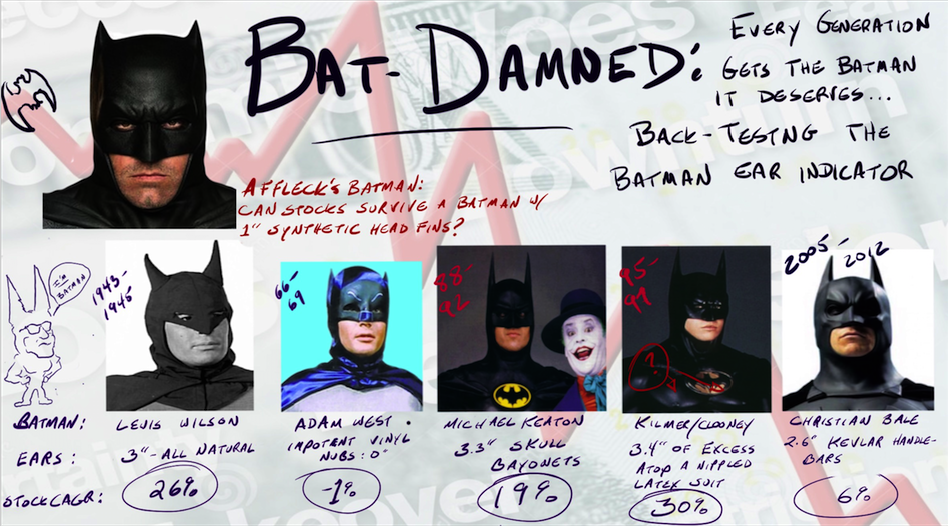

I also happen to already have a theory about the length of Batman’s ears and the economy.

@Hero_Spin tugged on the wrong guy’s cape, is what I’m saying.

First I’ll pre-review the film then I”ll share single most important scientific discovery since Calculus: the Batman Ear Indicator.

The Movie

Screw Superman. Just as a blanket statement. No one likes him. And enough with the Nazi Propaganda visuals. This is a comic book movie. It shouldn’t have the same score as Schindler’s List. Based on the trailers, DC’s twist on the Avengers was to take out the jokes but keep the training staff and pharmacists.

No judgements. He looks great. Affleck’s real Batman body looks like the suit they made George Clooney wear. Ben looks like a professional wrestler delivering a promo in the cuts of him as Bruce Wayne. I’m good with that but let us be clear: The only way a guy in his 40s can replace 30lbs of dad body with muscle is through both insanely hard work and a wife suffering from human growth hormone deficiency. Finding a Low-T friendly doctor would help as well.

I love Affleck’s movies, for the most part. He’s somehow underrated despite a monster career. But this isn’t his movie. He shares it with Superman and Wonder Woman and the guy who played Zuckerberg and who knows what else. This thing has train-wreck written all over it.

Oh, I’ll go see Ben Affleck as Batman in this ponderous, overwrought piece of garbage, @Hero_Spin. I’ll probably even enjoy it. But don’t tell me it’s good.

Which brings me to the theory:

The Length of Batman’s Ears is Correlated to Future Stock Market Returns

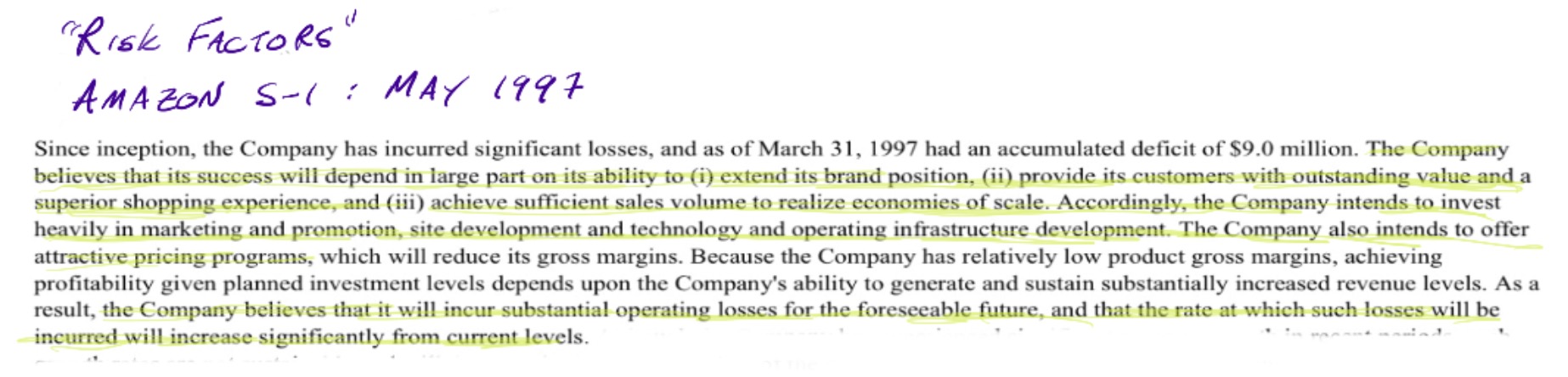

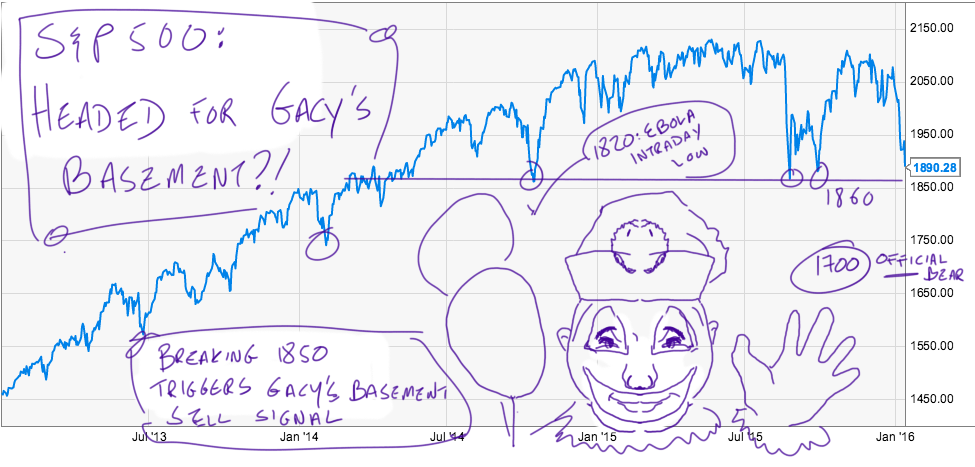

Art reflects the values of the generation that produces it. Just as we build the most garish buildings during times of peak mania, the super heroes which resonate with an era express the values and desires of their day. Batman’s ears are the mercury in phallic thermometers measuring the heat of our national ambition. They are economic indicators.

Which broadly fits if you work backwards from the 1960’s being the nadir of recent existence for both America and Batman. Vietnam. Race riots. Assassinations. And, starting in 1966 just in time for a bear market, the world was introduced to this:

Stocks fell 22% over 8 wrenching months.

This morning my son and I watched Keaton Batman while I calculated the length of every major television and cinematic Batman’s ears, relative to his skull. I then ran stock market returns during each of the 5-distinct Batman reigns.

As it turns out, the Batman Ear Length Indicator is a balls-on stock market tell for 80 years. The longer Batman’s ears are the better the stock market during the period. Note I’m not talking art. Just size. The most bullish Batman was Joel Schumacher’s nipped Clooney / Kilmer outfits, with their ears like stout Viking horns. Perfect for a run of 30% CAGR in Bill Clinton’s America.

That’s not a trading call. Trading based on Batman’s ears would be insane. Yet it is fact. It’s also fact that Batman vs. Superman hits theaters March 25th. Do with that information what you will.

Comments »