Everyone Loses

In the poker game of investing Bear Markets are the rake*. Everyone loses.

Bears are different than crashes. When stocks crash a small but vocal minority of investors get the timing right and make a fortune. The winners in bear markets are the investors who don’t die.

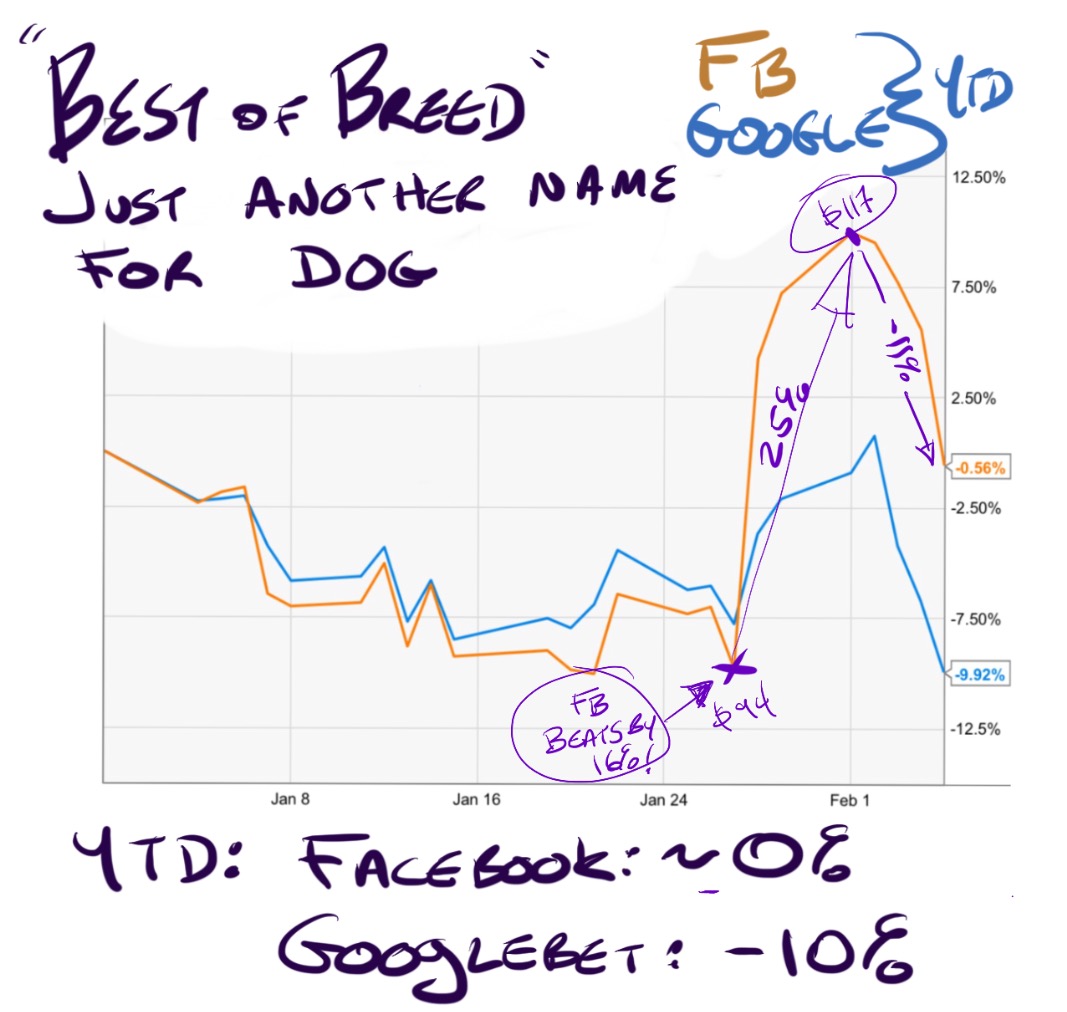

Yesterday the ursine claws of doom targeted the smug with particular relish. The FANGS got killed just because screw that stupid acronym. They were down 10% for the week. GoPro on the other hand was up 1.8% Friday (though it’s still down 45% YTD). And gold was strong. Pathetic holdings up and past winners trounced. The resulting sound of battle was a mash-up of gloating lepers still holding the GLD and robust cries of agony from freshly-killed champions.

It was horrifying.

McDonald’s fell 4.4% on Friday. Seriously… Screw you, bear market.

There are no winners here. It is a level playing field of misery.

“Air-Pockets” Lurk Everywhere

True students of the stock market tend not to believe in any one “system”. The game is fluid. Fundamentals are never as objective as devotees claim. Charts are only voodoo to people who don’t understand them.

Prices are ultimately set by humans. Humans are idiots. Imagine how boring life would be if we weren’t. Which is a nice way of spinning the fact that every morning when you turn on your computer there’s a reasonable chance a stock you own will have imploded.

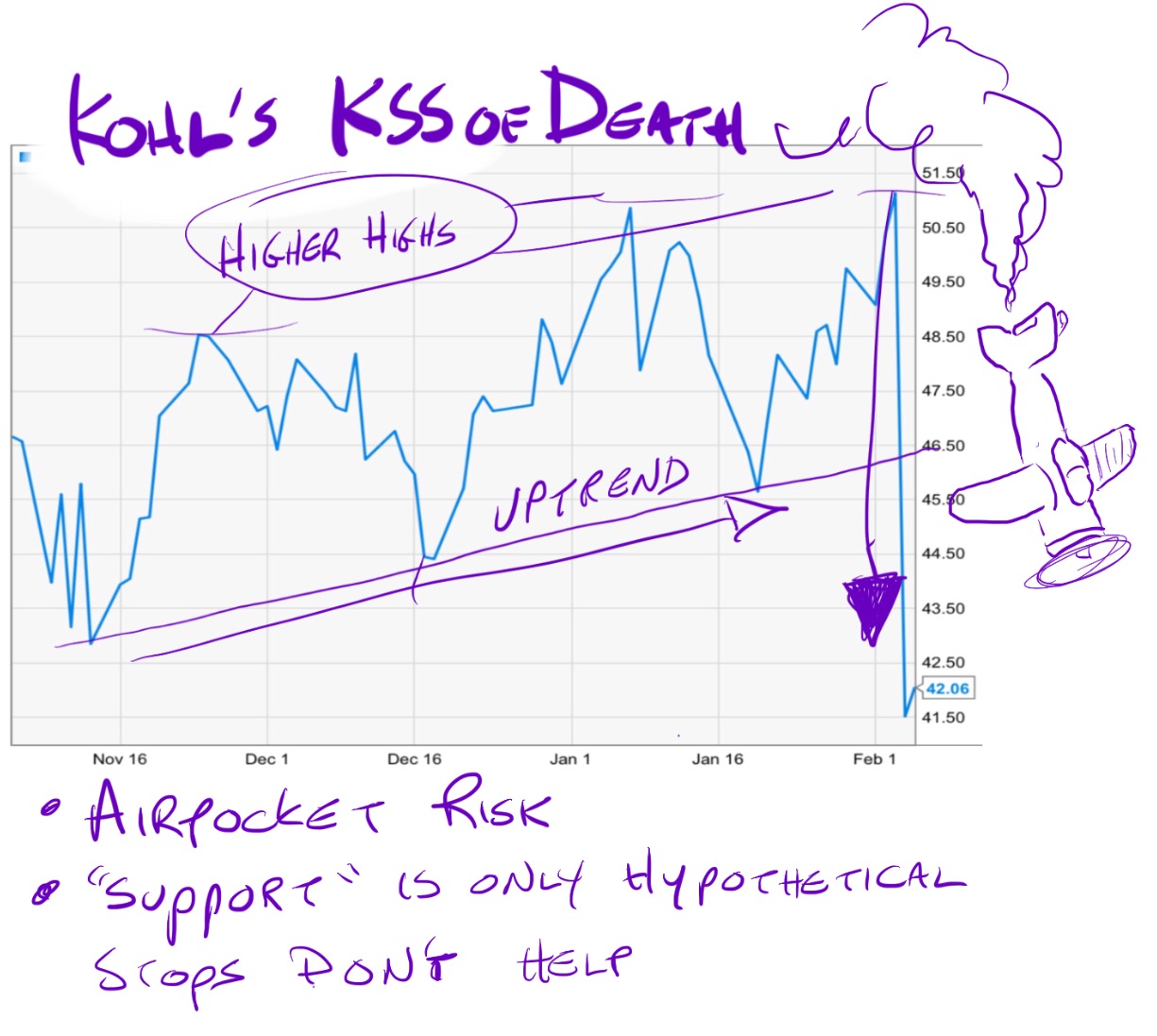

Forget LNKD. Too Obvious. Here’s a 3 mo chart of Kohl’s:

Kohl’s is a dump. I find the stores maddening and I’ve never owned the stock. But right up until a couple days ago KSS was a very sexy looking chart. Going into earnings the stock was over $50 and looked to have support at about $46.50.

The stock lost $10 overnight on a warning. If you had a stop-loss it was hit $5 below support. Puts may have saved you but you had to be very good. For most KSS holders it was simply an instantaneous 20% loss.

Mr. Market is a Bad Mutha. He can smell hubris and fear. Seek to exude neither.

Bear Markets Are An Emotional Process

Investor moods aren’t binary. We don’t just feel Euphoria or Despair. Investing is deeply personal and entirely emotional. People grieve losses much like they grieve loved ones. Denial, anger, bargaining (eg “Please God, get me back to even”) etc.

Right now investors are starting to get a little pissed off. They’re looking to blame people for the sell-off and no one makes an easier target than the media and punditocracy.

I’ve got some experience with this. I don’t like to talk much about it but I’m kind of a big deal. By any objective measure I’m the 3rd or 4th Greatest Television Financial Pundit of the Modern Era. Really. That’s not a boast. It simply is.

The point is I know what it’s like to be on TV every night when the public starts looking for scapegoats. It’s ugly. People are mean.

Here’s some tough love: No one on financial television is running your portfolio. They didn’t make you buy a stock. They didn’t force you to sell. Some television pundits are good. Some are bad. None of them is paid to do anything other than share their opinion.

If you disagree with anyone in particular do the opposite of what they suggest. Don’t troll them. It’s mean and it makes you look like a whiner.

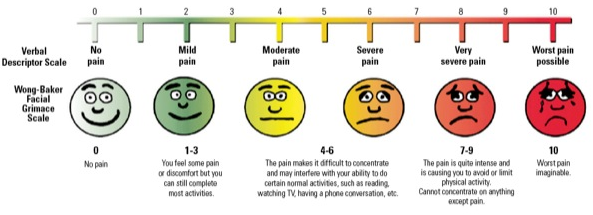

Simple Rule of Thumb: Above is the Wong-Baker FACES Pain Rating Scale. It’s used by doctors world-wide to asses a patient’s level of suffering. If your portfolio makes you feel worse than 6 don’t Tweet anything directed at a television personality. I promise you, they are all trying their very best.

And if you make money short keep it to yourself. To paraphrase Brad Pitt in the Big Short, “You’re betting against America. Don’t dance”.

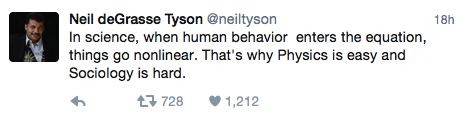

No one actually knows what’s going to happen next. The best you can do is get the odds slightly in your favor. For some perspective on the difficulty of predicting markets, here’s a Tweet from Neil deGrasse Tyson yesterday:

Economics is the bastard love-child of Calculus and Sociology. It’s Physics for people who couldn’t quite hack the math. Economics is bullshit, is what I’m saying. Do you really think mass psychology can be broken down into a formula? Please.

No one is keeping the answer to this market a secret. We’re all just trying to figure out the same puzzle, some are just doing it in public.

The Week Ahead

In the 220-odd years of formal stock trading in the US meaningful pullbacks have hit their lows during Friday twice (that I know of). Once in 2001 and again in 2004.

I’d expect the S&P at least retest the lows near 1800 in the next couple weeks. That’s not a trading suggestion. The most likely outcome is I’m right but there’s some sort of brutal, ironic twist that prevents it from being a useful observation. Like we go to 2000 then drop 200 overnight.

I can’t tell you what do. I can only help you learn how to think for yourself. There is a huge difference.

* Rounders reference. The Rake is the house take in poker tournaments. It’s the money that disappears, from the gamblers’ perspective. In Wall Street terms, The Rake = the money lost by longs but not made by offsetting shorts. Plenty of people were short LinkedIn but not nearly as much money was gained short as was lost long. The spread goes to money heaven. Because Bear markets maul everyone.

Specifically:

Comments »