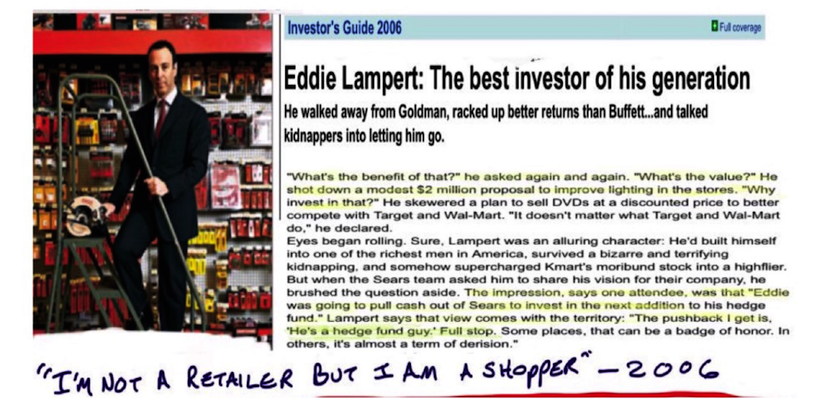

Ten years ago Sears Holdings Corp boss Eddie Lampert was widely regarded as the best investor of his his generation. Already a billionaire at 43, Lampert had levered a sweetheart, bizarre deal for Kmart into ownership of the once mighty Sears. He seemed poised to reverse the fortunes of both chains and turn the combined entity into a retail juggernaut.

The financial press salivated.

“Eddie Lampert is the Steve Jobs of retail: he thinks differently and acts differently, with extraordinary results” raved Fortune.

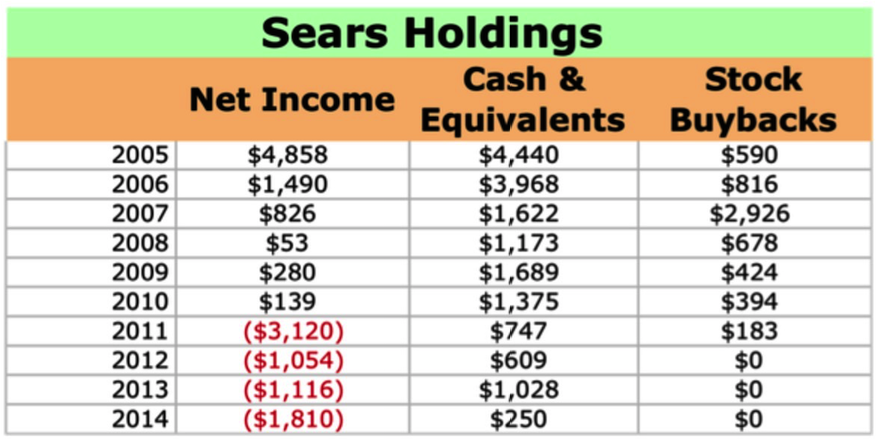

As it turns out, not every aspect of retail needed a rethinking. Take for instance the notion of investing in the stores. Lampert proudly shot down minor investments on store maintenance, sneering at the lack of ROI in providing customers a clean, safe place to shop. He spun off real estate and gutted the balance sheet with buybacks.

“The pushback I get is, ‘he’s a hedge fund guy’. Full stop. Some places, that can be a badge of honor. In others, it’s almost a term of derision.”

10 years later it’s easy to be more specific. As far as retailers are concerned calling someone a “hedge fund manager” is tantamount to hate speech.

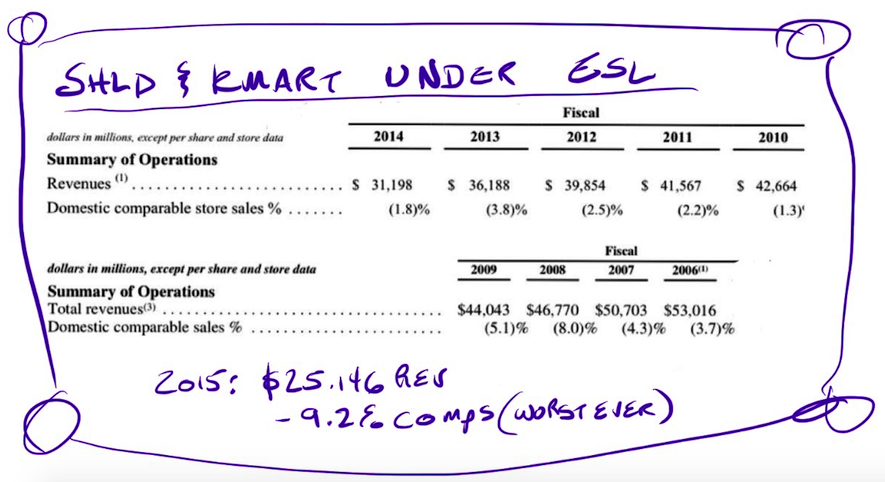

Since those remarks were published shares of SHLD are down more than 85%. The company has posted net losses of $3.8b, including results announced this morning. Same store sales have fallen every year, including a stunning -9.2% for the year just ended.

SHLD’s top-line has dropped by more than 50%, accounting for more than 100% of the entire decline in total US department store revenues over the last 10 years (based on census data).

Meticulous Cannibal or Bumbling Fool?

What makes Sears interesting isn’t the abject failure of the stores but the mystery of whether this is the story of a bumbling retail exec or a masterfully cold-blooded, lucrative vivisection of what was the once the biggest company in the world.

People in finance discuss Lampert in hushed tones. A former Goldman Sachs employee and Richard Rainwater protege, Lampert is more connected than Keyser Soze. For years anyone daring to bash the company could expect to be pressured by Lampert acolytes for inaccuracies real and imagined. (Not a rumor… actually happened to me several times).

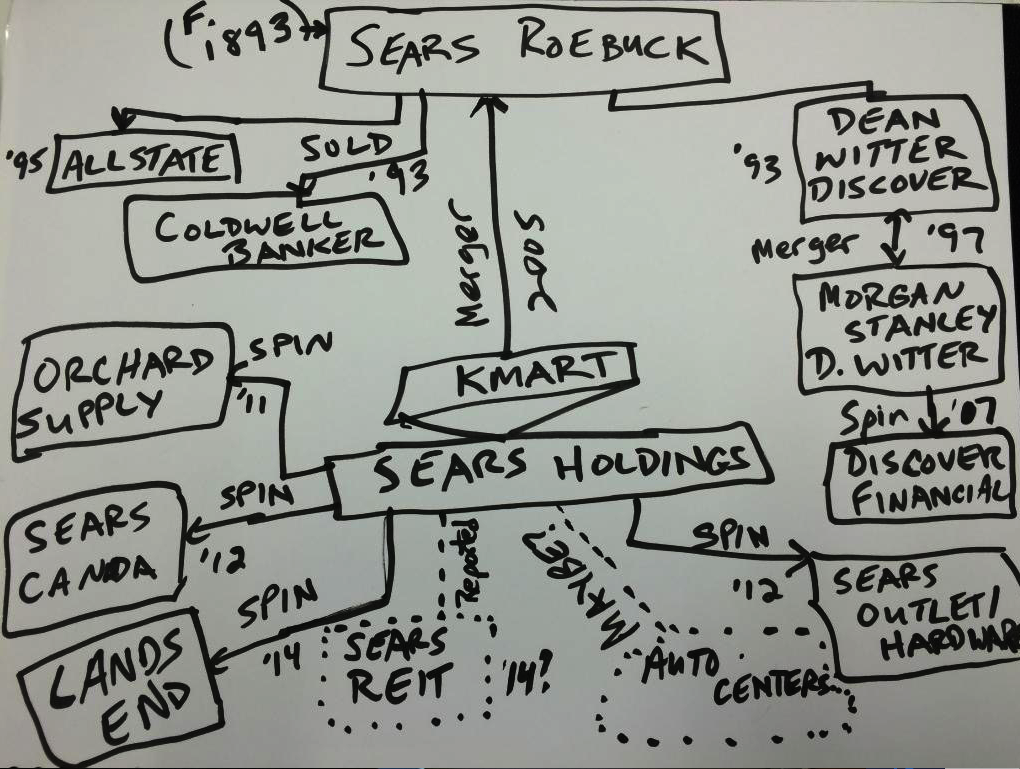

Such murkiness only fuels the legend. My former colleague Mike Santoli put together this back-of-the-napkin family tree for the Sears corporation. It’s a starting point for calculating ESL’s ROI but it doesn’t tell nearly the full story.

Lampert has been taking control of Sears assets and cutting questionable lending deals using assorted companies under his control since the early stages of stealth liquidation.

Is it illegal to tell thousands of investors and employees that you’re pushing them into the future even as you slowly chip out the ice from beneath their feet? No. The not-so-hidden secret of finance is that the line between crime and opportunism is defined by who has the best lawyers.

Here’s the link to an SEC filing describing a deal between Sears and ESL in which Lampert loaned Sears $400 million. For collateral ESL forced Sears to put up “25 locations of the lender’s choice”. The value of the real estate in question would be anywhere between $500 million and $1.5 billion, based on prior transactions.

Lampert has been both sugar daddy enabler and butcher to SHLD for years. Once the company’s cash had been spent on buybacks Sears started requiring emergency funding on a semi-regular basis. ESL shell companies have been there to make the loans every time. Altruism or usury is in the eye of the beholder. Since he’s on both sides of every deal it’s all but impossible to figure out whether or not Lampert has been abusing his position.

The Cavalry

Today Sears announced that Bruce Berkowitz of Fairholme is joining the board. Berkowitz is a savvy investor, despite being a SHLD holder. Previously supportive of Lampert, Berkowitz signaled a change of tone, and increased position size, late last year. He now controls over 20% of the company and is ready to start flexing.

At this point Berkowitz is likely to focus on making sure his investors get a fair cut of whatever meat is left on the bone. Sears has been doing everything it can to drive away customers for the last decade. After this much damage Berkowitz’ goal isn’t a recovery but a dignified end.

If you enjoy the content at iBankCoin, please follow us on Twitter

Sears is such a mess. Talking about a big mess, Japan, yep it’s a given, but such a Catch 22, Weaken the Yen and it hurts the Yuan, which makes a weaker China which hurts Japan and strengthens the Yen for risk off. Which causes the Pension Funds in Japan to get hit hard.

Jan ’18 puts are about 1/3 the cost of the stike price for otm. Too early?

i saw the writing on the wall over 2 years ago and tried leap bankruptcy puts on both SHLD and JCP….unfortunately, both sets expired worthless as both companies are still alive.

You can’t short it. It’s like shooting at the devil. What if you miss? He’s murdered shorts all the way down.

I tend to read the situation as evil genius. The company loses a billion a year and just keeps hanging around, finding chunks of skin to peel off.

The squeeze Lampert put on $SHLD shorts in Jan 2012 was legendary. I’ll never forget that.

I used to buy all my appliances at Sears.

I go else where now.I’m a piker

of a buyer and they are not interested anymore.

I’ts not like they anything better going on.

I remember part of the long thesis for $SHLD when ESL came in was that, even without a tremendously successful turnaround of the actual retail business, their real estate was worth a fortune by itself. Is the $M story similar in that regard?

Yup. And ESL did well on selling a lot of stores even before the REIT. The prob for SHLD was that they ran out of good stores. Prob for Macy’s is who the hell is the competitive bidding for their flagship stores?

Nice tale kept me reading. (beyond the failing-of-institution interest) Thanks for the Q (&A) on macy’s. I would love, love to see M be crumbled as part of the post-amazon r.e. shuffle. Still good case study on execs/model of SHLD

I could write a whole history of retailers failing due to leverage and / or being run by financial gurus.

https://www.washingtonpost.com/archive/business/1987/10/15/dayton-hudson-again-rejects-takeover-offer-from-hafts/d6cf6c36-d2fe-480e-8330-c98f829a6d60/

I was a senior in high school when the Haft Family made its early push for Dayton Hudson / TGT. I left for college the next year and never really moved back to MN. That was 1987. My earliest memories of tagging along on store visits with him are mixed in with Ali – Foreman which puts them in 1974 and 5. That makes “Asshole Bankers Don’t Understand Retail” the final lesson in what was a roughly 12 and a half year live-in retail apprenticeship under the guy who was central to the creation of the modern Target.

Which is nothing I really did. I was just lucky as hell to be raised by (and get along with) a very unusual guy who was certainly one of the top 10 merchants from 1950-2000. (He’s wildly underrated but I’ll argue his placing with anyone).

[Foregive the digression. Quite a bit of coffee is involved in these Sunday morning columns and visits to the comment section]

I’ve touched on this before but never directly. Ken’s problem with retail LBOs was the debt. He wasn’t afraid of the risk. He loved risk. What he hated was cheap, dirty stores. Or empty cash stands when there was a line. Or flimsy displays… Wow, did Ken Macke hate flimsy displays. You end up with all of those when you lever up retailers whether it’s to do an LBO or buyback or dividend. Retail margins are terrible. 10% is about your cap. There’s no room to add excessive debt payments without cutting spending. Cutting spending leads to sloppy execution which becomes a messy store and so help me God if a Target store was dirty my dad would grab the nearest flimsy display and use it as a staff to Smite the store manager dead like Ken was Moses himself. (May be conflating that memory… I was a kid)

The Haft family ended up crapping out of Daytons. The Hafts had been front-running their own press clipping. They’d get long, announce a bid then sell down the position in the ensuing ramp. Lather-rinse-repeat. In the summer of 87 the Hafts were out. By the time of the article, October 15 1987, the Hafts were long up to 4.9% at $50. They’d bought huge in the fall of 1987.

Which means the Hafts were levered long about $300m of DH for the crash of 87. The stock fell somewhere around 40%. So Endeth the lesson on mixing leverage and actual business.

[another funny point on the article… Check the part where it says Daytons sent a “tersely worded 2 page fax”. The original draft of the fax was 2 words. “F— you”. The lawyer wouldn’t let Ken send it. I was listening to my dad on the call when he asked his lawyer “Which part do you think the Hafts won’t understand?”]