As I suspected might happen, Amazon shares are being clubbed mercilessly after the company missed Q4 estimates and issued laughably broad guidance.

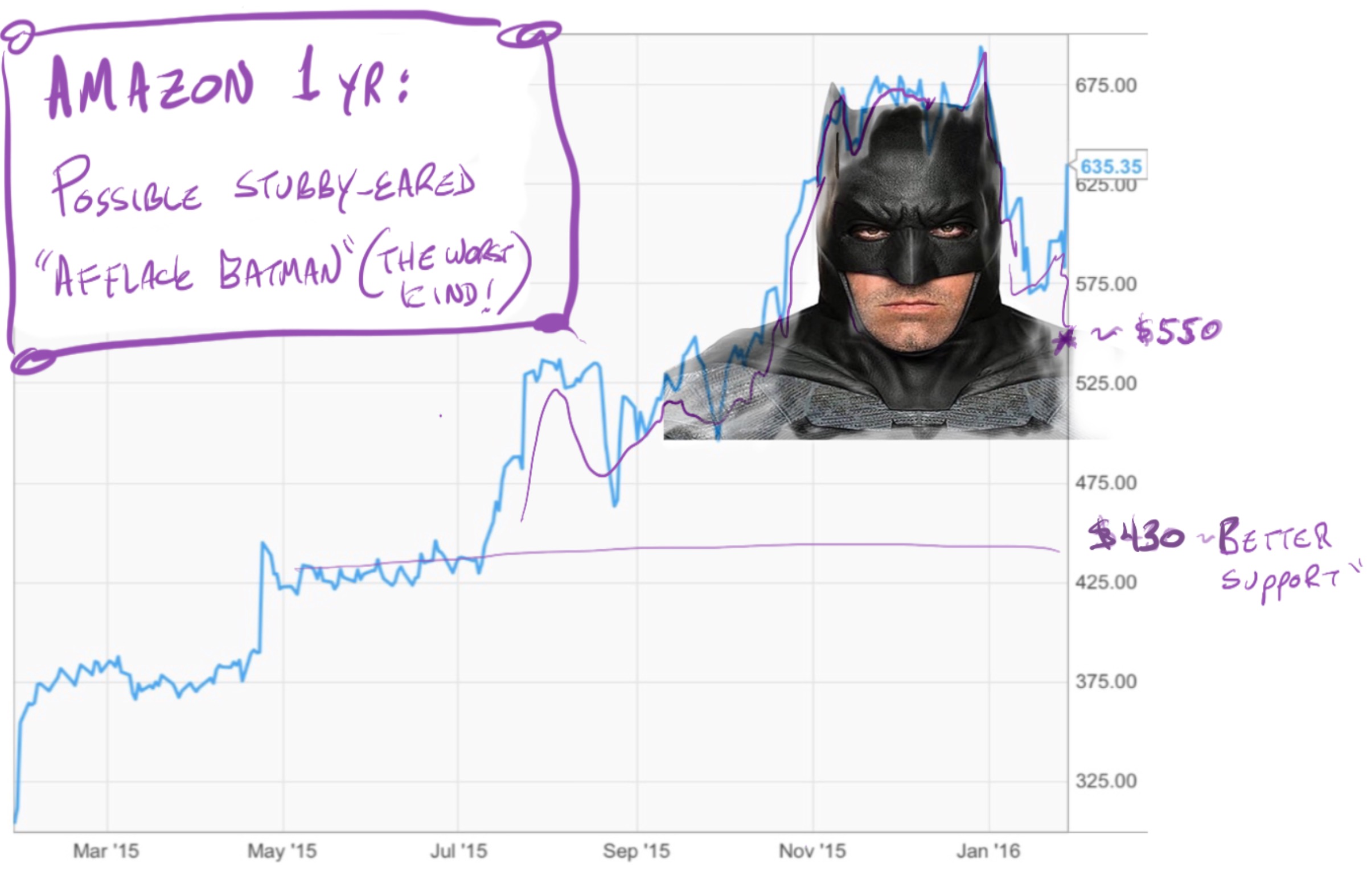

Amazon stock is down about 10% early and the chart is frankly sort of ugly. There’s a combination head and shoulders / Brooding Affleck Batman (the worst kind) forming. Yesterday’s rally was a cruel trap, driving shares into weak hands. There’s some support on Batman’s shoulder but the current shareholder base most likely gets scared out lower.

Is it a buy? If you’re patient but you have to understand what that means with Amazon. Yesterday I showed a chart of Amazon stock pullbacks over the last 10 years. Her’s what the long-term looks like (hide the women and children):

To capture Amazon’s gains you’ve have to ride it out periods like the 95% spelunking after the dot-com bubble burst. Doing so is all but impossible for most investors. Investors with stomachs made of iron (or who were lucky enough to forget about owning the stock entirely) have been insanely well rewarded for their faith:

Amazon Has One Job

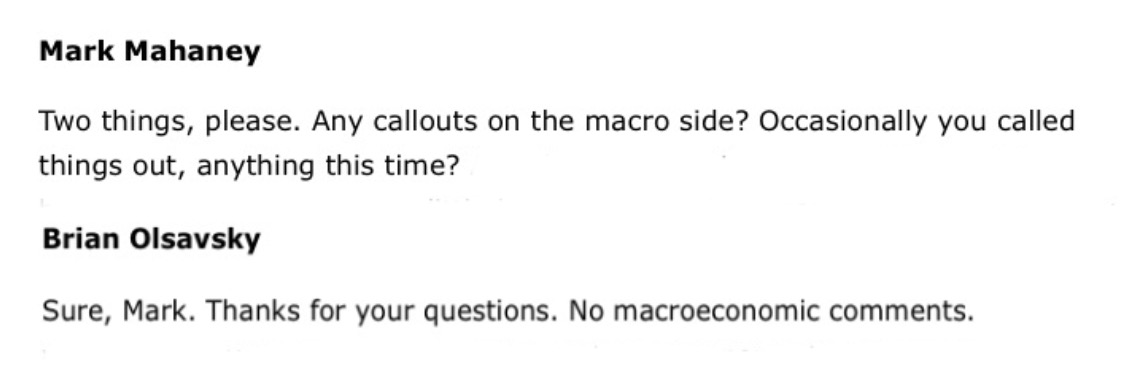

In many ways last night was quintessential Amazon. The company demonstrated total disregard for short-term planning in favor of growing the business. They don’t care about anything except customers. They never have. This tunnel vision often creates a cultural divide between execs and analysts during conference calls.

Here for instance is CFO Brian Olsavsky on what’s happening in China:

To me that’s a perfect response. Every retail CFO should have exactly the same answer. As for estimates, Olsavsky cautioned that nuanced predictions of even the ongoing quarter are “impossible” then said Amazon will earn somewhere between $100 million and $700 million in Q1 versus $255 million last year. That puts the earnings growth rate for this quarter at somewhere between -60% and 155%. Best of luck plugging that into a spread sheet.

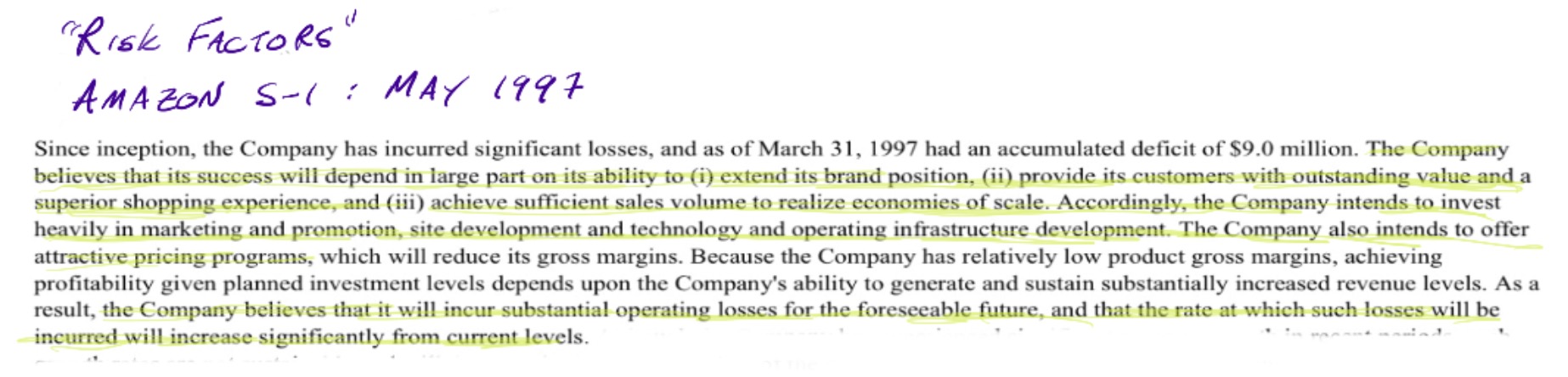

Amazon’s indifferent approach to guidance should have been exactly in line with expectations. Amazon has done precisely the same thing literally every quarter since its IPO. Here’s a clip from the Amazon S-1 in 1997:

20 years ago Amazon set the goals of “(i) Extending its brand position (ii) Provide its customers with outstanding value and a superior shopping experience” then says achieving those goals will incur “substantial operating losses for the foreseeable future”.

Amazon has spent 20 years living up to that vision. Anyone who was surprised by the quarter or that Amazon is going to spend billions killing the shipping industry because same day shipping is the future (and Amazon is already doing it in 25 markets) simply hasn’t been paying attention.

Amazon is like the Grateful Dead or Opera. You either get it or you don’t. Even if you love it, and I freaking Love Amazon, you don’t need to be there all the time. I’ve been out of Amazon for a while but I’m looking to start to nibble. In other words, I’m following the plan I laid out at at the beginning of the year (from Jan 4):

If not I’ll wait. They’ll be back.

Value-Trap?

The quarter was fantastic as far as I was concerned. North America revenue grew 24% to $21.5b in the fourth quarter. For the sake of comparison, Amazon started this year with about the same top-line as Target. Target is expected to do $21.9b total in Q4 which represents a growth rate of ~0% (zero percent).

Amazon gets a lot of abuse for being over-valued. Some of that is deserved and some is because Amazon is often covered by tech analysts who typically don’t know (or care to know) much about retail. Let me put Amazon’s US growth into context. The NRF says holiday retail sales grew a meh 3% in 2015. Online grew about 9%. Again, Amazon grew 24% year over year just in North America. Of the top-10 mass merchants in the country CostCo has the next fastest top line expansion. For the Holiday quarter Cost might grow 5%.

Amazon is playing a different game than the rest of the industry. There is no “correct” valuation for Amazon because nothing like this has ever existed. No retailer has ever been this big relative to the industry and still growing anywhere near this fast. Amazon’s numbers look like young Gretzky getting 200 points in one NHL season or Barry Bond’s “Big Head Era” stats. That’s just as a retailer. No one on earth knows what AWS could be worth but it’s a lot.

Amazon makes money. Not much but remember even really good US retailers are only netting 6 or 7 cents of profit on every dollar. Between breaking even while sucking up billions of dollars in market share a year or grinding out 5% growth and net margins I’ll take the former. Any valuation work beyond that is just doodling.

If you get a 50% pullback back up the truck. Anything less than that is almost noise as far as Amazon sees the world.

If you enjoy the content at iBankCoin, please follow us on Twitter

Great post. I wonder if there will ever be a 50% pullback from here…I’d love to scoop some up.

Their AWS division is phenomenal, as Lord Howard pointed out on Bloomberg yesterday. So phenomenal, $FB just had to quietly shut down their competing Parse platform. AWS’s lockdown is unfuckwithable.

These posts are an absolute joy to read.

Except for the part where it was the worst month for the portfolio in close to forever, Macke Month has been awesome — bravo

The Affleck Batman formation is the worst – only the Charlton Heston loin cloth pattern aka NRA Chuck cock and ball formation exceeds its grievous majesty.

If you see it on horseback, clap your hands and say $250.

killer analysis

Do you think its worth $500 billion like some analysts claim it should be? With a pittance of earnings compared to $AAPL? Will they ever make a $50billion profitable year?

Will this BoJ rally last longer then the BoJ QQE rallies from before? Us Bears so hate central bank action.

What a great piece. Thank you Jeff!!

Fantastic piece. I think it’s hilarious and cute that the analysts took a couple of straight quarters of positive earnings as some sort of love note from Jeff Bezos. I guess they will never, ever learn that Jeff just doesn’t give a crap about them. Jeff continues to drive the company to make money hand over fist in a really disciplined way, ignore any noise from the outside, and reinvest profits into growing the business at a furious pace. If investors want to come along for that ride, they’re welcome to join in, but they aren’t going to be coddled along the way. Amazon controls the ride, not Wall Street, and Wall Street doesn’t quite know what to make of that.