Last August during the China meltdown Apple CEO Tim Cook skirted SEC rules by sending an emailing to CNBC star Jim Cramer. The goal was reassuring investors.

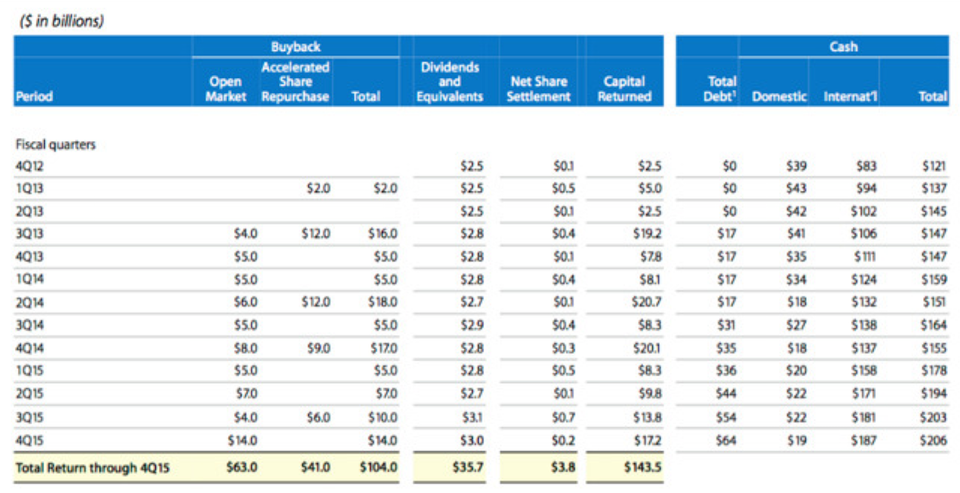

Cook was talking his book. During the quarter ending September Apple spent $14 billion repurchasing its own shares at an average cost of $114. The company also completed a $6 billion “Accelerated Share Repurchase” last July, retiring 10m shares (listed below as part of a Q3 transaction but completed in July, per Cook himself during the Apple Q4 call).

During the last 3 months of 2015, in the quarter reported last night Apple bought $3b worht of stock on open market purchases at an average cost of just over $115 and yet another Accelerated Repurchase for $3b to get 20m shares on initial settlement. (For a good primer on why the average cost of accelerated repurchases is so much higher than open market transactions see this from the Motley Fool).

All of which would have been fantastic had Apple not discovered what the rest of the world already suspected: China isn’t great.

In his opening preamble Cook spent 2/3rds of the opening 750 words talking about currency, Chinese headwinds and the generally horrific turn the world has apparently taken since Cook emailed Cramer and launched an aggressive battle to protect Apple’s shareprice by throwing money at it.

“We’re seeing extreme conditions unlike anything we’ve experienced before just about everywhere we look” Cook said, all but ululating as he handed the media an almost perfect spotlight quote.

Cook went on to guide lower for the current quarter. Product shipments were a disaster on the iPad. Watch sales weren’t specifically disclosed (which means they are insignificant) and margins are a question. Currency alone swayed revenues enormously according to Apple itself. Those facts should pretty much eliminate the idea that companies in general, or at least Apple in particular, has a better guess than anyone else when it comes to their future results and share price.

Theoretical Cash

The company says it has $216 billion in cash but that’s misleading, to be nice.

Apple has about $16.5b in US cash, $53b in debt and another $35b in non-current liabilities. 93% of Apple’s cash is overseas and it currently costs 40% to repatriate foreign earnings.

How do you value all that foreign cash? You have to discount it dramatically. If you assume Apple repatriates the money at full tax rates (40%) Apple has an amount equal to $136b in real value. If you assume Apple can keep skirting the repatriation problem by borrowing cash in the US against the foreign cash of indeterminable value you have to discount the money for the interest paid, at the very least.

All of which ignores all that currency trouble Cook was nattering about last night. If Apple gets paid in China when does the money become dollars? What if cash flows drop? IBM once thought it had plenty of cash for buybacks. It spent a decade spending cash on shares and missing opportunities. Now IBM has neither the money nor the ability to execute.

None of this matters to buyback fanboys, the most vocal of which being Apple shareholders. Here’s AppleInsider’s take on buybacks from last October:

The key parts there are the assumption that both shares and earnings will rise. Also, Apple executives are uniquely positioned to “fully grasp the potential of the company in the global markets it is operating across.”

Everything about this is wrong. More concerning still, Apple itself demonstrably has no grasp on what’s happening in China this year. Consensus estimates, the muddy bedrock on which buyback logic rests, are coming down as I type.

Rising debt, lower margins, uncertain earnings and a recent track record of buybacks utterly failing to help the shares. What’s the answer?

More buybacks, natch.

“We plan to be very active in the US and international debt markets in 2016 in order to fund our capital return activities.”

Selling Shares to the Least Efficient Buyer

Buybacks are the biggest scam since GreenMail. A company repurchasing shares is literally the least efficient buyer on earth. If you had $100 in cash yesterday you could have bought 1-share of Apple from me. Less the drag of transaction fees we would each still have about $100, or $200 total.

When Apple or other companies buy back stock they retire the shares. That’s the whole point. If Apple didn’t retire the stock the repurchased shares would drag on EPS. What’s more, the entire underlying assumption of buybacks is reducing shares outstanding will raise the price of the stock by an equal amount (which only makes sense if the market is efficient… and if the market is efficient there shouldn’t be “irrational” price drops in the first place).

The only buyer to get nothing out of Apple’s share appreciation since it launched its buyback program in 2013 is Apple itself.

The key to buybacks is that the shares outstanding disappear. So, unlike every other purchaser on earth Apple can’t practically sell shares purchased on the open market. Companies doing buybacks profit less than literally every other potential share holder when a stock rises.

If Apple buys my 1 share I then have $100 and Apple has 1 share which it immediately shreds. 50% of the total pie has been destroyed. Apple doesn’t get to count appreciation on repurchased stock. It means nothing to them. The cash and the stock are gone, all Apple has left are the interest payments. Just like John Law trying to stop the implosion of the Mississippi Bubble in 1720 Apple is effectively buying stock and lighting it on fire.

If the stock goes higher and earnings rise and cash flows stay robust that’s no problem. Should anything in that list not happen as expected the whole model falls apart immediately.

The Cult of Buybacks

I’ve harassed Apple on this point in the past and been shelled for it. I don’t care. Buybacks are a scam and I’m one of the few people who understands why and doesn’t have a financial interest in keeping it a secret.

History will be unkind to the capital allocations made by corporate America during the era of free rates. As usual, individuals are the sucker at the poker table with the Buffett’s and Icahn’s of the world.

Honestly, what would you expect?

If you enjoy the content at iBankCoin, please follow us on Twitter

During the conf call, Tim Cook announced he was gay again.

An exploration of gender and sexual preference inequality would have been much more bullish than Apple being the last to discover China is going pear-shaped.

Are we sure he isn’t a terrible CEO? Why are we sure about that?

Carl Icahn wants more buybacks

Awesome article as usual Macke. I love this buyback topic. I would be very interested in a macro take from you on the buyback craze of the past few years. Likely to be a bad outcome of course, but curious to hear how some of the specific risa could play out in a macro sense. Thanks again for the great post.

Another great Article Jeff. I am a huge fan of the site and your contributions to it are second to none

What do you think of the buyback a at $AZO?

I might buy it at $74.

Yeah, great commentary, Jeff. AAPL’s biggest problem is no new exciting products.

Jeff, great piece, Its amazing how many advisors get excited when companies announce the buy back. I always said give me the special divvy instead and I will allocate the capital !

Market does not respect AAPL anyway! All eyes on that $74 gap. Probably AAPL should put a limit order on its buy backs at that price and do nothing till then!! Save shareholder capital

I feel you on the “shelled” part. If you Hate on AAPL, everyone Hates on you. IMHO, it’s so ugly, just like the global economy…Global QE has really messed things up so bad.

Hi Jeff, love the article and financial insight. Just to play devil’s advocate (extra Pacino) for the moment, what happens if a company doesn’t retire its shares? I don’t believe it’s a requirement for them to retire their shares, but I could wrong on this. Does it depend on the buyback agreement? Would appreciate any commentary on this. Thanks in advance.

You can’t have your shares and buy them back too. If stock isn’t retired it counts for calculating EPS. Raising EPS (and the fallacious “supply and demand” argument) are the whole point of buybacks.

There are a number of ways to put repurchased shares into suspended animation. As usual on Wall Street, the more you dig into them the more you realize they are complicated bc they are bullshit.

It’s pretty simple: If repurchased shares still exist as freely traded product they have to be counted for earnings purposes. That would make such buybacks a purely speculative play by the BOD and no BOD wants that burden.

On the other hand, if shares are retired they no longer have any tangible value that you can specifically foot to the value of other stock trading in the market. Neither Apple nor anyone else can’t flip their own shares (for a lot of really good reasons). The stock is dead as is the cash paid for it.

The interest payments remain. The debt load is still there. Companies very, very seldom flip from buying back stock to doing secondaries. Doing so would absolutely kill their shares. That means liquidity is restricted even beyond interest. So a buyback is financially tantamount to buying shares and lighting them on fire then paying an annual fine for pollution. If you’re lucky you’re interest rate is roughly equal to the dividend payments saved.

Companies are in a literal economic sense the worst conceivable buyers of their own shares.

Every CEO bragging about how a stock has gone up during a buyback program is either an idiot or just begging someone like Carl Icahn to tell him he’s a good boy.

Makes complete sense now, especially as it relates to repurchased shares not being counted in the EPS calculation. Thank you for clearing that up, and shedding further light. I truly appreciate the interaction. Suspended animation… Only a phrase Wall Street could brew up.

You forgot to cut and paste this:

“Dilution

Another reason that a company may move forward with a buyback is to reduce the dilution that is often caused by generous employee stock option plans (ESOP).”

I have rec’d tons of ISO’s, ESOP’s and outright grants. Obviously you have not and don’t know how it works.

You’ve lost the right to be heard by me.