Shares of Whole Foods Market are getting kicked in the face with organic-covered boots, down 5% and below $30.

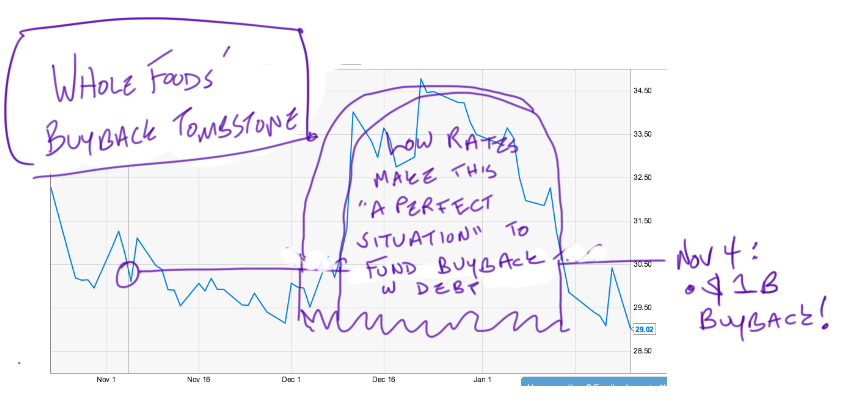

It’s the lowest WFM has traded since the company missed estimates and announced a $1 billion debt-funded buyback program last November 4th!

“Stock buybacks are accretive in the short-term and the long term” raved CEO John “No Relation” Mackey. Nothing about that sentence is necessarily true. Coming as it did at the same time as an earnings warning, which the company presumably didn’t see coming, it’s just gibberish talk.

Mackey said he intended to spend most of the $1 billion in the first half of the year (meaning starting immediately as this WFM’s Q1 2016 started November 1st). So presumably some of the money chasing WFM higher in December came from the company itself. It’s unclear if WFM is still buying now that shares are at 2011 levels.

Remember, retired shares aren’t re-issued. They just disappear along with the money it takes to buy them on the open market (or the other ways WFM mentioned). What remains are the debt payments.

Whole Foods has an organic margin problem with no easy solution. It knows profits are declining yet insists buying shares is a good idea despite the fact that doing so comes with interest payments that make future profitability less likely.

Shareholders have a larger share of a less profitable business with reduced potential and higher debt.

If you enjoy the content at iBankCoin, please follow us on Twitter

JeffMacke –

Thoughts on DPZ? It’s been resilient as fuck & has a terrific stable core business as well as international exposure. They’re in great places (like the Netherlands & the UK) that are generally not in the heart of the Emerging Market meltdown hot-spots. You also get a dividend….

BUT – I’ve been reading your thoughts over the weeks about buybacks backfiring. I’m well aware that DPZ is one of the most leveraged fast casual & pizza shops on the market & has has been using buckets of “cheap” debt to buy the shit out of their stock over the years.

Have you looked at this one? Thoughts?

Probucks, I am not Jeff, but I so miss bottom up analysis..so indulge me. DPZ on a Fibo T/a basis has major resistance and support at 124.52 and 78.19. THey did borrow 1.3 Billion in Oct and is hand over fist buying on an accelerated buy back plan now.Ouch. That BIG buyback will end at the end of their 1 quarter so I wouldn’t want to be a buyer on March 23ish..well unless the FOMC doesn’t cut rates in March and ECB adds stimulus). The debt to EV is actually not that bad as others in the field and has been dropping, Margin ratio is about the same as competitors, PEG and P/E ugly of course. Problem is major Institutional owners are both out of Capital Group which has a heck of a lot of foreign investors. (Capital World Investors is the top holder per Yahoo, fwiw), EM melt down will cause problems soon cuz investors will have to get cash out.

Solid thoughts.

Presuming an investor does actually think DPZ deserves a higher PE than peers due to fundamental reasons & stable cash flow

&

Presuming they’ll be able to manage their debt expense due to it being intelligently scheduled so-as not to drown the company all at once with payments in near future

It sounds like the biggest downside risk is how much artificial demand the buyback created & how will the stock trade when it’s complete?

&

Second, worry over largest holders needing to sell to raise cash?

As a customer I buy things from Whole Foods that are unique to WFM. I buy commodity groceries at Safeway or Giant. I can see the problem if less expensive stores offer products with the same attractive attributes as WFM.

There is the factor of the WFM experience, the vibe and aspirational appeal of shopping in the store. The thing is, creating this is dependent on the work force and management of each store. It can be great or a real let down, depending on how they are doing with the staffing.

And… if WFM is still moving forward with the lower cost version of the store, this seems like a recipe for mucking up the cachet of the brand.

In my business we’d say make a decision- super serve the core, or go mass market.

@probucks…yep, and thank you, I so miss Bottoms Up Analysis. Plus the upside is so limited at 124 HUGE resistance. Risk/Reward not there until we are back down to the 78ish range. But IMHO Top Down Macro is so Ugly, I wouldn’t be in anything except Ultra Shorts.