I’m not here to lie to you.

We’re pretty screwed.

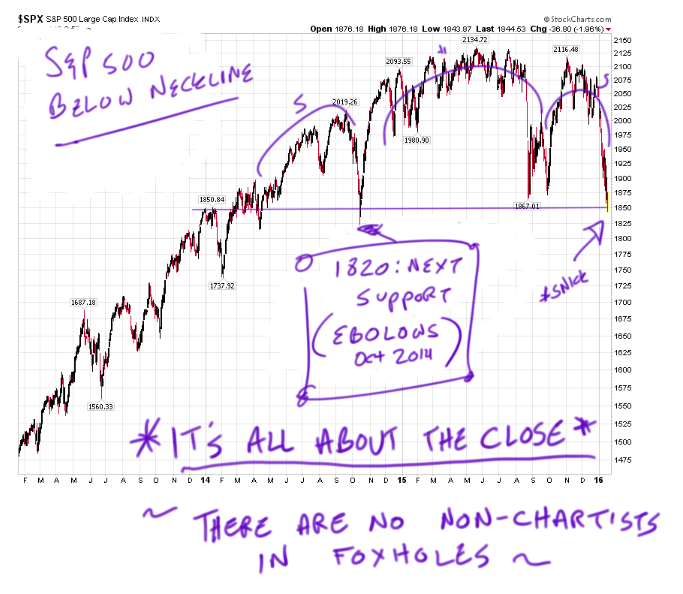

As I type we’re at 1817 on the S&P500. That’s below the neckline of a huge head and shoulders pattern. It doesn’t matter how you personally feel about charts. Incremental selling will be done unless by some hand of God and the Plunge Protection Team we close back above 1850.

In just a couple weeks the market has been kind enough to offer me grist for a brief course in Macke’s Personal Rules for Sell-Offs:

Here’s the core problem with Crude and Currency going crazy, boiled down as far as I can rend it, and why it might lead to the Worst. Year. Ever.

I think there’s a massive underlying problem with balance sheets. Cash has been thrown away buying back shares instead of making improvements in core operations. Both at Macy’s and IBM. Watch for this to become a bigger issue as margins get tighter and all that “cheap” debt becomes more expensive.

Here’s a Crash Survival Guide and some case studies of past misery.

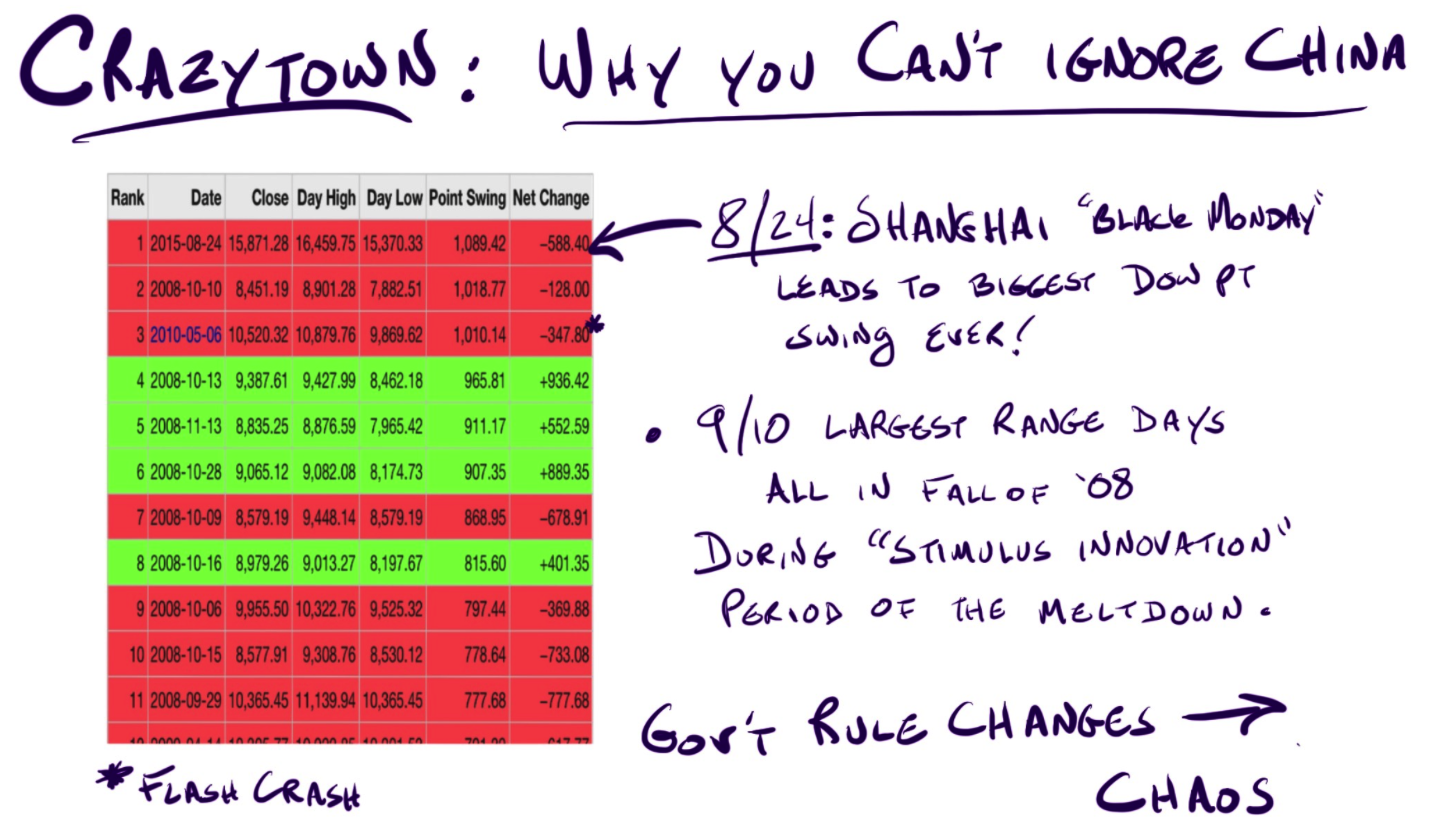

None of which matters because China Has Us By the Balls.

Which reminds me of a story. Two guys are camping. They get hammered and leave some meat sitting out overnight. In the morning a bear is ripping open their tent.

While one guy frantically smacks the bear with a lantern he notices his friend lacing up his shoes.

“You idiot! You can’t outrun a bear!” screams the fighter as fangs sink into his hand.

“I don’t have to outrun the bear” replies the second camper. “I just have to outrun you”.

Point: Don’t try to make money here. Let other people lose money. Then we’ll pick through the scraps.

Stocks are collapsing as I type. My thoughts remain these:

- The S&P500 needs to close above 1850

- It doesn’t really matter where we close because the market is broken. No one will buy stocks when they can wake up to this type of selling every day.

- This isn’t the time to learn how to short.

- If you know how to short, I’m not going to tell you your business. But I will point out that the hugest, angriest, face-rippiest rallies happen in Bear markets. Consider the Fall of 2008:

- Bear markets kill everyone. 99% of investors should be liquid enough to not have night terrors. I’m serious. If you can’t sleep you’re going to puke up your whole portfolio at the exact bottom.

- Respect the Panic. My show is called Panic out of respect, not advice. Sir Isaac Newton blew up investing in stocks. Really. Sir Isaac Newton was super, duper smart.

- There will be opportunity. It will come. I like a lot of individual stocks at their August lows (Come to me at $72, Facebook).

- No one knows anything. I’ve done this professionally for 2 decades. I know as much as anyone who will talk to you right now, on TV or in print, and I don’t know shit.

- This market is a human flesh thresher turned up to 11. Just back away from it and wait.

Best article I’ve read here in quite some time. Thanks.

And thank you for the article rather than a video. I tend not to watch videos.

Also, why is this article so far down the front page? Seems to be more recent than every article above it.

Same here, but that’s because I read your stuff at work. 🙂

So is it too late to short for those who are not regular traders?

Since 2009 I have watched, what I call the Shanghai Copper Bubble form Ieven started a website to document the anatomy of a bubble). Now it looks like I am finally starting to get my pop, (BTW that Lottery Article you did has been my all time fav). Tomorrow the ECB meet, since 2009 the Central Bankers have rallied the markets and created a bigger bubble. If Super Mario can’t say his magic words, we are SPX 1755ish.

Veritas

I recall buying Veritas (VRTS) around 15 or so in late ’90s and then trading the POS as it soared in the internet bubble.

It crashed and burned (bought out for not so much by Symantec) about the time I saw some fancy car out on the road that had vanity plates that said VRTS.

I also saw a car that had tags that said DITC (Ditech bubbler based here in Orlando area).

You’re a Role Model.

Well, there’s pretty screwed and then there’s totally screwed. Pretty screwed, there’s the chance we get a rally in time to unload the crap we thought was a good deal in December. Totally screwed, your margin clerk, Rhianna, is paying you a visit, and she isn’t happy:

https://www.youtube.com/watch?v=B3eAMGXFw1o

I guess the Fed is probably done for awhile.

Just like the U. of KY BB team- one and done.

Lately it seems like stocks are going to go negative– where brokers will have to pay people to accept stocks for free. And China’s GDP will go negative, where companies there will make products and will pay people to accept them for free.

The bear story is a good one.

I just need to outrun you. Hysterical.

Video, text, guitar accompaniment, I don’t care how you post…just glad you are posting. What I appreciate most is you just don’t spew forth random thoughts/predictions, but back things up with examples and your experiences. And, I do appreciate your dry wit in a time of panic. Are you really just with iBankCoin for January or will you continue to share your wisdom with us through out the year. If just for this month, thanks for stopping by as I’m learning a lot from your posts.

So… today is working out better than expected.

I blame the mob bosses in Davos leaving stooges in charge. Apparently we’re all better now.

Weak hands were washed out today. The market is a little better for us having gone through this. And it’s not over…

But this is a good pausing point. We’re going to need new scary things for the market to keep free-falling. We’ve adjusted to this spate of horrible.

Thanks for the kind words. It’s fun being here.

Had me create a user name and post my first comment on the site after lurking here for years… Great post, same as the earlier one on Macy’s buybacks.

So many awesome points in this post.