S&P500: A Genuinely terrible chart…

There was a little bounce on Friday. Which is to say we didn’t close on the lows.

The bullish scenario is we’re oversold, sentiment is “wetting myself” and it wouldn’t be a bear market if it didn’t squeeze the hell out of bears every once in a while. We’re down 10% in a straight line. That doesn’t mean tomorrow is “due” to move higher. That’s not how odds work.

Market days are independent, for betting purposes. Like a roulette table. Sharp reversals can and do occur within larger trends but by definition they have to be random.

A face-ripping, explosion of a rally is coming but there aren’t any cheap ways to wager on it. Calls are still expensive. Stocks aren’t cheap, or even possible to value, in theory until oil stabilizes AND China gets done having to kick traders in the ass with jackboots to get them to buy stocks in the Shanghai Comp ($SSEC). (see: China Has Us By the Wontons).

You want to get long ordinary stocks? Yeah. All bullshit aside. It’s a terrible stock market. That’s an awful chart, even without the monster.

Buybacks Bite

The fundamentals are just as bad. I’ve been doing some work on buybacks. To bring you up to speed; companies have borrowing a lot of money to buy back shares. Corporations aren’t stockpiling cash, at least not in the US. They’ve levered up to inflate short term EPS. Leverage taken on to do buybacks is about to be a Big Freaking Deal. Other folks have noticed this (a couple in the comment section). It’s very bad.

Buybacks are this era’s Greenmail. Just a different way for activists to generate short term performance. They work in up cycles. As long-term plans buybacks are a short-sighted, indefensibly cynical allocation of capital to appease hedge funds. Since this opinion runs contrary to the Word of Saint Buffett of Omaha I’ve taken endless abuse for mocking buybacks of the last few years.

I’m about to be right in a huge way. Which sort of sucks.

Ive been looking at these things all weekend. I’ll use Macy’s as an example but they’re far from alone

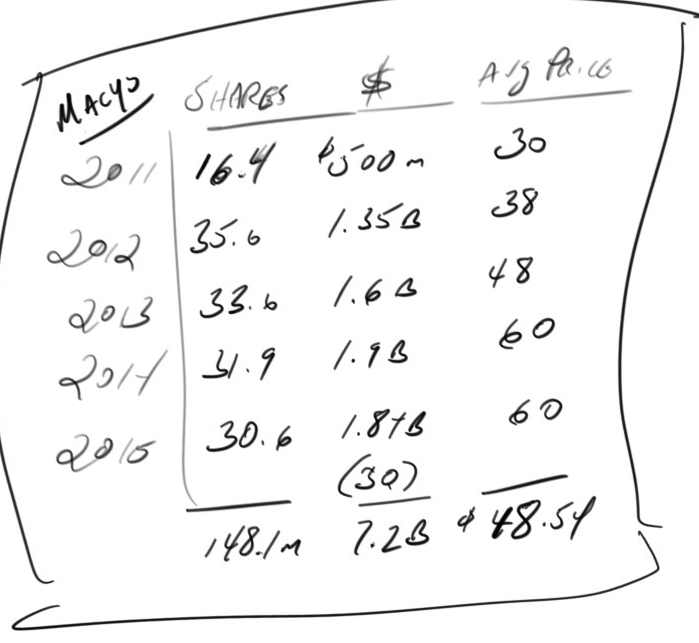

Here’s what Macy’s has done in buybacks since 2011:

Forgive my handwriting. It’s a little sloppy. I’ve been looking at this stuff since 2am.

The scribbling says Macy’s spent $7.2b buying 148.1 million shares at an average of $48.54 from 2011 through last October 15. The stock is down 50% in 6 months, well below $40.

Some very basic accounting: Repurchased shares aren’t “bought and held”. They are retired to reduce the share count. Effectively the shares, and money spent on them are just lit on fire.

Because all repurchased shares go to zero (with the weird approval of investors) it technically doesn’t matter that Macy’s would be down $1.6b on its Macy’s position of repurchased shares. Again, if they had any value at all. That’s a loss of 22% against a 45% gain in the S&P500. Buybacks are tantamount to a group of executives running a hedge fund that buys only one stock, on which it has limitless inside information and Macy’s lost 22%.

The simple numerical fact of this makes the idea that buybacks “are an expression of confidence” laughably obtuse. When a buddy brags about his kid being a great athlete do you take him at face value? Of course not. CEOs always like their chances. That’s what makes them good CEOs. It also makes them shitty stock pickers.

Like most companies Macy’s always thinks its own stock is a buy. In the short term, buybacks boost earnings per share, often triggering CEO bonuses and delighting activists! For a while

It’s a predictable sequence

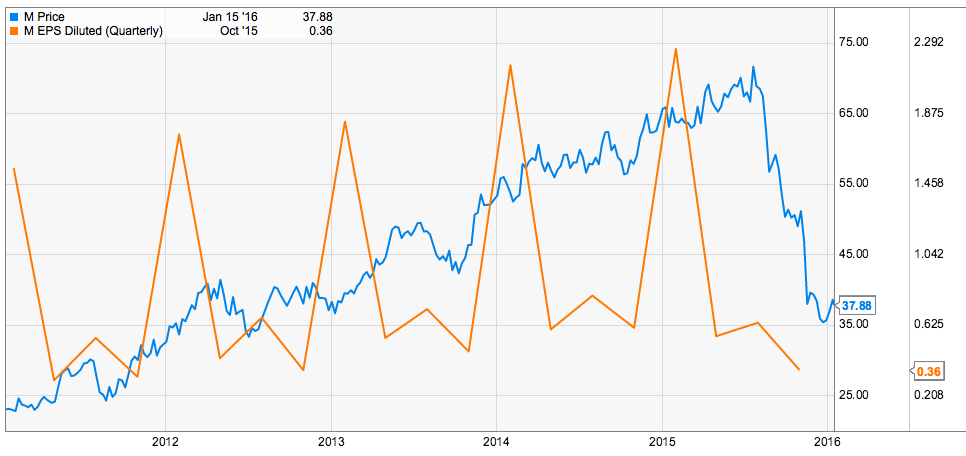

For a while EPS looks awesome because of the share reduction but net income lags. The whole time enterprise value is erodes. Long-term investors get a bigger chunk of a lesser business and no cash at all. Then the earnings (orange line) rolls over and takes the stock with it:

Oh yeah. “Money is returned to shareholders!”

(Dispense with this quickly: When Wall Street tells you it’s giving you cash and you don’t see any money in your hand you’ve been had.)

Debt is a cruel mistress.

Retail is an insanely low margin business that requires constant investment. Macy’s has a 4.9% net margin. So when Macy’s borrows $500,000,000 at 3.7% to buy back stock it sounds cheap but it’s just about the company’s entire margin on $500,000,000 in sales in a growing economy.

Bookie or banker, loan givers don’t care about your personal problems. “No winter so coats didn’t sell? Screw you, give me my money. Bought your own shares at $50 and now you don’t have the shares or the cash? TS, give me my money.”

Now business has turned down, stores haven’t gotten any attention. Activists are prodding mercilessly. Macy’s is sitting on billions of dollars in winter coats in some sort of monumental inventory screw up that we’ll never know the full story on. Seriously, they could do hands across America tying coat sleeves together. It’s insane.

Oh yeah, Macy’s is on credit watch.

So earnings, both on a net and per share basis are going to end up much, much lower than expected. Shareholders have no cash. Macy’s has no cash. They just have 80% of the world’s down and impatient bankers.

The activists have the cash. Because they sold their shares to Macy’s and the rest of the muppets.

Macy’s and its shareholders have been conned. Everyone buying into buybacks has been. Corporate America borrowed cheap and bought itself. According to FactSet as of Q3 180 S&P500 companies have spent more on buybacks than they’ve earned in the last 12 months.

It’s not a story across the whole market yet. It will be.

If you enjoy the content at iBankCoin, please follow us on Twitter

Nice write up Macke! Really like the chart action!!

Guess I’ll be buying a great winter coat cheap at Marshalls.

Hi Jeff, I’ve got a question/comment for you. So what you’re saying is that these activist hedge fund managers are selling those shares back to the company. When this happens, is this usually through a tender offer or open-market sales by the fund? Thanks for the insight!

Buybacks create an ever-ready size bidder for a stock. You build an enormous, illiquid position, demand a buyback to “return money” BC you are a champion of the people then ease out of the position.

Ideally you never have to tender.

The insidious aspect is that the fundamental rot shows up slowly. So buybacks seem great until you’re IBM and realize you’ve spent all your money and no longer have a core business.

Makes sense, really appreciate the insight and response. I’m learning a ton, and look forward to your posts.

Great Chart…especially the MOM finger. Yep, and it is not just US markets Problem. Tencent, a Chinese internet giant regularly repurchases its stock. The conservative champions of Japan, including Toyota, Mitsubishi and NTT DoCoMo, are buying their own shares at a record rate. But Jeff this Mess has been happening for years, just another part of the big UGLY that we have created using Global QE…which BTW ECB meets Thursday, they didn’t have the votes last week, but Mario May come to the rescue for the Bulls once again…grrrrrrr.

Great case study.

Theory of ultra-low interest rates: encourage investment to spur economic growth. Businesses take some risk and make capital investments that yield productivity gains and jobs which lead to GDP growth.

Practice of ultra-low interest rates: Businesses lever up to drive short-term share performance to a) appease hedge funds and b) enrich the management. No near term risk. No productivity gains. No GDP growth. Capital destroyed. When the going gets tough the 2-and-20s and corp execs retire with their fortunes intact.

A virtuous loop unless you are anyone other than a hedge fund manager or senior exec at a public company buying back shares. The worst part is I think these guys actually believe they are acting with fiduciary responsibility and prudence. As George Constanza said, “It’s not a lie if you believe it.”

You nailed it except for the part about them believing they are acting responsible. It is a reprehensible situation of rigged greed.

Jeff, is there some kind of tipping point to look for with a company doing stock buy backs. I know kors has also made some bad buys on their stock. Is there some line item or ratio that is forward looking that gives a hint that it’s a good time to short these kinds of companies or is it dependent on too many factors in your opinion?

.

Great post, Jeff !

.

while your argument might be true in some cases – what about the behemoth $AZO? Eddie has been buying back shares for years, and, well, look at it…..

Ok, I can’t be the only one thinking of the “Fuck you, pay me” scene in Goodfellas when reading this part:

“Bookie or banker, loan givers don’t care about your personal problems. “No winter so coats didn’t sell? Screw you, give me my money. Bought your own shares at $50 and now you don’t have the shares or the cash? TS, give me my money.”

https://www.youtube.com/watch?v=3XGAmPRxV48

Nice, Po Pimp! I was thinking of Goodfellas. Actually Tweeted the scene later. Figured it was too obscure for the column.