What the hell was going on with my silver and gold plays today? Something sneaky I thinks, my preciousss, yes…. verrrrrry sneaky, it is, yessss! <Gollum>!

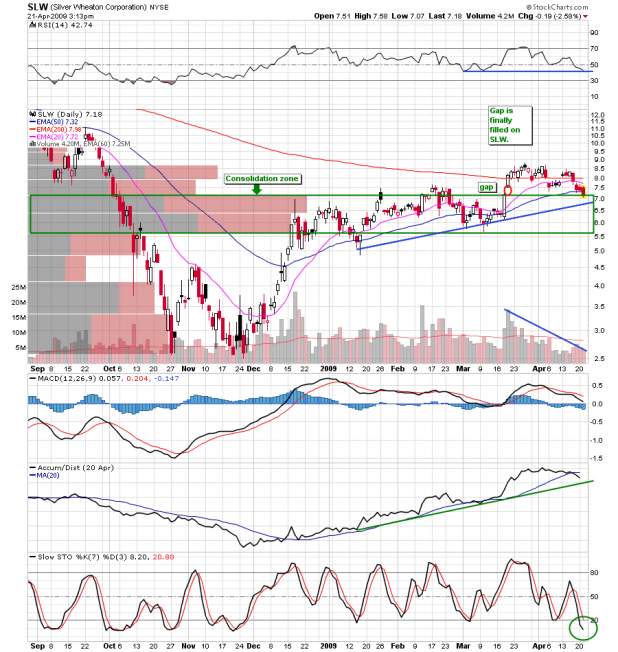

A lot of people who watch these things were commenting on the PPT and elsewhere about the noticeable surge in end of day trading on almost every major precious metal play, both gold and silver. What people may not have noticed, however, was that a similar surge — of similar length (timewise) was going on in the 10 a.m. to 10:30 a.m timeframe in those same names. Let’s take a gander at today’s [[SLW]] 5 minute daily chart as our first example:

First, let’s note that there are 78 5-minute periods in a trading day. In most of these examples we are talking about only 8 or 9 of those periods, because of where this buying phenomenon was taking place. What was notable for me was WHERE these buys were coming in. Conventional trading wisdom tells us that “the big money” — meaning the institutional traders– will generally make themselves known in the very beginning of the trading day and at the very end.

The first period of activity here is right at the 10 a.m. hour which is not literally the very beginning of the trading day, but perhaps marks the period where most seasoned traders begin to take positions “after the morning shakeout.” Given that this is a Monday, and we had a relatively large negative futures position trading at the open, this explanation of “wait and see” makes some logical sense. The uniformity across the sector also gives some indication of a coordinated purchase here, as there were very few large well traded names in the precious metal sector that did not see some kind of activity in the 10-10:30 area this morning.

Note also the last twenty minutes of the trading day. We can ascribe some of this scramble to short covering, of course, but large late day purchases generally bode well for tomorrow’s trading in these instances. I believe that is so because institutions are clearing the way here for more explosive action in the next few days. Keep in mind that the four five-minute candles (or, 20 minutes in total) we see make up only 5.13% of the trading day, but are responsible for 10% of the shares traded. Again, I think this is significant not only because of the volume, but because the rapid ascent and the sharp upturn of the A/D oscillator shown in these last twenty minutes also indicates that most of that volume was buying at the ask.

Let’s look next at fellow Jacksonian Silver pick [[PAAS]] :

If anything, the two moves in PAAS are even more significant in both price and volume, compared to the rest of the day’s trading. The four five minute candles from 10:10 to 10:30 a.m. comprised 13% of the day’s trading and reflect a large buying program, as the price ascended rapidly. The rest of the day consisted of light volume pullback until again, the last tweny minutes gave way to almost 20% of the day’s trading, and another rapide ascent in price. All tolled, those forty minutes (10% of the trading day) of buying accounted for one third of the daily trading, and again seemingly almost all “on the ask” — figuratively, if not literally.

Let’s look last at New Jacksonian Holding [[SSRI]] :

SSRI shows a full half hour of buying in the morning, again, starting at 10:10 and concluding at 10:40. While this morning purchase was not market by the same volume as PAAS, it again shows the rapid ascent characteristics of a persistant buyer or buyers behind the bid. That half hour comprised about 11.6% of the daily trading (in about 7.7% of the time) and the “afternoon session” was limited to a brief fifteen minute period that was marked by increased volume and another very rapid ascent. In that fifteen minutes (less than 4% of the trading day) we saw over 12% of the daily buying. Again, I think it’s clear we are talking about a concentrated interest here in this final burst.

In the interests of saving time and space, I won’t go through the Jacksonian gold positions that saw similar patterns today. Interestingly, not all of the golds — particularly the smaller cap names (like [[EGO]] and [[ANV]] ) — saw the 10 a.m. buying, at least not in the same consistent fashion. However, they all saw the late day surge in purchasing with ANV seeing a full 23.7% of it’s daily buying (along with a 4.5% price move) in the final 15 minutes!

We find the same morning and afternoon program purchases that we saw in the silvers above in Jacksonian pick [[RGLD]], with 10% of the daily trading between 10 and 10:25 a.m. and another 15.5% in the final 20 minutes of trading. [[GG]] shows a very similar pattern, as do many other of the “big golds” like [[AEM]].

I guess in conclusion I’d posit that there’s something afoot here, friends, and that you should be attending to your PM positions, as I think we may see a more significant move here in the coming days. Of course, we may not, and all of this coincidental analysis could be the result of my rampant apophenia due to excessive exposure to William Gibson novels. Nevertheless, I believe this action bears consideration and careful attention.

Be well, friends and enemies.

______________

Comments »