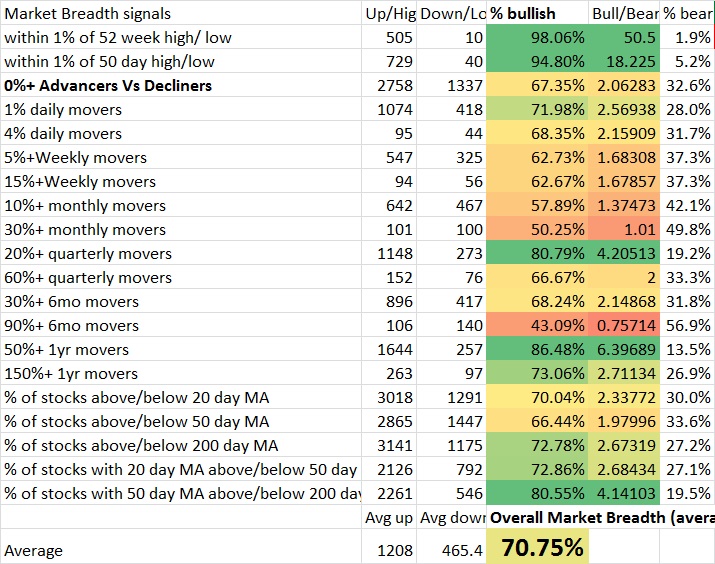

Right now it seems that the breadth reading over various time frames is coming into the range where you need to be cognizant of any potential sell signals. Overbought can stay that way for a long time, but keep in mind that the more overbought a market becomes, the more amount of new buying it requires to sustain the newly established prices. Some strong markets can stay overbought for a long time as people wait for dips that aren’t available and people chase and even go on margin until they are flushed out.

As Charles Ponzi eventually learned, you need increasingly more new money to pay off the old. Don’t get me wrong, I’m not suggesting the market is a ponzi scheme, but that in certain ways the mechanism will operate the same way. More buying demand, higher prices and new investors… but too much buying demand and too many investors to pay off and suddenly prices are unsustainable for the time being. In a ponzi scheme the gig is probably up, but in an actual market backed by earnings the bullish trend can resume after a repositioning period.

The market is backed by solid earnings, but earnings are less important than how the market reacts to them. Price is governed only by buying demand and selling supply, everything else is a rationalization of WHY the buying occurs. It just so happens that strong earnings and valuations happens to be one of the more persuasive rationalizations for people to buy. However, should investors reach a point where they’re all tapped out long and can’t recruit any more buyers, the market will have to rest or sell off until people can come up with more cash and credit or more capital from new money enters the market or shifts from another asset.

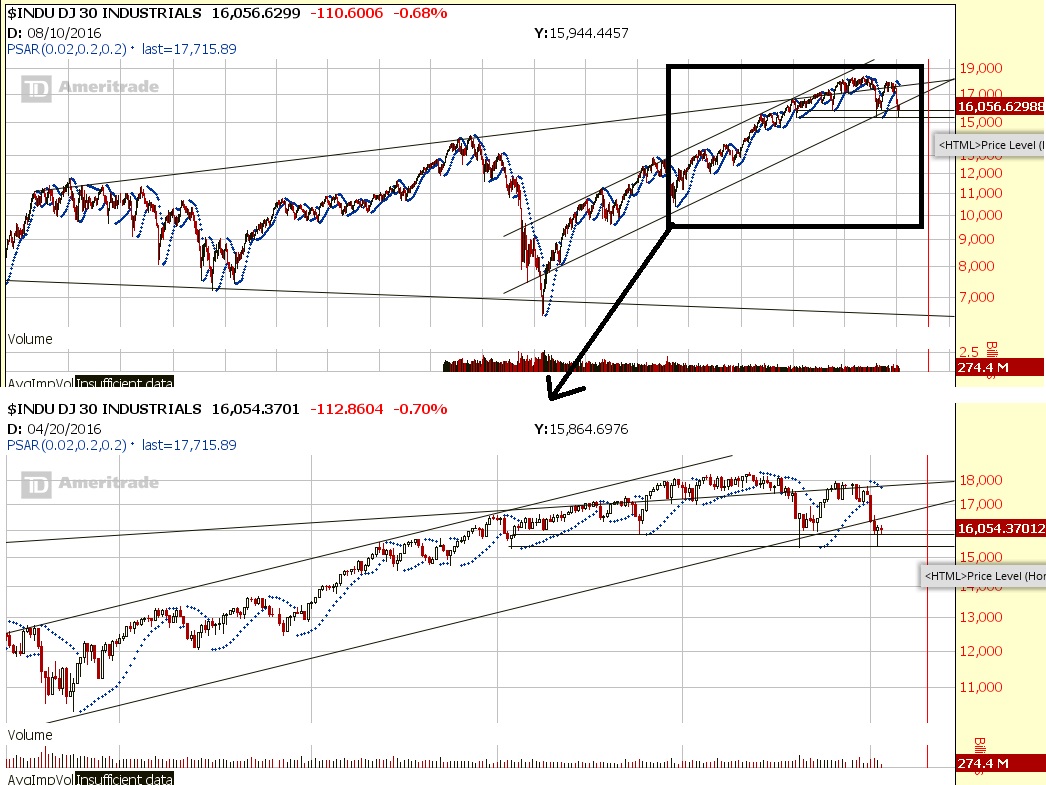

In Paul Tudor Jone’s “Trader” documentary I believe he said something about how this occurred throughout the 80s in a strong bull market. It’d rally up overbought as people chased until they were over levered long and then it’d gap down. The market would force everyone to be leveraged long and then the crashes would be bullish as it would flush people out and they’d quickly try to chase after satisfying the margin clerks. PTJ’s take was that the market was governed by private and public debt and margin. Each had a cycle of when payment was due and when cash would leave the system, as well as the introduction of new debt that would inject capital into the system. This eventually lead up to the 1987 crash which many feared was a sign of a new depression on the way until it eventually took out the high.

So to be clear I am not, nor is the breadth predicting a crash, but I’m saying the market is backing itself into a corner where should this buying pressure continue, a selloff is perhaps the only healthy move left, an alternative is a buying mania that gets money off of the sideline and enters a more of a bubble market, or increased debt and margin so that buying persists and the market becomes increasingly vulnerable to a crash. The Feb 1st print of a VIX under 10 also may have signaled complacency.

I’m a little concerned about a correlated selloff ahead as the market has had such little correlation, such low VIX, and so many more stocks moving higher than moving lower over various time frames.

Breadth is usually more of a concern when it begins diverging from the market and showing decreased interest and increased selling under the surface from high levels, but be aware.

If you enjoy the content at iBankCoin, please follow us on Twitter