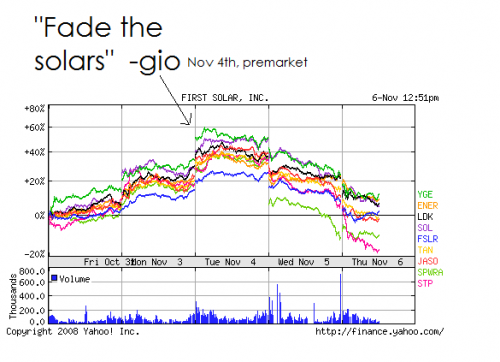

Well, I got this sector on lock down for now. Yes, “for now”, because according to the law of large numbers after being right on solars too many times, my next call on solars will be wrong. I called a fade on solars Monday night ahead of the elections (http://ibankcoin.com/gioblog/?p=2217) based on the fact that you should “buy the rumor, and sell the news.” I warned yah… “take profits in solars!” Obama Green stocks = red stocks [[spwra]] , Suntech Power Holdings Co., Ltd. (ADR) [[stp]] , First Solar, Inc. [[fslr]] , JA Solar Holdings Co., Ltd. (ADR) [[jaso]] , Energy Conversion Devices, Inc. [[ener]] , Yingli Green Energy Hold. Co. Ltd. (ADR) [[yge]] , ReneSola Ltd. (ADR) [[sol]] , LDK Solar Co., Ltd. [[ldk]] .

I also got the Vix readings down, which is my personal Da Vinci-S that I use to dissect this market (what? you don’t know what aDa Vinci-S is? Shame on you). Its easy to get caught up in the “market is going to rally because some woman is not going to be vice president” justification (no offense to vice presidents), I mean, that’s probably what 90% of bloggers out there thought. But the Vix double spike theory shut that down saying to NOT buy that nonsense rally yesterday (oh yeah, and Wood’s Big Bamboo was wrong six times in a row, so the LLN theorem suggested that the Bamboo’s next call would be right. heh).

Trader Psychology

So, after being right on solars for quite some time, that got me thinking a lot like Fly, that I should try and “trick” myself and the market by making another bold call, but quietly investing like 1/20th of a normal position since that call will be wrong. Haha. Does that stuff really work? I know what a lot of you do that! And here’s why… its all about trader psychology (a topic I enjoy, that’s why I’m a Vix chaser). The more and more you get a call right, then the more nervous you get about your next call. Your mind starts over-thinking things like, “What’s going on? Surely my next call will be wrong because I can’t be right all the time.” And so you go and sell your longs prematurely, either that or you try to “trick the market” by publishing some random call, believing that the market has ears or that your audience’s attention dictates your skill, so that you can hurry up and get that wrong call out of the way.

… you know what, sometimes that works! And it all goes back to the law of large numbers. Just look at the New England Patriots. But there’s a better way to “trick” the system. Basically its this: when you’re on a win streak, just keep trading! When you’re on a losing streak lighten up your trades, either in size or in frequency. Don’t over think things. Just set some rules to maximize returns and go by them. Treat your trading like a business. When times are good, you hire workers, buy more products etc. But when business is slow, you layoff people, keep your inventory low. You can’t think, “well, I’ve been selling so much toys during holiday season, surely tomorrow no one will shop here so let’s shut down the store,” nor should you think “Wow, ski sales have been really slow here in Hawaii. Maybe I should try adding snowboards to my inventory to get sales up.” That’s not going to increase your sales, and neither does that improve your trading.

So, when you’re hot, take advantage of it! We all get those streaks, and when it comes, make sure you get aggressive on it.

Oh yeah, my next call, for the sake of the law of large numbers, is to buy this solar dip. (actually I’m trying to trick the market. I’m secretly still shorting solars on a fade, but I’m trying to get a wrong call in first.) …this is annoying.

…this is annoying.

Comments »

…this is annoying.

…this is annoying.