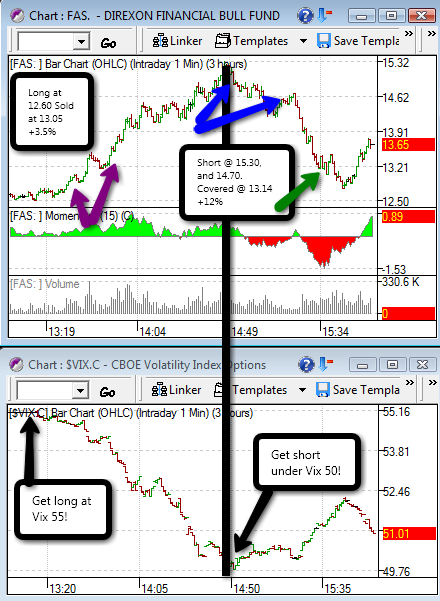

These type of days are very rare, but if you find them, then it’s worth trading the volatility. Today I traded the 3x Bull ETF FAS both on the long and on the short side. The market certainly played out that way as we saw the Dow rally from down -200 to +90 back to down -50. From my notes last night I had Vix @ 55 as a rally point, and wow, did we sure get that set up! Here’s an analysis of my successful day trades. I made one error at Vix 52.46, where it seemed like support was building so I went short on FAS at 14.30. It was a bit too early so exited for a loss at 14.50. However, under VIX 50 I re-entered the short at FAS 15.25 (near the top!) and added at 14.70 and watched as it fell apart… all…the…way…down… under 13. I covered at 13.14. During that period of panic sell on FAS, the market reversed from +80 to -50. Seeing the Dow/SPX red was NOT what the FAS bulls wanted to see. Incredible!

At the end of the day, I made out about 3% on the long side, and 12% on the short side for FAS. If I bought and held FAS from my entry point at 13:20 pm, then I would have came out with 7.45%. Again, I don’t consider myself as a traditional day-trader, but rather a volatility trader. I rather go out and play in the sun than watch green and red tickers. But if volatility is on the tape, then I’m usually there to trade it. Thought process of these trades can be found on my twitter.

Today was crazy. Now relax brah…

Aloha

-gio-

You’re doing an awesome job there, friend.

Btw, how’s Hilo’s favorite son, BJ Penn, doing these days? He’ll have a tough match against St Pierre, but revenge is a motivator, so I think he’ll prevail.

i love this shit!

you are the man.

WINNERS everywhere.

BJ Penn is a monster. BJ should win. Mixed Martial Arts is huge in Hawaii.

Thanks BOTD… I know FAS and FAZ are your plays. Today was actually the first time I played it. Usually I short SRS.

who do you use to be able to short SRS? fidelity has no shortable shares. damn them.

Gio

Thanks for recommending holding LEAP with the PPT checks last week. Worked out very well for me today.

Hi Gio!!!

School’s Out.

I’ve been running an online class on how to short education stocks. Is there any irony in that?

Education stocks are at the top-

Chart ESI,APOL,CECO

http://zstock7.com/?p=327

Gio-

Love the VIX stuff. I am a huge fan of your blog. Thanks for everything. One thing that would help me (and maybe others) is if you would list some of your “bad” trades using the VIX. These, I have found, are oftentimes the best teachers. Thanks again!!!

Sure thing Fox. Day trade or swing trade? Vix on the swing trade is usually very accurate. I would rather focus on how the Vix works than when it doesn’t during medium term timelines. On day trades, it’s more difficult. Just remember, the higher the volatility, the better the read.

Gio, I’m posting a VIX based system for you tonight.

Look for it in a couple of hours.

Congrats. I recognize the favorable trading conditions from spot checking in and looking back, tho was on other tasks today. For perspective, how rare is this type of trading day? Not to suffer the missed chances, but to help my feel going forward how often such relatively “smooth” conditions up then down in volatility, with volume, happen on a given trading day. Implying how I guess you’ll answer, what’s your experience of the duration of such conditions during a really good trading day, e.g., a few intervals of twenty minutes here, fifteen minutes there? Your thoughts putting today in context may help pragmatic trading, with upcoming opportunities. Since I was not watching the live feed: how different was it for you watching the tape unfold and executing trades, than it appears looking back at the tape? The VIX and candlesticks may be the same in real-time, but if you also watch momentum indicators, they adjust as the ticks progress. Do you have any minimum number on the VIX that draws you into trading, or is it a minimum percent gain in the VIX over the previous close?

here come the bulls… and i have time to enter…

i was in ‘field’ so missed getting in TAN… FAS

Hey Bob, thanks for stopping by. there are a few setups that create wonderful day-trading opportunities. I’ll explain on my next post.

-gio-

Are you sure you didn’t create the VIX? You seem auspiciously in sync with it.