I gave the VIX the kiss of death early in December , taking note that the market environment had drastically changed: People were not selling stock after bad news! That led to a 500 point rally.

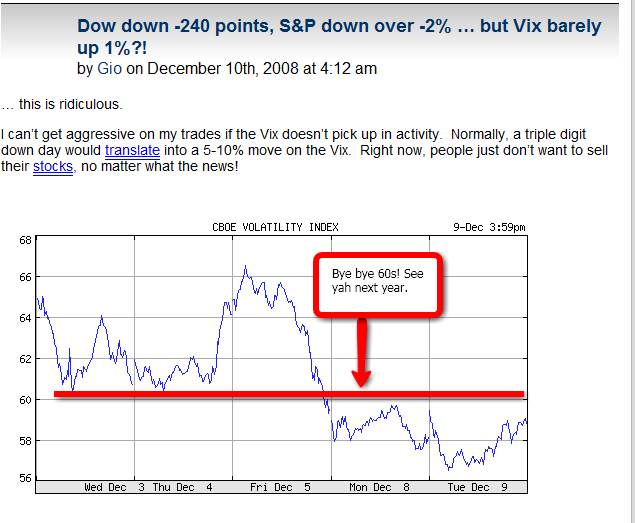

Since then the VIX has melted down over 25% in the past 10 trading days. What does this mean? For me, it just means this is not a good place to enter new longs, or if you already enjoyed the rally, you have to start thinking about taking profits in some of those longs.

Conversely, you may ask, is this a good time to short? I can say it’s a much better time to short than when we were in the 50s, and since then, this light volume trading has shook out most of the weak bears. The time to short is certainly getting closer, and the Vix has almost reached my range to start shorting which was 35-39. If I get a spike down there I will definitely start shorting. If we throw in the double top in the VIX on November 20 = 81, then the VIX has been cut in half in about 1 month. Since then, the market rallied over 1,000 points.

I do think we can go higher within the next 2-3 months, but as a swing trader, it’s better to get out when complacency hits extreme levels, then re-enter on a dip.

If you enjoy the content at iBankCoin, please follow us on Twitter

Nothing stopping the VIX from going back to 20.

VIX is at RSI 32–oh man–VIX gets to RSI 30.5 what will the VIX do next? $VIX Goes to RSI 29.5 and it’s all over for the bears.

Thanks Geo.Still looking forward to seeing those 2009 predictions. And Happy New Year!

I’m aiming for 2nd week in Jan to start shorting aggressively. Right now, the low low low volume is messing with my head.

Okay, back to work!

next stop: 200-day SMA

Let’s break that 912 pivot first ….

I just read CAddict’s Seagull post. Giving me a better idea on how to play this strange tape. Two higher probability plays… 1) short on the top of the seagull, I guess that would be the 912. and 2) Another way to play this is to short when the VIX finally turns up + volume in broad market on that reversal.

Talk about starting 2009 with a pop quiz!

Sounds like a plan.

Gio, congratulations on your fine work in December, and may your 2009 be even more successful.

i nibbled in an purchased a couple of SKF shares since i too am expecting a big bounce in the vix and in the markets. You can see the momentum starting to change in the SKF charts and momentum and building quickk

Gio,

Don’t know how you concentrate on trading in Hawaii, but thanks.

Looking forward to your blog in 2009.

Don’t forget seagulls take massive dumps too.