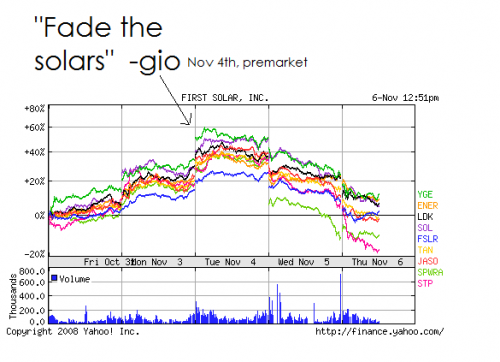

This is for those who faded the solars (http://ibankcoin.com/gioblog/?p=2217). I am issuing a warning to take profits on any shorts in solars very soon, either today or by tomorrow. At least cover half of your position. I would not want to stay short solars over the weekend.

For those of you who are position trading into solars, you may want to take note of FSLR bouncing off a key support today at 137. You can enter here, or you can wait for the next Vix spike up for a more conservative entry point.

Speaking of the Vix, notice it just trending straight up today. No spikes! Again, this means people still think the bear rally is not over and are moving in and out of longs, trying to find an intraday bottom. Remember, your probabilities are low to find an intraday reversal without a spike in the Vix.

Anyway, if you faded the solars as a swing trade, you came up big in the past 3 trading days. These are HUGE +30% gains. Classic fades!…

Right now, I am waiting for the final hour of trading to get long solars as a day trade. Relief rally play. But that’s irrelevant to this post.

aloha!

-gio-

“green stocks” = red stocks… one fine contrarian play!

btw, it sure is bloody out there. Dow is currently down -400. Still no Vix spikes on the intraday chart! amazing.

Vix reversed. covered some shorts and sold some inverse ETFs.

http://www.thehawaiitrader.com/2008/11/trade-eev-wire.html

wow, i made a quick gain in getting long LDK. i couldn’t wait for the end of the day.

i will be buying some energy names near the close of the day.

I’m also considering a few of these buyonthedips…

EYE, MEA, QSII, GMXR

LoBV signaled green at 911.

now, remember what I always say, it’s NOT a green light go, and the green could turn off the very next bar.

but, fwiw, it hasn’t been green since 1000.

In any event, you CANNOT short on a green signal — it’s either buy or ignore.

fanfuckingtastic call on the solar burritos btw

LoBV grey again. That came and went fast. Oh well.

Bought CSIQ at 8.33, couldn’t wait.

I was thinking the same as I was looking at all the charts…..looks like longs to me…

i shoulda held my LDK longs. now its above 19.

pie… nice entry.

Note to self… why does fly want to short HK so bad?

props Gio on the solars call.

and more props on AFAM which i think you called the other day, if i remember correctly, and said you’d be writing something up about it.

Who knows, but I have made a killing off the new 3x iETFs BGZ and TZA today.

thanks yossarian for the hat tip. calling the solar fade was a money call, but calling AFAM which hit a 52-high in this kind of tape was like finding a diamond in the sand. Fly is starting to mention AFAM on his posts too.

charlie… 3x inverse ETFs sounds like a big bet. so far i’m playing with the double inverses.

I think HK is dangerous, doesn’t act very well. Market down 450 it holds in there. I stayed away. Have daytraded it.

i wouldn’t want to hold a swing short on HK at this level. its been consolidating which is bullish. I think there are a lot of better shorts out there. For example, DSX. oh yeah, the shippers are another great fade-sector. check them out…

DRYS, DSX, TBSI, GNK

…. still no Vix spike! all day long. this is unusual for a Dow -400 day.

People want out before the jobs data, which why were down 10% in 2 days. Thats fine, but what is the outcome?

I figure a gap down open is a buy, or the market will gap up.

In both cases, I wouldn’t want to be short, here at 904.

risk reward isn’t savory, even if we fall further into the close.

below 895-890 and it’s a different story.

there hasn’t been ANY volatility today. just a perfectly straight line lower from the open, except for that one blip which we both nailed.

danny… i covered most of my shorts and sold most of my inverse ETFs. i know i’m violating my Vix spike rule, but this is where my instincts take over. considering how queer this market has been, i wouldn’t be surprised to see some massive short covering tomorrow. anyway, like you, i think the market is against the shorts at this level… i just wish a Vix spike up could back me up. oh well, gotta leap!

good sense Gio, I feel the same way re the squeeze tomorrow.

Everything that I was short wouldn’t go down any more. The market drops another 50 points and all my shorts didn’t react. That’s why I covered and went long CSIQ(early by the way). Everyone knows the jobs number is bad, its baked in. Too dangerous to be short here.

What do you think about a gap down on a bad jobs number tomorrow, followed by a bullish reversal mid-morning? I have no idea why I feel that way, but that’s the feeling I am getting. Not that I will play it – I don’t know that I trust my feelings that strongly – but I think it is a possibility.

I know the VIX didn’t “spike” intraday as you were looking for Gio, but did you notice how it is pretty much right at its former trendline it broke through a few days ago? A lot of times breakouts (or breakdowns) are tested before moving higher or lower. Just a thought in terms of looking for a reversal.

Keep up the good work and good luck Friday.

mac, we share similar thoughts

“# Danny Says:

People want out before the jobs data, which why were down 10% in 2 days. Thats fine, but what is the outcome?

I figure a gap down open is a buy, or the market will gap up.

November 6th, 2008 at 3:53 pm +0 “

Mac: a gap down on jobs #s would definitely give me a spike down on the Vix which would be a good spot to cover shorts, or a day trade to the long side. I guess that’s in line with my strategy heading into the weekend: i already covered WIRE and MELI in the final hour and took profits in EEV, and sold half of FXP which was my largest position, but still hold a number of shorts and some FXP because there was no “spike” anywhere in the Vix… just a slow deadly trend up, which is not a traditional “cover your shorts” spot for me. maybe we’ll get that breakout at the trendline? I don’t know how else to read that except traders are still complacent, and are “playing” with their gains that they made on the bullish 1,000+ pre-election rally.

btw Mac, i couldn’t get your video to load.

Oh yeah, you all realize that solars are going to drop more tomorrow because based on the Law of Large Numbers, my next call on solars is likely to be WRONG. lol.

Try the video again – I think it is working fine right now. I came close to covering WIRE today but just moved my stop up. I will probably cover tomorrow especially on a move lower.

Anyone notice the massive call buying in the 12.50 strike on TAN?

Wow, 2000 contracts on the November 12.50. that is a big bet for a small cap fund. Maybe they saw the support in FSLR at 137?

but look at the DEC, same order size, Calander spread maybe? Big open interest in the Nov, small in the Dec.

What are your thoughts Gio?

LONG, UNP,USO,STP,INTC,QQQQ,AAPL