Ever wondered how the stock market performs throughout a president’s term? Editor of Stock Trader’s Almanac, Yale Hirsch (a guy with too much time on his hands, like Woodshedder) came up with the presidential election cycle theory to explain this correlation. The theory suggests that on average, the stock market has performed in the following manner in each of the four year that a president is in office:

Year 1: The Post-Election Year (+7.35%)

The first year of a presidency is characterized by relatively weak performance in the stock market. Of the four years in a presidential cycle, the first-year performance of the stock market, on average, is the worst.

Year 2: The Midterm Election Year (+10.16%)

The second year, although better than the first, is also noted for below-average performance. Bear market bottoms occur in the second year more often than in any other year. “Wars, recessions and bear markets tend to start or occur in the first half of the term”

Year 3: The Pre-Presidential Election Year (+22.29%)

The third year or the year preceding the election year is the strongest on average of the four years.

Year 4: The Election Year (+12.18%)

In the fourth year of the presidential term and the election year, the stock market’s performance tends to be above average.

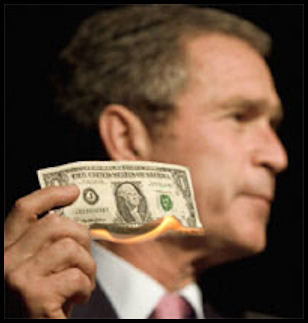

… as you can see, the Theory was quite close during Bush’s first term. The second term almost was true, except this year was historical.

S&P Performance

First Term

2001: -16%

2002: -22% …bottom

2003: +30% … best term

2004: +7%

2nd Term

2005: +5.6%

2006: +10.78% …bottom?

2007: +2% …nope!

2008: -30% … what the?

Now, as I always do, I try to find the story behind the pattern. Basically, my theory is that it has a lot to do with POTUS’ agenda (POTUS is “President of the United States” for those of you who don’t watch action movies). Game theory suggests that POTUS delivers bad news immediately after being elected and does everything in his power to create good news just before ensuing biennial elections. Therefore, my TheHerdIsStupid theory suggests that the general population will fall for all the political hopeful rhetoric, but because the Herd always has a higher IQ than POTUS, they will stay on the stock market sidelines and watch to see which promises are fulfilled. Any sector bubbles created by the election hyped will quickly fade in the second year as attention is now focused more on the policy’s that are prioritized by the new POTUS. That’s probably why bear market bottoms and recessions usually occur in the second year of the term, not so much because of the detail’s of a political procedure or fiscal stimulus, but because the herd has developed a new sense of confidence (people get tired of bad news) or have finally been distracted from one crisis to another issue. They sort of rally the market without even knowing it… then Yahoo Finance or CNBC will come up with some kind of gay headline to explain the rally in terms of Government intervention or contradict themselves trying to explain economic data.

Anyway, it will be interesting to see what happens under the new POTUS. Seeing that we ended the cycle with a huge outlier of -30% on the SDX so far, tells me to throw out the presidential election cycle theory and expect the unexpected. Who knows… we might see the best gains in the first year in which we would call the Bush-Relief-Rally.

If you enjoy the content at iBankCoin, please follow us on Twitter

I really think the Defense sector may have a tough time if Obama gets in. Thus i think LEAP puts or long term puts are in order. I plan to get puts in NOC,GD or LMT.

I think we are historically in new territory. The past markets would be difficult to pattern after.

I wish i bought TAN… that is a dirt cheap ETF. It will run up in a few years….

Yeah, TAN up almost 30% since recd.

Geo, are you still holding GG,EEV and MEA ?

yup. Whatever I post on thehawaiitrader.com are swing trades.

GG is a hedge on “government policy”

EEV is a hedge on our market trading near SPX resistance

MEA is a longer term buy, as I am bullish on commodities in November.

Thanks Geo, Im going to look these over tonight.