In After Hours Trading

IPOs due this week ADMA Biologics, BioAmber, Ellington Residential Mortgage, ING US, Insys Therapeutics and QIWI PLC. Secondary offerings none of note GWPH LOV TSRE. Courtesy of www.ipofinancialreport.com.

What’s Happening This Morning

US futures: (S&P +5.50, Dow Jones +49, NDX +12 with fair value a bit higher) Asia moistly closed and Europe higher. Copper and gold higher with WTI Crude higher and Brent Oil Futures lower. $ is lower vs Euro, lower vs. Pound and lower vs. Yen. US 10 year Treasury Yield +0.0085. Prices as of 7:55 a.m. EST.

Earnings Expected

Earnings due after the close among others ESRX SU GGP NEM HTZ SBAC PCL MAS ACGL JEC QGEN HLF CYH PPS RVBD BWLD TXRH among others. Due tomorrow morning of note PFE BP UBS EPD NEE BEN TRI ECL HCP VLO CMI SIRI AET PEG ZTS MHP among others.

Rags & Mags: Inside Wall Street

We are big fans of www.247wallst.com summary of the newspapers each day. Going forward we will link to their website so you can read their summary, Media Digest

Reported Earnings This Morning

AWI (-.17) CNA (+.15) ETN (+.05) L (-.28) ROP (+.05) SOHU (+.07)

Data Points

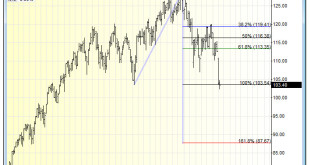

Yesterday saw 1210 stocks rise and 1767 fall on the NYSE. NASDAQ saw 933 risee and 1503 fall. The S&P 500 is above its 50 day moving average and above the 200 day moving average. The Russell 2000 moves back above its 50 day moving average. The 10 day spread moving average of breadth is now positive. We moved to cash on the Madison Market Timing Indicator on February 22nd which can be found on www.superstockinvestor.com.

Economics

Releases of note this week include weekly chain store sales, oil/gas numbers, mortgage applications and jobless claims along with personal income, Chicago PMI, consumer confidence, construction spending, ISM manufacturing, nonfarm payrolls, unemployment rate and factory orders.

March Personal Income is released at 8:30 a.m. EDT and is expected to be 0.4% against 1.1% in February

Politico

President Obama expected to announce several cabinet picks.

Conference & Analyst Meetings

Analyst meetings none of note. Bank of America Merrill Lynch Africa Conference 2013.

Conference of Note

10th Annual Stem Cell Summit.

M & A News

Bayer AG to buy CPTS for $31 a share and the stocks closed at $25.90.

Key Upgrades and Downgrades

| Firm |

Upgrades |

Downgrades |

| JP Morgan |

|

LEAP |

| Goldman Sachs |

|

|

| Morgan Stanley |

|

|

| Deutsche Bank |

|

|

| Citigroup |

|

|

| Merrill Lynch |

PBR |

|

| Wachovia/Wells Fargo |

|

|

| Credit Suisse |

|

|

| Banc of America |

|

|

| UBS |

|

|

| ING Group |

MT |

|

| Societe Generale |

LRLCY |

UNCFF |

| Jefferies |

|

|

| HSBC |

|

AEM |

| Sun Trust Robinson Humphrey |

|

|

| Raymond James |

|

|

| Credit Agricole |

|

|

| Cowen |

OIS |

|

Comments »