Today we are going to write about the infamous short squeeze. Too often investors and speculators try and use the potential for a short squeeze incorrectly.

First, It makes no sense to buy a stock just because it is in a short squeeze. Contrary to what the media may report to you this is often a loser’s game. For years, I recommended stocks that were in short squeezes just because they were in a short squeeze. That was the extent of how far our research went. That ended two years ago with a big advance in the research.

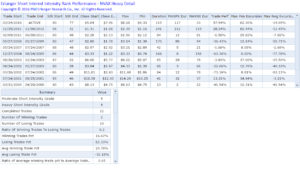

Why? Simply we created the ability to track how short sellers do each time they heavily short shares, which is very cool. No longer will I recommend a short squeeze without looking to see how the shorts have done historically.

If the shorts have a good batting average of making money, greater than 50%, when heavily shorted, then I will not recommend the name when it is in a short squeeze. Second, if the shorts have a batting average of less than 50% but they have made big money several times when it was heavily shorted, then I will not buy the name either. There is no reason to put yourself in harm’s way when we have 6500 stocks to potentially recommend as a long.

So a natural question is how do I determine when the short selling is heavy? Simply we look at the range of the short ratio over time. If the short ratio is the highest it has been in 5 years, then we say the short intensity is at 100%. My definition of heavy short selling is when the short intensity is above 80%. We then track it until it drops below 50%. We also track moderate short selling, above 50%. However, the sweet spot is heavy short selling. Now onto the good stuff and what happened Friday.

Earlier last week, I noted that Novavax ($NVAX) was heavily shorted again to some clients and prospects. Short sellers have made money 10 of 12 times when the short intensity level rose above 80% until the time it dropped below 50%.

When the shorts have a high batting average we assign a Heavy Grade on the Short Intensity of 5. Clearly, this name had a Heavy Grade of 5.

The first time that short sellers bet against it was in 1996 and they made 15%. The next time they shorted they pocketed 57%. For shorts this has been soak, wash, rinse and repeat time and again.

The average return for the shorts in this name when correct is 32.18%. Shorts made money 10 times when they shorted Novavax, so their batting average was 83%. 2 times they were squeezed and the longs made 20.78%.

With this type of history, why would someone try to play this from the long side when the shorts were pressing the stock? I do not know. Just remember the definition of insanity is doing the same thing over and over again with the expectation of different results.

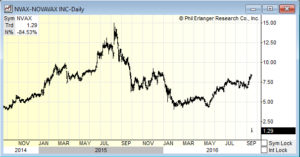

But clearly, many of those long thought they were smarter than the shorts. Once again they were proved wrong on Friday as the stock fell by -84%. That is not an error, yes it fell by -84%.

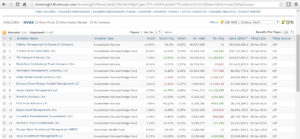

Many big firms owned the stock according to recent filings. The largest holder was Fidelity.

As I talked to one of these holders on Friday, they told me that despite us being able to predict when such a drop was coming, they did not care to know about this data. It did not enter into their equation. They were fundamental in nature and this data would never enter into their buy or sell decision.

We like to follow the progression of data to information to knowledge. Data that is turned into information and then into knowledge seems worth knowing about. That is what we have done with short interest. Short interest is the data. The short intensity is the information. The Heavy Short Intensity Grade is the knowledge.

The ironic thing is that this knowledge is derived from fundamental analysis by short sellers. There are many other stocks in the biotech space that are vulnerable to a similar fate and we will be writing about some of them in the not to distant future.

If you enjoy the content at iBankCoin, please follow us on Twitter