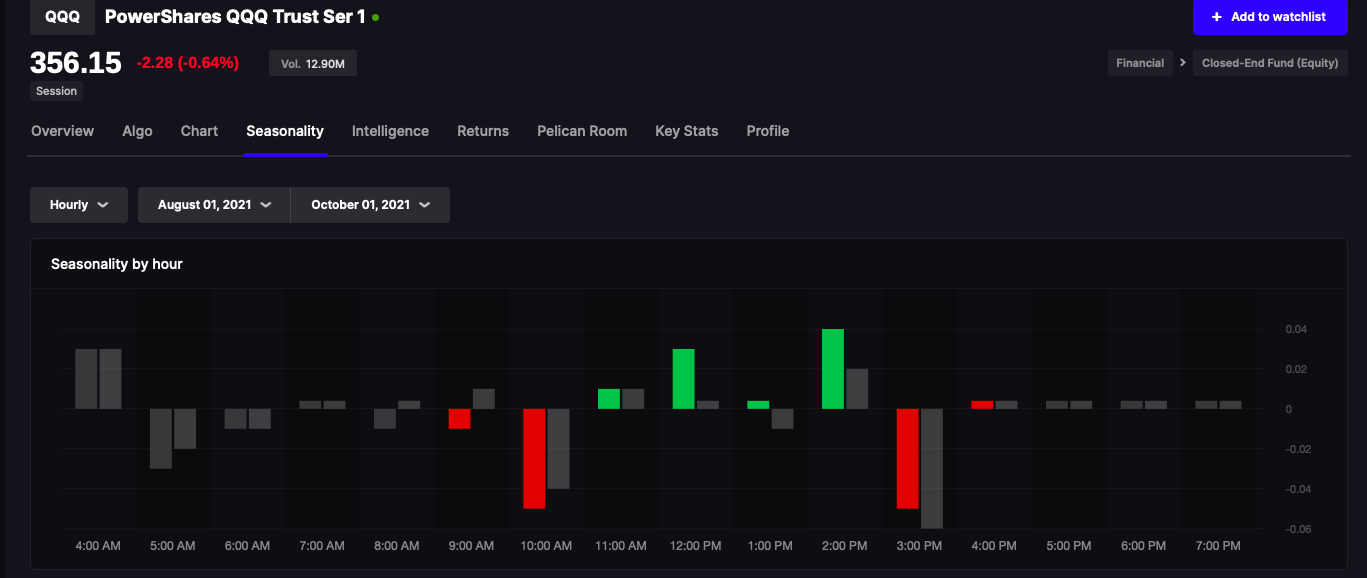

This is predictable. I sold every god damned stock but one at the open, locking in a 100bps gain and have since NIBBLED because I am now a rat in this market — running around fast taking bites of cheese. If you’re instincts suggest the opens are fucked — you are right. Check out the 9-11pm data on QQQ since August.

Fade the opens; buy after 10am and sell again by 1pm — for 3pm looms and it looms large and Monday we’re gonna die.

If you enjoy the content at iBankCoin, please follow us on Twitter

I feel like Europe and Asia needing to shut down their power grid may be double plus un-bullish for stonks.

Can’t argue. I’m net short for a reason.

Sorry. It must make you nervous when I agree. 🙂

Apparently the action in the dollar and bond markets lately had to do with default concerns, which had to do with trading as much as anything. Of course, that problem was merely kicked down the road a few months.

I don’t know what the next worry will be but it should be whether this economy can sustain itsself without more federal spending. I doubt it and I believe that the 4.5t is crucial.

These two news items will dominate for the foreseeable future, and I suspect the the Big Money agrees, judging by market action. Why wouldn’t it? Even with higher tax rates they stand to benefit.

Note: For the time being, (today?) inflation seems to be what has peep’s attention, at least as far as commodities, but the moves toward inversion in the bonds are being rapidly unwound

Also, globally, the US is STILL where people run to when there is a threat, as witnessed by late forex and treasury action.

Well. It seems that the markets like 3.2t. And I like its chances of passing. 4.5 woulda been better IMO but it’s a start, they can add later.

Closed out my short positions except for a few puts.

Today is a relief rally driven by treasuries getting bid and foreign investors fleeing their sinking ships.

US markets are higher because US 10 year yields are down. But this is from dollar strength against foreign currencies as Asian markets panic and selloff.

Asia and Europe are both in the midst of a major energy crisis now. Lead times for shipping remains 2 months for components and parts. Inventory shortages are hitting the shelves and are set to get worse.

For the moment international trade is neither healing nor is it further deteriorating. But the energy shortages are a major development in the wrong direction.

If I’m not much mistaken this bitch is going down.

It won’t be permanent, global trade will recover shortly but it will do profound damage to corporate earnings, numerous bankruptcies will occur and I very much do not want to be holding equities at 35x fucking earnings when it happens, thank you very much.

3.2t will paper over many sins at least for a little while.

“Good news everyone! We gave 45 year old workers parental leave to offset their industries getting ground to dust.” – the Democrat

Democrats*

I really don’t think there’s going to be $3.2T in spending. I’m not sure Democrats get a single spending bill through.

People are assuming that Joe Manchin wants something of monetary value. What Joe Manchin wants cannot be given in a bill; Manchin wants to be Senator of West Virginia.

And Progressives think they have super leverage to pass any bill by stopping any bill. They’ve staked their reputations on the whole $4.5T.

This is setting up for $0T in spending.

Net long now. QCLN, COPX, APA, EOG, NEM, BOIL.

Along with some out of the money puts in case Monday brings the Fires Of Hell.

I’m enjoying this market but I’m wired kinda different.