During the financial crisis Volkswagen manifested a short squeeze for the ages and became the world’s most valuable company, if only for a day.

Source: FT

On Monday morning Volkswagen’s ordinary shares opened at €348, up 66 per cent from Friday’s close, and kept rising. The shares closed at €517: a 149 per cent gain in the space of one day’s trading.

For those who had not squeezed out the fire escape, the worst was yet to come.

The first tick on Tuesday was a touch lower — €497 — before the shares took off again, rocketing to an intraday high of €999, before easing off to €940 at close. For those who sold a share short on the Friday, the losses were brutal. If they had borrowed €100m of stock, it would have cost them €450m to buy it back. (This calculation has been updated since publication to clarify the cost of buying back the stock.)

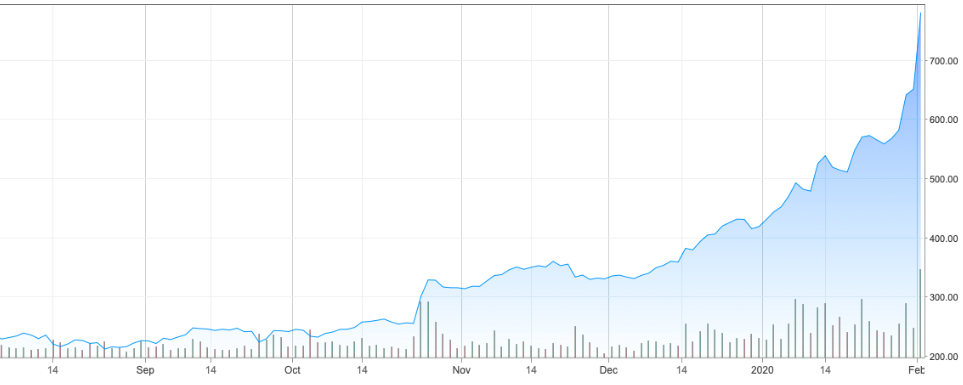

Similarly, TSLA has catapulted itself over the past 6 months, and hastened the pace most recently, to become the 2nd most valuable car company in the world — currently valued at $160b. Toyota is #1 at $196b. At this pace, with TSLA +13.5% in the pre-market, they’ll probably surpass TM sometime this week.

As for the overall market, looks like +400 by the open — thanks to PBOC liquidity injections. China was up 3% last night, so the machines want to get back every cent that was lost on Friday, and more.

In a bid to cushion the economic blow of the epidemic, China injected 1.7 trillion yuan ($242.74 billion) via reverse repos on Monday and Tuesday, helping Chinese stocks reverse some losses and lifting the world equity index.

The monetary intervention boosted investor sentiment even as several economists cut their forecasts for 2020 global growth as the death toll from the outbreak mounts and business operations in China remain suspended.

Bottom line: Nothing can stop it.

If you enjoy the content at iBankCoin, please follow us on Twitter

Glad I got back in yesterday. Now I need to figure out if I sell the open or wait for $1,000?

It’s aommon logic game: you have to sellbased not on your prediction of what the stock is worth, but on when you think others will sell.

I will short at $1000, no question. Many holders (Group A) will also sell at $1000, even the cultists, becuase they made a sh!t ton of profit and because it is a “pretty number”, as i said yesterday. This is obvious, so many (Group B) will sell slightly before them. Let’s say $995-$999.

However, sicen it is common knowledge that people will sell at $1000, it is also common knowledge that many peopel will try to sell sooner. So then many (Group C) will try to sell before these other groups, and so forth.

What is clear is that once the massive selling starts, there won’t be a “buy the dip” moment, so everybody has to figure out when the massive selling will start, and then sell before that.

I VERY much doubt that it will actaully hit $1000, based on people tryingh to “sell before the other guy”.

Have fun!

I like this take. It’s all greater fool theory, but several orders magnified. If you have a number in mind, a lot of people are also going to have the same number. A lot of people are not true believers in this stock. There are a lot of greedy bandwagoners.

+20%. Again.

“Tesla is Now Bigger Than Ford, GM, and Fiat” and has gone op 50% on **no copmany news**, yet the Motley Fools still won’t call it overvalued. They really are the polar opposite of ZeroHedge. The odds of a Bear article on MF are the same as a bullish article on ZH. Iwould strongly advise any reader of one or the other to diversify their sources.

This is absolulely a 1999 stock.

now near +25%.

My guess is that is drops like a rock in the last 5-10 minutes.

So that’s Phase 1 of a bubble popping.

Down 10% in 10 minutes aftre reaching ~$965

However…the stock was still up 14%, which is extraordinary for a no-news day. Also, it caught a branch ($860) and didn’t fall all the way through the close. Given that, I’m sure the faithful never actually sold. So we will likely see at least one more attempt at 4 digits.

Also, it’s Tuesday.

Most people don’t look at their stocks until the weekend (or less often). Many others will just look at the close, maybe at the high, but totally miss (and discount) the rapid accleration of the plunge. Not really bearish for true believers or chasers.

TL;DR: not the time to short TSLA…yet

Tesla exec states the obvious, pops bubble.

https://www.cnbc.com/2020/02/05/tesla-coronavirus-carmaker-plans-delay-to-model-3-deliveries-in-china.html

“The emperor has no clothes”: Tesla exec states the obvious, pops bubble.

https://www.cnbc.com/2020/02/05/tesla-coronavirus-carmaker-plans-delay-to-model-3-deliveries-in-china.html

Founding secured! *furst*

an Hipster trader is crying somewhere. in ball.

Citron can’t help themselves and went short. lol

they got a thesis!

I need to get my head examined shorting this market, Mr. Fly. The Chinese central banks are not going to let their economy collapse, just like ours.

In terms of China’s market actions, I’ll remind the youngsters that when the SEC banned short-selling of financial stocks in 2008, that caused a large rally in XFL – but it didn’t last. In terms of the markets, nCov will have a lasting effect similar.

Basically, banning shorts removes valubale price discovery action from knowledgeable market participants. Price discovery slows down, allowing sphisitcated longs to get out, while unsophisticated longs (retail investors) are left holding the bag while stocks continue falling. Just like in nature, chopping down dying trees and allowing small fires is helpeful for the forest by averting larger disasters. Price discovery can only be averted on a temporary basis (although “temporary” can be long).

https://corpgov.law.harvard.edu/2013/05/23/shackling-short-sellers-the-2008-shorting-ban/

We both know their efforts are crude and probably will end in disaster, but it doesn’t matter on a day like today.