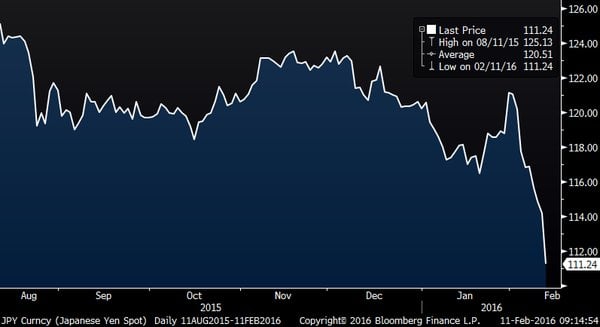

As a barometer for “risk off”, a rally in the Japanese Yen is spot on.

From the 121.70 USD/JPY euphoria level achieved post rate cut, we elevator shafted through 111 and even got into the 110’s before bouncing to the current 112.35. While 10 big figure moves in the world’s 3rd largest economy should be alarming to all, there is a good chance we get more. Barclay’s today forecast a further rally to 100 by the end of Q1 2016 and 95.00 by year end 2016 (prior YE 2016 estimate 120).

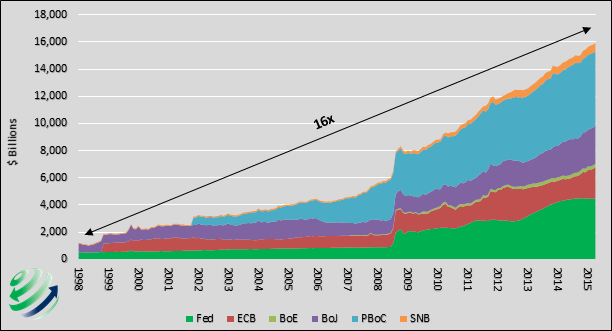

Central banks have officially run out of runway.

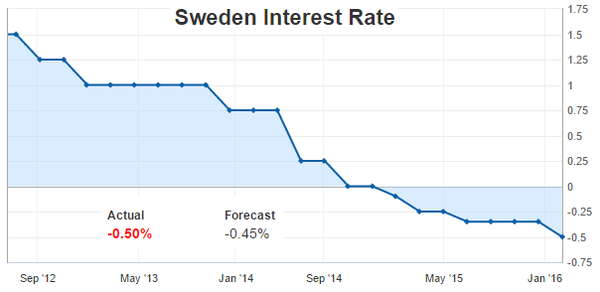

The Fed, EBC, BoJ, ECB, Riksbank (Sweden cut to -0.50 yesterday, submerged by 5bp more than the market expected and expanded QE purchases through reinvesting monies from maturities and coupon payments) & SNB’s goal of achieving 2.0% inflation in unison is not going to happen.

Gold has something different to infer from these moves it would appear. My modest allocation to gold miners will be tweaked (higher weighting) and DXJ (currency hedged Japan) jettisoned as wrong-footed folly. You have to trade what you see, not what you know (think you know).

Japan Topix financials were down 24% since the very recent rate cut in Japan (the market is further dissolving today as they return back from vacation). Mitsubishi UFJ entered the jaws of today’s market trading at 49% of tangible book, Mizuho 66%, Sumitomo Mitsui 52%. For reference Bank of America trades at 80% of tangible book. What is the liquidation value of a Japanese bank? Where does that bid come from? Not even Citi could make a go of it and sold their Japan franchise for less than $1bln. Even Ford is packing up their Japan tent and going home.

The reasons for such apparent “distressed” bank valuations is clear, the lifeline of higher rates is further beyond the grasp of banks globally. Yellen, Gundlach, Bass, JP Morgan, etc. talk about and research negative rates as if it is a “normal” conversation to be having.

There is an ebb and flow to the relative valuation of financials, but historically the equity markets struggle without the participation of financials. Going forward, bank balance sheets will more fortress like, less levered, and more conservative in their make up. CoCos (Contingent Convertibles) will make up a bigger proportion of the capital structure as there will be no “put” to their respective governments. Credit ratings will be lower, as no “lift” from implicit government support should be implied or expected.

Coming back to the car analogy, gone are the days of the V8, 4 cylinders, hybrids and full on electric are in vogue. Adjust your return expectations accordingly. JCG

Comments »