While a number of “Mom and Pop” investors were also caught in the downdraft of Fannie Mae and Freddie Mac’s Conservatorship in September 2008 (10 year anniversary next year!), the largest current law suits appear to be from the hedge fund community at large. Fannie and Freddie had $36bln in preferred shares o/s when they were placed into Conservatorship, with community/regional banks the largest aggregate holder.

Bruce Berkowitz’s Fairholme Capital appears to be the most “all-in” with respect to position sizing with 35% of the fund’s capital deployed long Fannie and Freddie subordinated preferred shares. AUM for Fairholme is currently approximately $3bln (they were managing $19bln at their pinnacle), making this a 10 digit wager.

In Fairholme’s words:

“Fannie Mae and Freddie Mac. We believe that these two companies may be the most important financial institutions in the United States – perhaps the world – and directly support housing affordability and accessibility, including the uniquely American 30-year fixed-rate mortgage. They are a major reason why our country did not descend into a second Great Depression. Millions of American families depend on Fannie Mae and Freddie Mac to lower the costs and improve access to homeownership. In times of stress, these two have helped to ensure the continued functioning of the U.S. housing market. They have no substitutes. Fairholme’s investment in Fannie and Freddie demonstrates a commitment to ignore the crowd and invest in valuable, systemically important institutions – even those that are politically unpopular.”

Richard Perry’s Perry Capital (in wind down), is also long the prefs, exclusively.

Bill Ackman’s Pershing Square is much less committed, in terms of size of position at least (but still a sizeable swing at 9%), and has chosen to purchase the common shares of both Fannie and Freddie (although he has been rumoured to be selling common in favor of the prefs). Both GSE’s applied to be de-listed in 2010 from the NYSE and now trade over-the-counter on OTCQB, the “venture” stage marketplace for early stage companies that report to a US regulator.

The original government bailout of Fannie and Freddie was $187.5bln and they have now remitted in excess of $265bln back to the Treasury ($78bln more than the amount of the bailout). Fannie Mae accounted for $116.1bln of the $187.5bln and have repaid $159.9bln total to date (owned + $43.8bln surplus via net worth sweep).

The mechanics of the tithe were changed in August 2012 when the 3rd Amendment to the GSE Conservatorship was passed (both GSE’s were paying a 10% dividend to the US Treasury on the Senior Preferred shares up until that point). The 3rd Amendment, as it became known, called for a “Net Worth Sweep” which is to be kept, in effect, for perpetuity. The golden geese have remained tagged since and the $ have been rolling in. Earnings for both GSE’s have been bolstered by an increase in guarantee fees as the fees on new mortgages exceeds the fees on those in the existing portfolio. Both have seen growth in their total guarantee portfolio, along with underlying mortgage origination and finally both have experienced lessening credit losses as their aggregate portfolio level credit metrics improve. An amazing turnaround story, were it not for the gold eggs being sent to corporate (aka Treasury) while they are still warm from being laid.

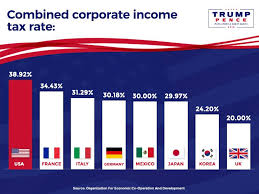

Fannie Mae had a profit of $12.31bln in 2016 as a point of reference. One potential fly in the ointment, in terms of reported earnings going forward, relates to deferred tax assets (DTAs). This is a bigger issue for Fannie than Freddie because of the relative size of their DTAs and the potential impact of Trump tax reform (corporate rate from 35% to 15% proposed, but many handicapping a final rate of 20%). Fannie Mae’s DTAs stand at $35.1bln and Freddie Mac at $18.7bln. Steve Eisman, who disclosed owning Fannie Mae prefs in smalls, implied on TV this week that the DTAs could prove to be a catalyst for action, implying the US Treasury would be called upon to make the GSEs whole on the potential DTA value impairment due to the proposed Federal corporate tax cut. I may have misinterpreted Mr. Eisman’s call on this, but one thing is 100% for sure, the status quo is not sustainable. The US Treasury can ill afford to assume an additional 5-6tln of debt by nationalising the GSEs when the non revenue neutral programs on the table already get the USA to the mid 20’s (trillion) in Federal debt.

The lawsuits have not been going swimmingly for the hedge fund dominated plaintiffs to date. Shares of both GSEs have dropped >25% in the last 2 months months after an appeals court upheld a ruling against shareholders challenging the legality of the government’s Conservatorship. Shareholders continue to argue that the government’s net worth sweep of all GSE profits in perpetuity is unconstitutional. An overturn of the perpetual full profit sweep is the only viable alternative leading to a non zero-valuation for both the common shares and junior preferred shares of Fannie Mae and Freddie Mac. This is a binary, legal based outcome, hence not for the faint of heart. Ackman’s take, “We believe that Fannie and Freddie offer a compelling risk-reward as there are various scenarios which will generate a many-fold multiple from current levels. While a total loss is possible, we believe the probability of a total loss is relatively modest, and has become lower in the new political environment.”

Catalysts for a positive outcome:

1.) The U.S. Supreme Court overrule previous court decisions and overturn the net worth sweep.

2.) Trump and Treasury Secretary Steven Mnuchin recapitalize Fannie and Freddie, returning control to shareholders.

The 2nd scenario is the one that has boosted the stock since Trump’s win in November. FNMA and FMCC spiked as much as 250% (from $1.65 to $4.40) before settling in at the current $2.65 level (+50% from November).

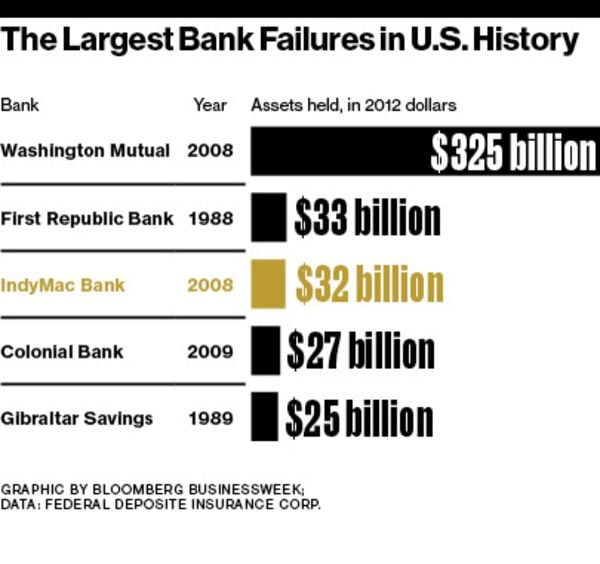

Nobody is better suited to craft and execute GSE reform than Mnuchin, aka “The Loan Ranger”. Post Goldman, he purchased failed Pasadena, CA IndyMac, doubled its capital base (via additional acquisitions) renamed it One West and sold it to CIT for a tidy profit.

https://cei.org/blog/mnuchin-must-bring-transparency-fannie-mae-and-freddie-mac

https://cei.org/blog/mnuchin-must-bring-transparency-fannie-mae-and-freddie-mac

Mnuchin has publicly stated:

“[We have got to] get Fannie and Freddie out of government ownership. It makes no sense that these are owned by the government and have been controlled by the government for as long as they have. In many cases this displaces private lending in the mortgage markets and we need these entities that will be safe. So let me just be clear we’ll make sure that when they’re restructured they’re absolutely safe and they don’t get taken over again but [we have got to] get them out of government control.” (Footnote: Nov. 30, 2016)

“[…] it’s right up there in the top 10 list of things that we’re going to get done and we’ll get it done reasonably fast.” (Footnote: Nov. 30, 2016).

Mnunchin’s right hand man is Craig Phillips, a near 40 year Wall Street veteran (most recently at venerable Blackrock) but he ran the Mortgage Securities unit at Morgan Stanley in the lead up to the GFC (May 2006, about a year before the wick was lit on the MBS woes to follow).

With Housing Finance Reform a top 10 priority, in terms of timing this likely makes it 2018 business (prior to 2018 midterms). The Trump tantrum we saw in the markets yesterday provide a potential entry point for punters willing to take Mnuchin et al at their word. FNMAS, the most liquid Fannie subordinated pref traded off by 5.6% to $6.75 yesterday (17-May-2017). The 52-week range has been a wide $3-$11, reinforcing the speculative nature of the proposed foray. The low was close to 9/11/2016, the 8 year anniversary of the prefs going ex dividend on 9/11/2008. The Trump Bump sent the Fannie prefs prices skyward, from lower left to upper right as Gartman would put it, approaching $11, appropriately, on Valentine’s Day 2017. FNMAS now at $6.75 have since given back 38% from the February 2017 $11 high.

This is the appropriate time to ask, “What is the upside on an investment in Fannie Mae subordinated prefs (FNMAS)?”, given that the downside has been shown to be zero. Fannie Mae did not file for Ch. 11. It was placed into Conservatorship, along with Freddie Mac. The capital structure remains legally intact, under which the subordinated prefs rank behind the US Treasury senior prefs, but importantly ahead of the common (which is to be diluted by 80% …. the US Treasury mandated “deal” when placed into Conservatorship). Also worthy of note, at the time the GSEs were placed into Conservatorship all senior and subordinated debt of the GSEs was paid/matured at 100 cents on the $. Before the US Treasury prefs can be extinguished (legally) it highly likely the dividends on the subordinated prefs would have to be reinstated. There are 16 discrete series of Fannie Mae subordinated prefs, FNMAS just happens to be the most liquid. None of the prefs are cumulative (i.e. no legacy dividends are owned once they start to pay again). The coupon on FNMAS is Max (3 mth Libor +4.25%, 7.75%) with a par value of $25.00. Cessation of the net worth sweep would see FNMAS trade back to par ($25) in short order for a 3.7x return on invested capital. It will likely take Fannie Mae time to build a capital buffer once/IF the net worth sweep is nullified. The US Treasury, despite the windfall seen via the net worth sweep will likely mandate the timetable for their senior prefs to be repaid. FNMAS, on a dividend reinstatement would pay 7.75% until Libor gets to 3.495% (good things are happening if/when we get 3mth Libor back to a 3 handle, I assure you), at which point L+4.25% would become the MAX, hence the applicable coupon. Given how high the rate is versus current market rates, it stands to reason that steadfast FNMAS investors could well see the market price trade well above par. I like the potential payout on a positive outcome for FNMAS (3.7-4.5X invested $) much better than FNMA common. FNMA common traded off 3.3% yesterday to $2.65 and with some analysts guessing on an equity value of $15 post net worth sweep that would get risk-seeking investors a 5.66x return on their money. The pick-up versus the subordinated prefs does not seem worth the substantial additional unknowns and the known capital structure inferiority in terms of priority of payments.

Mnuchin is scheduled to speak today on GSE Reform in front of the Senate Banking Committee. Nobody is holding out for 100% clarity, but in a land increasingly filled with mere whispers, a clear voice can go a long way in setting the future course for perhaps the #3 priority for the Trump administration (just behind healthcare and tax reform).

Follow me on twitter @firehorsecaper

JCG

Disclosure: Long FNMAS, 2% allocation @ $6.75.

Comments »