Pokemon Go, get used to hearing a lot more about it.

Thus far the limited release, including the all critical USA market, has been record setting.

From a trading perspective, the pin action has been awe inspiring, but without the wide trading ranges one would expect of daily double digit gains in the stock price of Nintendo. Buys have been exceeding sells by a factor of 7:1 on some platforms over the last week. Lower left to upper right as Gartman would phrase it. Nintendo officially has game, mobile game.

The global roll out of Pokemon Go is underway. I’m reporting from Japan, home of Nintendo (ticker 7974 on the Tokyo Stock Exchange), where fans can’t wait to get access to the app and begin their frolicking. The Japan roll out appears to have been set coincident with the end of the rainy season in Japan. As an outdoor “augmented reality” experience, Pokemon Go is best launched without torrential rainfall, hence I expect a release date the last week of July. The rain spigot ceases like clockwork around the 20th of July in Japan. Expect take up rates on app downloads, usage, paid users, $1 pokeball sales and overall hype to pierce the giddy precedent set by the US market.

The opportunities for Nintendo to exploit their extensive catalogue of intellectual property is immense. Pokemon, developed in 1995 by Satoshi Tajiri was already raking in $2bln in revenue per annum for Nintendo. Generations of gamers know the sketch, keeping advertising cost down and hence margins high. Others have pointed to the immense retail deals that could result with global franchises keen to build a stable of pokemonsters to drive traffic and resulting $. Poketourism can’t be far behind, I kid you not.

The many, including me, not yet long should study further for rational entry points. Shorting this rocket is not something characterized as an investment activity and should not be considered.

Nintendo has over $7bln on cash on their balance sheet and no debt. The previous high in the ADR’s was $78.50 in 2007 and there are 15% less shares outstanding now (held as Treasury stock by Nintendo, now the largest sole shareholder of Nintendo stock via timely buybacks at much lower levels).

The current $33.38 price for the ADR’s has come too fast, but it is difficult to fade this move for the multitude of reasons noted. Nintendo has a market cap of $32bln at present.

Pokemon Go was developed by Niantic Inc., a Google spin off which Nintendo holds a 32% stake in (yet another reason to own Alphabet too). One can bet there are many more augmented reality games in the wings. No gaming company has been more successful than Nintendo, who have brought 22 of the top 25 console games to market over the history of the gaming space.

The previous stock price pinnacle of JPY 75,000 (we closed at JPY 27,780 Friday last) was achieved when Nintendo’s Wii console took the market by storm, selling >100mm units. There are 2.5bln smartphones in use globally at present, and growing. Candy Crush has the record to date for smart phone penetration at 20% and it would appear Pokemon Go could easily exceed that metric. Those early to the story in January 2016 saw 3-4x upside for Nintendo shares. The recent spike of near 2x since the limited Pokemon Go launch clearly increases the risk for new holders, but it would appear a mobile gaming juggernaut has emerged in Nintendo.

For those that feel restricted trading only North American hours, the more liquid parent listing denominated in JPY, 7974.to is another option for those enabled to trade on foreign exchanges. Any medium to long term hold would be best currency hedged, as even though the JPY has rallied 15%+ at points in 2016 seems destined to depreciate versus the USD.

Play safe and trade safer. JCG

PS: Follow me on twitter, Caleb Gibbons @firehorsecaper

If you enjoy the content at iBankCoin, please follow us on Twitter

Barron’s :FOLLOW UP

Nintendo Could Double on Pokemon Go Craze

The Pokémon Go smartphone app should lead to bigger opportunities for the game-console maker.

July 16, 2016

Review | Preview

Since the Pokémon Go smartphone app was released this month, Nintendo’s stock has surged nearly 90%.

After years of punishing Nintendo for missing the smartphone revolution, investors have made quick amends. The stock (ticker: NTDOY) has surged 89% since the July 6 release of Pokémon Go.

In case you missed the headlines about distracted players walking into ponds and falling off cliffs, the Pokémon Go smartphone app has millions of people on a simultaneous quest for monsters.

The virtual hunt takes place in a fusion of the real and imagined known as augmented reality. “Pokémon” are hidden across the globe. As users walk around their towns, the monsters—queued by the phone’s GPS signal—pop up in the app. The initial goal is to catch them. Eventually, Pokémon become fodder for trade and virtual battles. The real world— picked up by the phone’s camera—is the backdrop for the action.

Enlarge Image

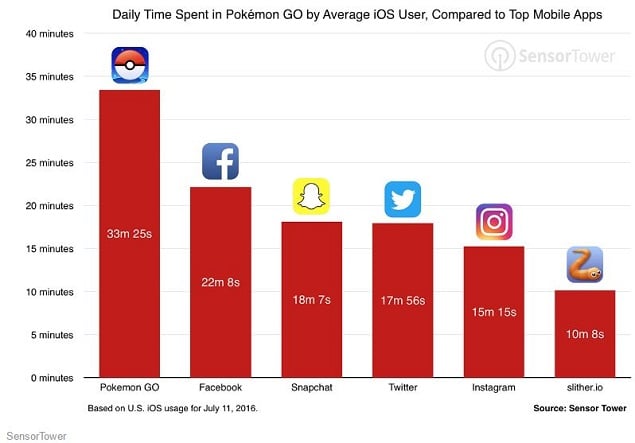

In a few days, the app had more users than Twitter, by some estimates, and was sucking up more smartphone time than Facebook. (Shuli Ren at Barron’s Asia is tracking Pokémon’s day-to-day successes.)

Pokémon’s impact could extend beyond the phone. Retail analysts at Cowen argue the game could save bricks-and-mortar shopping by pushing people to malls in search of monsters. Sponsorship opportunities are significant for retailers and anyone else seeking to draw people to physical locations.

Nintendo controls only a third of The Pokémon Co., and the game’s economics remain hazy. But the craze is reminding investors that nobody knows gaming better than Nintendo.

Barron’s highlighted the opportunity last year (“Nintendo Bets Smartphones Can Revive Its Fortunes,” June 20). We wrote that Nintendo’s American depositary receipts could go from $20 to $30, once the company stepped outside its console box and embraced smartphones. Sure enough, a week after the Pokémon app’s debut, Nintendo hit the target and kept going, closing Friday at $33. There’s more good news to come.

More From Barron’s

Jefferies analyst Atul Goyal, who has been a rare Nintendo bull, calls Pokémon Go “the tip of the iceberg.” Nintendo plans two of its own mobile games by September and another two by March. One 2017 release could feature Mario, Nintendo’s best-known character. “Mario is many times bigger than Pokémon,” notes Goyal. “This isn’t about Pokémon’s earnings, based on five days of data.” He says Nintendo has become a “concept stock” that requires a long-term view.

Nintendo ADRs hit $79 in 2007, when its intellectual property—Mario, Zelda, Pokémon, and more—powered games for the Wii and DS consoles. Our 2015 story argued Nintendo could revisit that all-time high in three years, if the phone strategy panned out. So far, so good.

Consoles’ reach pales in comparison with that of smartphones. Nintendo sold 102 million Wii units. Candy Crush from King Digital, in comparison, had 550 million active smartphone users at its peak. Goyal thinks Pokémon Go could easily reach one billion.

Nintendo is about to launch a $35 wristband that notifies users when Pokémon monsters are near. If just 5% of a billion users buy it, Nintendo would generate $1.75 billion in revenue and north of $1 billion in operating profit—from one accessory for one game. Nintendo’s profit—just $273 million last year—peaked at $6 billion in fiscal 2009. The smartphone could drive a worthy sequel.

—Alexander Eule

Very thoughtful and informative article Thanks! It looks so stupid seeing these people doing this, it’s going to make a lot of money.

Fitbit goes by by don’t they?

Some names in the wearables space could well go bye bye. That said I like my Garmin VivoFit Plus. Nobody needs or wants more battery drain (iWatch). I have not seen the spec on the Pokemon wristband @ $35 but it will likely have at least basic fitness functionality.

Nintendo continually impresses me. Every time I think the company is stuck in the past and slowly dying out, they come roaring back with some crazy innovation.

Disclosure: Long 7974.jp at JPY 30,000. Equivalent level for ADR’s (8:1 ratio) with USD/JPY 106.05 is $35.36.

Pokemon Go rumored to launch in Japan tomorrow, July 20th (as noted end of rainy season), McDonald’s as 1st “sponsored location.”

There will be blowback. Is it true Google takes pictures on this app, since it’s goog mapped fo life?

Nintendo and Google are partners in this on a couple of levels. A lot more CCTV cover for police enforcement as long as a Pokemonster in the mix is not upsetting to the courts of the land in question.