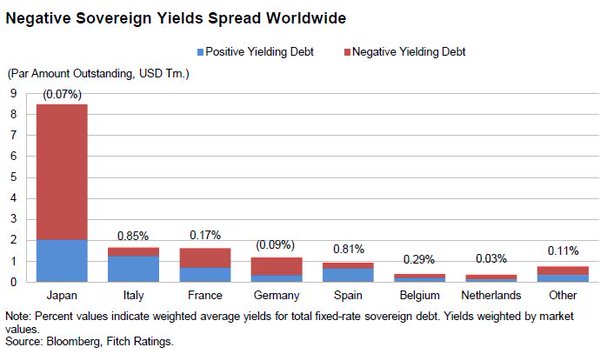

Some sectors within Japan are hot, which one would would not know if following only the popular “sky is falling” press. The traditional widow maker trade, short JGB’s, has gone exponential grim reaper on the NIRP holo-deck. The benefits effects of being a creditor nation, where less than 10% of JGB’s are held outside of Japan (i.e. no weak hands) I suppose. The same calculus make NIRP of limited value for a market rabid for a means to increase the resting heart rate of a market comatose for 25 years running.

Arguably the largest ever financial bubble (in relative terms) was pricked in 1990 in Japan. Japan grew GDP at an annual rate of 10%+ every year from the end of World War II until the late 1980’s. It was real estate fuelled at its terminus, and the exponential momentum was awe inspiring in scale. On paper, Tokyo’s Imperial Palace (280 acres, 35% of New York’s Central Park’s size) was worth more than the State of California in 1989. As an expat in Tokyo you had to hold up your fingers to indicate how many times the stated fare you were willing to pay a taxi to have a shot at getting service.

The short JPY trade has been hurtful in 2016, but at 106.93 versus the USD at the time of print, not yet lethal (70?). Japan equities, on any metric except the Mothers Index (TSEMOTHR:IND, up 33.1% ytd) have been scornful as well, especially for those currency hedged exposed via ETFs like DXJ. The JPY is a barometer of risk appetite for certain and tethering the generic Japan equity index to the inverse currency move has served to be the equivalent of a levered ETF product, appropriate (perhaps) for a trade view measured in days, not weeks (ice pick) or months (amputation).

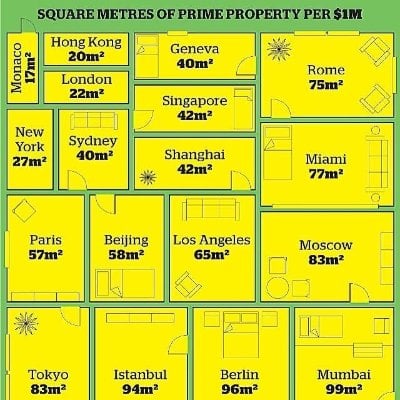

A trade worth revisiting is Japan is real estate. Japan is a very mountainous nation, with only 15% of the land mass habitable. A goodly portion of arable land is sequestered for agriculture, with rice being a key staple for the Japanese to maintain self sufficiency in. An urban myth is that there is no daylight savings time in Japan because the famers successfully made that the case that milk cows do not produce as much milk when the clocks are adjusted.

The standard unit of measure for land in Japan is a tsubo which measures 3.3 square metres (35.5 sq. ft.), about the size of a queen size mattress. A standard building lot in Japan is 50 tsubo or 1/25 of an acre. Less than 20% of the land in Japan has ever changed hands with families having owned their respective plots for 100’s of years. With respect to landed housing (freehold), all of the value is attributed to the land and upon sale it is generally expected to be delivered vacant. The “penalty” for disposal cost, depending on lot size and other variables can run US$200,000+. Most of the real estate in play is prime condo (freehold) stock. Individual room sizes are measured in Tatami mat (33.5 x 70.5 inches) metrics, further complicating the math for the Western brain. 6-jo is a standard sized bedroom and 14-jo is a standard living/dining space.

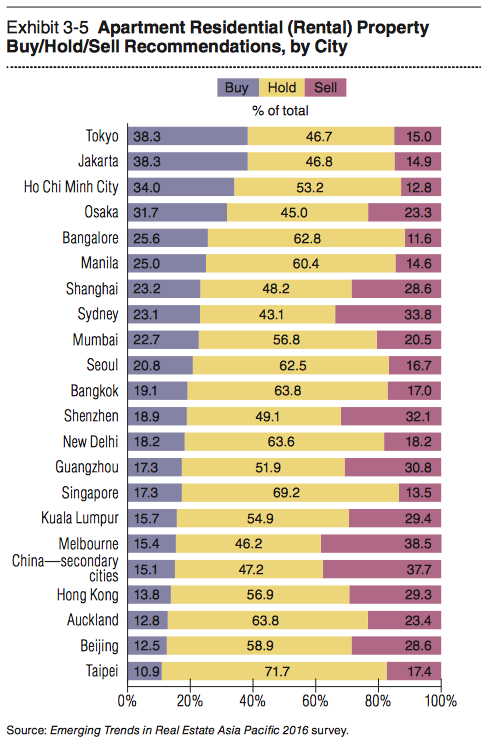

Quirks aside, many are bulled up on Japan residential real estate and place Japan as the #1 market for your investment dollar within Asia Pacific. I would argue the scope can be expanded to a Global metric on a relative value basis (valuation/yield driven):

Note: PwC / ULI 2016 survey results.

For many, Japan and Tokyo are terms used interchangeably. There is good reason, as Tokyo is the most populated metropolitan area in the world at 36.9 million people. A full 29% of Japan’s entire population lives in Greater Tokyo. Other Japan markets worth a gander include Osaka, Nagoya and Fukuoka, but much of my comment will be on the merit of the Tokyo market. You can buy more real estate in an afternoon than you can sell in an lifetime is a great adage to keep in mind. Bespoke plays should likely be left to specialist players with local market knowledge.

Demographics:

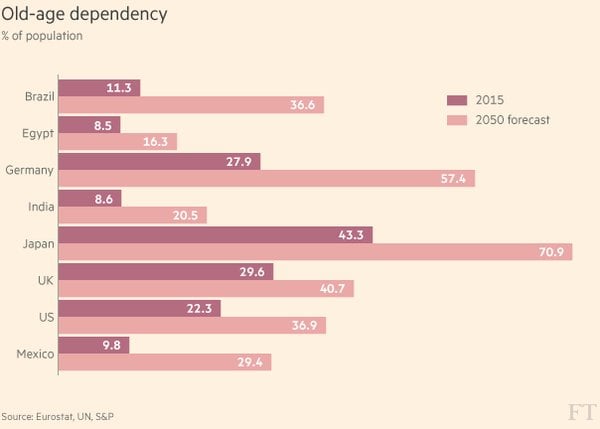

I would be remiss without covering this facet of the argument. By the year 2070 apparently there are only 9 Japanese people left on planet Earth? The actual stats are not as bad, in reality, with all developed markets trending in a similar fashion. That said, the working population is Japan is small and shrinking. 26% of the population are > 65 and 13% are < 18 leaving approx. 61% to “pull the economic plough”. The working population in Japan is estimated at 65,000,000, of which 1.4% are foreigners (910,000). Let that sink in for a moment, Japan is 99.3% Japanese. When I lived in Japan in the late 1990’s there were about 500,000 foreign workers, hence Japan was 99.6% Japanese. The foreign work force has spiked 40% since 2013 with a full 1/3 from China, followed by Vietnamese, Filipino and Brazilian skilled workers. Brazil would likely be the only surprise for most, but Sao Paulo, Brazil is home to the largest Japanese population outside of Japan. Over 250,000 Japanese have emigrated to Brazil since 1908 (migration briefly interrupted by World War I & II) with the population having expanded many fold since.

A more typical percentage of foreign workers in a developed nation such as Japan would be 5% of the workforce which leaves the potential for 2,300,000 incremental foreigners to enter Japan over the coming decade(s). Japan is clearly a good global citizen with respect to global aid (few are more generous), but there is no refugee intake into Japan and only skilled workers make the grade on visa entry.

Japanese labour demand sits at a 25 year high since Abe took office in Dec. 12′, driven by rebuilding from the 11′ tsunami and the construction mini-boom from the upcoming 20′ Olympics.

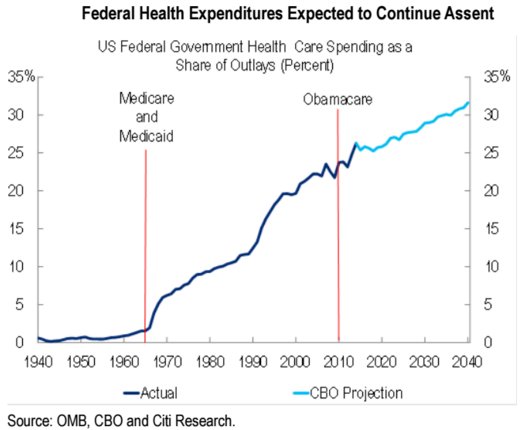

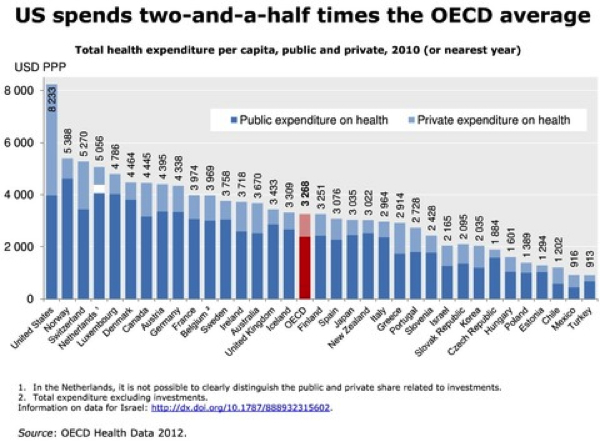

Japan may be relatively bold and wrangling (top 10% holder of a full 90% of the stocks listed on their main stock exchange) with respect to their quantitative easing program, but on a relative basis they have kept their healthcare costs in check as a nation (7% below the OECD average for an excellent standard of care). Healthcare as a % of GDP is still below 10% in Japan versus 20%+ for the USA where 65% “pull the plough” (versus the stated 61% in Japan).

Even though the Japanese are not replacing themselves from a mortality perspective, subtle changes in the traditional family make-up favour the Tokyo residential real estate market. Occupancy rates are currently > 90%. The family unit used to be more extended, with parents and grandparents under the same roof. These days, the family unit has shrunk to encompass the direct family unit solely, in many cases with that unit closer to the core of Tokyo. As with other developed markets, millennials are getting married later in life, but instead of staying with their parents until married, many young professionals (increasingly women) are moving to more central Tokyo housing on a rented basis (paying full freight). These collective trends have average condo valuations back at 1992 levels (approx. US$474,000), two years after the noted blow off top in 1990.

Valuation:

Fees, on balance, are reasonable in Japan. Closing costs are on the high side at 7-8%. Build quality is top notch (must be earthquake resilient to pass code).

Cap rates, the ratio of net operating income to value, are running in the 4% range for prime residential Tokyo, which on a leveraged basis can net 8-10% for investors. Typical loan to value has dropped to 60-70% versus upwards of 90% pre 07′. Mortgage rates have never been lower. Variable rate mortgages can be procured at 0.6%, 10 year at 1.05%, 20 years at 1.25%, 30 and 35 year terms at 1.8% and even 40 years at sub 2%.

Near term catalysts:

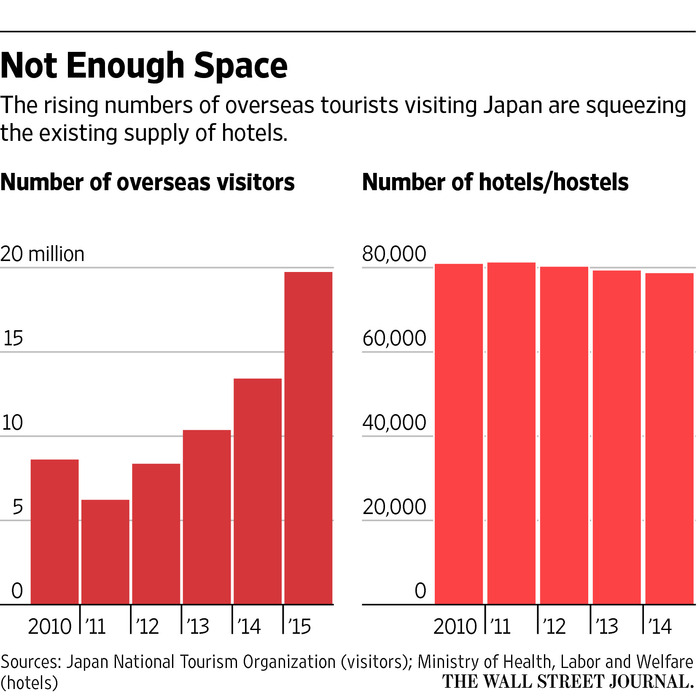

While not as marked as a Russia or Brazil olympics prep, the opening of the 2020 olympic flower has netted much nectar. For the first time, since stats were recorded, there were more visitors to Japan than there was outward travel in 2015. 19.7 million people visited Japan in 2015, up 41% from 2014. Spending from said visitors was JPY 3.5 trillion, up 72% from 2104. Chinese mainland shopping binges, termed “Bakugai” (explosive Chinese shoppers) made up a full 1/4 of the total sales bounty.

In prep for the Olympic games, over 10,000 bilingual signs are being erected to aid foreign travellers. Rules at Inns (Ryocans) are being relaxed to allow guests with tattoos to enjoy the natural hot springs that Japan boasts by the 100’s. Traditionally, only the yakuza (Japanese mobsters) sported ink in Japan and they politely deem tattoos as “unclean”.

International resort legislation. The only legal gambling in Japan at present is horse racing, but many expect broader approval over time.

The Japanese government has become pro-business . As with the stealth immigration stance pivot, such policies can have resources redeployed at the margin.

The negatives are nearly innumerable, which is part of the attraction. Demographics. The failure of Abenomics (12-18 month average tenure at the top, hence Abe is Cocoon like in his longevity). Earthquake risk. Nuclear containment (Fukushima) influence on proximate food supply and general health over decades of exposure. Post Olympics swoon expectations.

While Japan recently rated 56th on a global “happiness scale” for the Japanese, most foreigners I have known that lived there loved it and rank it near #1 within Asia (can’t get the smile off their face with a brick happy). While it appears the ship has sailed with respect to Japan as a regional financial centre (current ranking London, New York, Singapore., Hong Kong followed by Tokyo), there is much to like. Climate (ex August), food, safety, service, and unique experiences like no other available on planet Earth.

Ways to play:

The WisdomTree folks run DXJR a modest sized (sub $200mm) ETF which hedges Japan real estate exposure back to USD basis. While a stinker ytd, contrarians might want to give it a scrub. Down 6%+ ytd.

RWX – SPDR Dow Jones Intl Real Estate ETF (2 of top 10 holding Japanese), $4.8bln AUM , MER 0.59%, ytd up 8.7%.

VNQ – Vanguard Ex-US Real Estate ETF (3 of top 10 holdings Japanese), $3bln AUM, MER 0.25%, ytd up 7.1%.

Direct – Bespoke property in Japan. Financed in JPY (i.e. short JPY), down payment hedged (JPY upfront).

Personal carry trade – Finance foreign domiciled property with a JPY denominated mortgage. Common on the Continent pre GFC. Spotty availability expected in the current environment.

JCG

Disclosure: Vetting Setagaya( Tokyo suburbs) for potential mid 2017 move. Reported stat are in line in terms of cost and terms.

If you enjoy the content at iBankCoin, please follow us on Twitter

Nice article

Made the move myself last July to Tokyo (Sangenjaya in Setagaya)after pondering a few options.

And yes I have that smile now that a brick would not remove.

Best of luck with your planned move , there is nowhere on earth quite like Tokyo

I learned a lot from this post. wound up taking me 2 hours to read because I kept googling things I didnt know that you brought up throughout. thanks for writing it.

Glad you enjoyed it. Others have pointed out the challenges of getting mortgage financing onshore without permanent residency. Some lend only to the land value as that is really the only value you can hang your hat on.

In the interest of brevity I did not cover it, but changes are afoot with respect to derelict housing in Japan. Taxes are being substantially raised on owners/heirs to prompt action and in some cases the land reverts back to the prefecture which can then sell it. Good news for a country so starved for space. JCG

Book me a spot in Takadanobaba. 2020 or bust.