The first quarter is in the books and it was a profitable one. As I stated when I first started this project, I am looking for 2% monthly returns. So far, January and February fell short of that goal, but March was satisfactory. Yes, I could have gone long SPY, forgot about everything and doubled my returns, but hell, that’s no fun, now is it?

The new year brought about an interest in volume at price analysis. In my short time delving into this method of analysis, I have started to see how this tool can be used to identify stocks that have the potential to “run”. Stocks like TPX, CBI, RWT, WGO, PCL and MGA have been mainstays in my analysis and portfolio.

Now, their appreciation since the start of 2013 may be the result of a market high on fine white powdered drugs, but they also have exhibited a certain ‘slipperiness’ in their ascent that has added to my conviction in using Price by Volume as a means of analysis.

I believe that charts provide a visual representation of investor psychology. Price by Volume allows you to delve deeper into the rabbit hole to find where levels of supply and demand are in harmony and where there is an imbalance.

To this point, my collection of companies “on watch” has come from running a couple screens and populating my list as I find new stocks that meet the criteria I am looking for. Over the past few weeks I have been plowing through a list of almost 2000 stocks (those which trade more than 400k shares/day and are over $1/share) in order to create a volume void database. The process is tedious, but I now have built a list of 170 stocks that currently exhibit significant volume voids.

I am really excited about how this is coming together and I look forward to sharing how I use this information to trade these stocks.

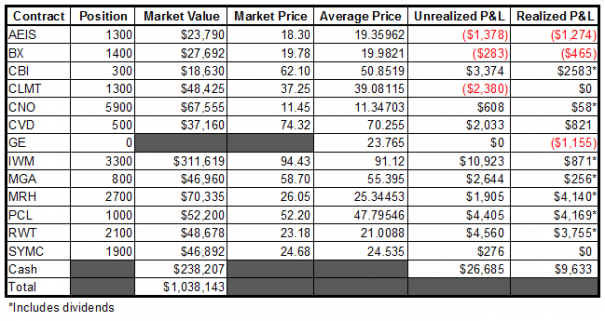

As for the portfolio, on Thursday, I raised some cash by selling off half of my laggard AEIS and BX positions and trimming a bit more from PCL. Cash is now up to 23%.

Final thought: I am looking forward to some volatility.

-EM

One Response to “Portfolio 03/28/13”

Raul3

…delve deeper into the rabbit hole to find where levels of supply and demand are in harmony and where there is an imbalance.

well said good sir, cheerio chip chip