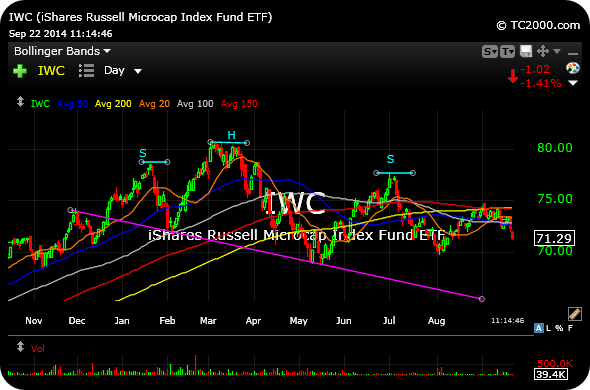

Micro-cap and small cap weakness (and U.S. Dollar strength) is likely beginning to pressure the rest of the market after an extensive period of time of divergences duking it out versus stubborn and spirited bulls.

I see plenty of attractive short setups out there, ranging from AA F GM PCLN to LVS SBUX WYNN, among others.

We have, of course, seen countless “bear traps” over the past few quarters, with each apparent breakdown simply setting up a V-shaped rally back to the highs in a vicious squeeze, then endless grind higher. So, seeing this weakness hold and then spread is going to be critical to the bear case this week and beyond.

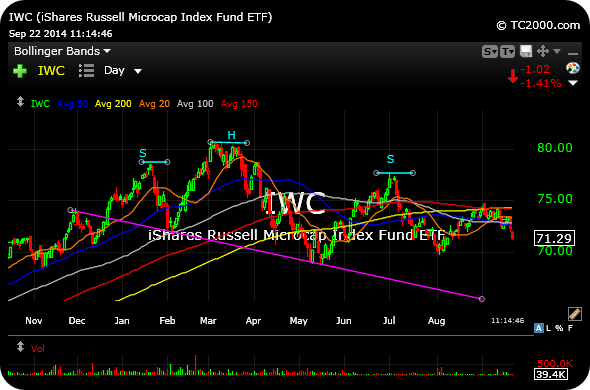

Circling back to the micro-caps, note the daily chart we have been tracking, below, indicting the major topping pattern is very much in play and asserting itself today.

As evidence, consider that the micro-cap index is trading back at levels where it was in October 2013–Nearly a full year with no progress made now.

____________________________________________________________

Comments »