The small caps in the Russell 2000 Index continue to throw cold water on any attempts at a broad market bounce.

In addition, the blow-ups of the day can be seen in the massive drops in ARWR SHLD.

To be sure, healthy charts are few and far between these days, as I expect the senior indices to continue to buckle under the same pressure the small caps have been facing for a while now. Although it seems as though a bounce is due, my sense is too many are expecting just that. Admittedly, however, it is always tough to gauge sentiment.

I am still pressing shorts inside 12631 and remaining opportunistic with inter-market trades.

Currently, the S&P 500 cash is testing its under-watched 150-day moving average, which offered support last Thursday, down at 1930 or so. Bulls are going to need to defend that in order to prevent new pullback lows.

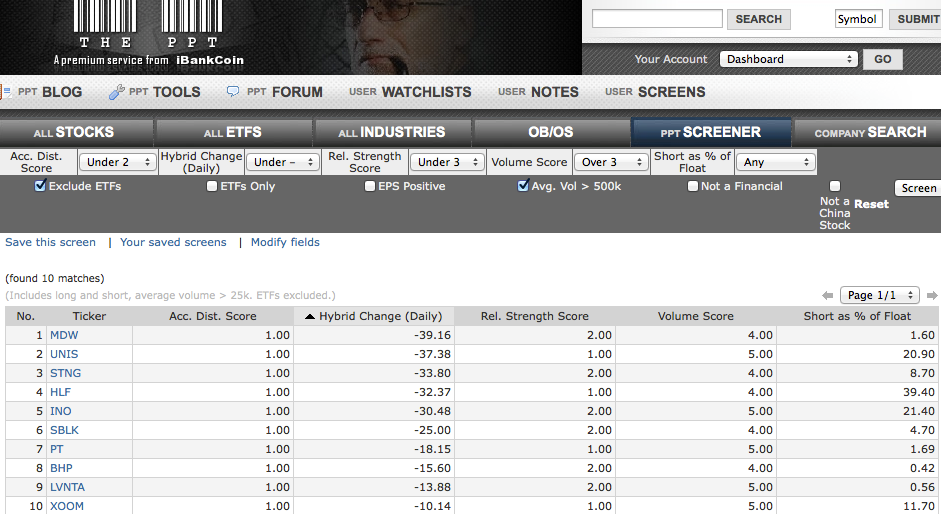

Overall, cash is a powerful position in this environment. I am electing to look for opportunistic shorts, namely AAPL MA SBUX, and others, in the event things really do get flashy from here.

Comments »