BTFO!

If you’ve been following me for the past 6 weeks, you know that I have called breakouts almost immediately before they do so. I was asked by dozens and dozens of people to provide some sort of educational post on what I lookout for. The primary patterns that make it on my imminent, potential, and waiting lists are as follows: 1) parabolic breakout+symmetrical triangle, 2) bull flag, 3) ascending triangle, 4) failed descending triangle, 5) rounded bottom, 6) flat base, 7) measured move.

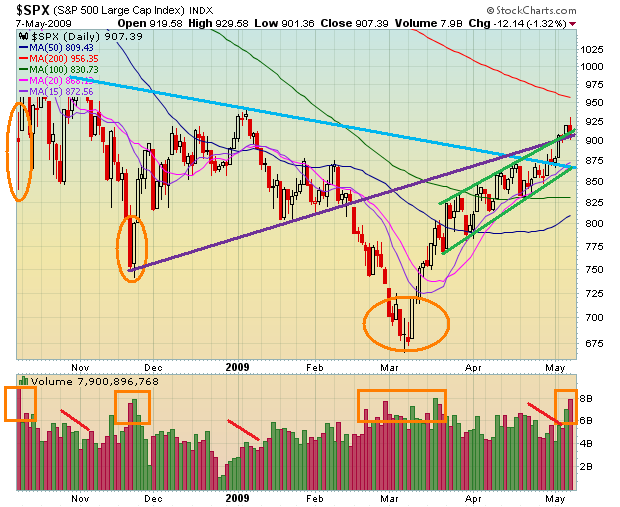

Each pattern must utilize price action, volume, moving averages (15, 20, 50, 100, 200-day), and the development of the pattern itself. The entry point is marked when everything “lines up perfectly”.

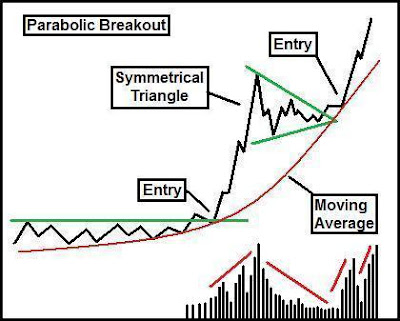

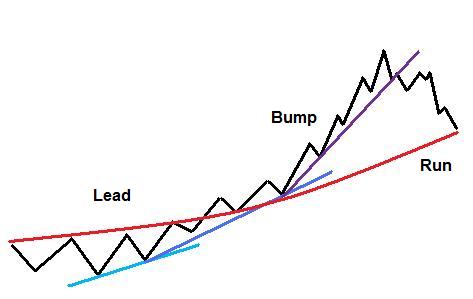

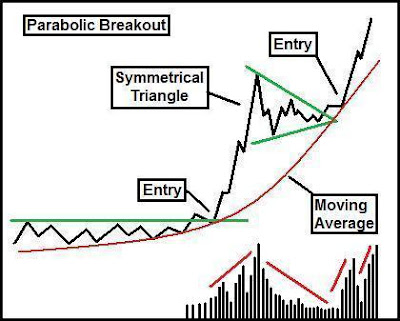

1) Parabolic Breakout and Symmetrical Triangle:

These patterns are the intra-day spikes that I covet dearly. They are responsible for many of the fastest and largest gains that I have ever achieved. This pattern utilizes 2 or more continuation or consolidation patterns to complete itself. They are usually flat bases, flags, and a variety of triangles. When the pattern goes parabolic intra-day, there will usually be massive profit taking and the entire move could retrace as much as 50%. Most weakhands would sell in panic when this occurs. However, this is wrong.

After a large move, the pattern needs to consolidate it’s gains, shake out the weak holders, attract the dip buyers, and gather accumulation and interest for the next run up. Towards the end of the consolidating period, there will be another breakout, which marks a secondary entry to add another position.

Volume must be flat and declining prior to the spike, which will be accompanied by huge volume. In addition, the moving averages listed above will help guide you to time your entry. My favorite short-term averages are the 15- and 20-day MA’s. 50- and 100-day MA’s are intermediate averages, and the 200-day MA is the big daddy himself – the most important long-term MA.

Whenever you see a symmetrical triangle form after the initial spike, it is almost a guarantee that the particular stock will breakout again. Failures are rare, but they do happen.The point is to harvest as many of these patterns and cut losses on any of the failures.

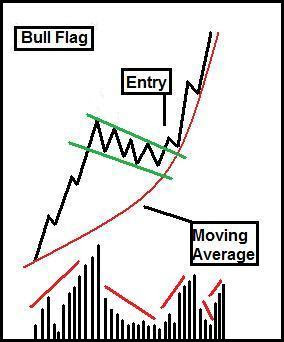

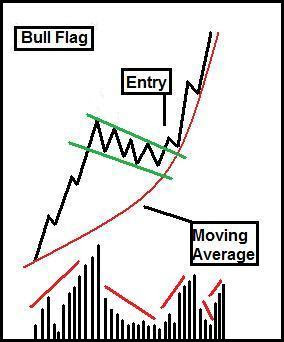

2) Bull Flag:

Bull flags are usually very small and can last for only one day or several weeks. The way to tell the entry is by using the appropriate moving averages. Sometimes, I like to enter a flag regardless for fear that I may miss the breakout. However, the closer the pattern is to the 15- or 20-day, the faster the breakout will materialize.

3) Ascending Triangle:

The ascending triangle is one of the most obvious bullish patterns, and one that is highly reliable. Each trough is marked by selling exhaustion while the buyers hold their ground. You want to either get in on the breakout from the pattern or if you are more tolerant to risk, then enter within the pattern and just sit tight. Do not get shaken out.

4) Failed Descending Triangle:

Sometimes, when a pattern fails, it can be a good thing. A pattern failure will force holders on one side of a trade to immediately reconsider. A descending triangle is a bearish pattern but occasionally, it will fail. This will force short covering and a great time to add longs at the same time. I like to get in on the breakout on confirmation.

5) Rounded Bottom:

This pattern takes months, even years, to develop. The pattern is created by a downtrend, followed by a sideways neutral range. When the right side of this “saucer” develops, it will be obvious that the stock/market wants to go up. There should be a massive increase in volume on the breakouts following the final completing of the right side of the pattern. Shorts will cover their positions as they realize that they can no longer profit from the stock.

When the multi-month base is forming, the main moving averages should catch up to the stock. They should level off and start heading higher and support the stock as a “launching pad” for continuous breakouts.

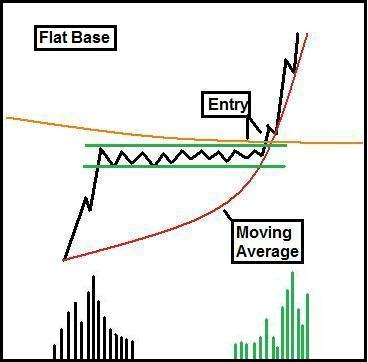

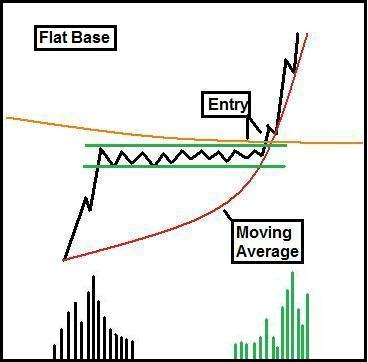

6) Flat Base:

A flat base is basically an over extended flag trading in a neutral range on low volume. These patterns have one of the most powerful breakouts, ever. A stock can easily double in a matter of days/weeks. There should be no evidence of breakdown in this pattern and they should be entered immediately when you first find them. When the breakout occurs, it its highly likely that you never see pre-breakout prices for a long time.

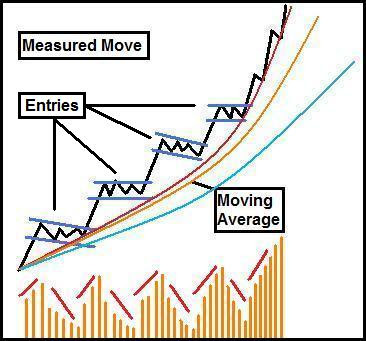

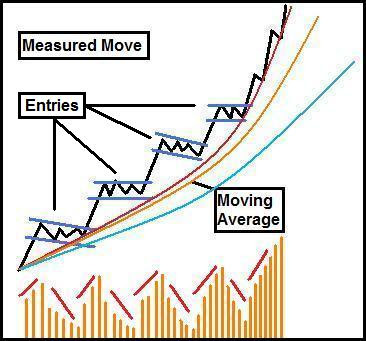

7) Measured Move:

The measured move pattern is one of the most beautiful and predictable patterns. They easily launch from their supporting moving average. The best part is that several moving averages should provide support below the stock. They act as back up in case there is a failure.There should be decreasing volume during consolidation, followed by large volume breakouts.

I hope this helps.

Comments »