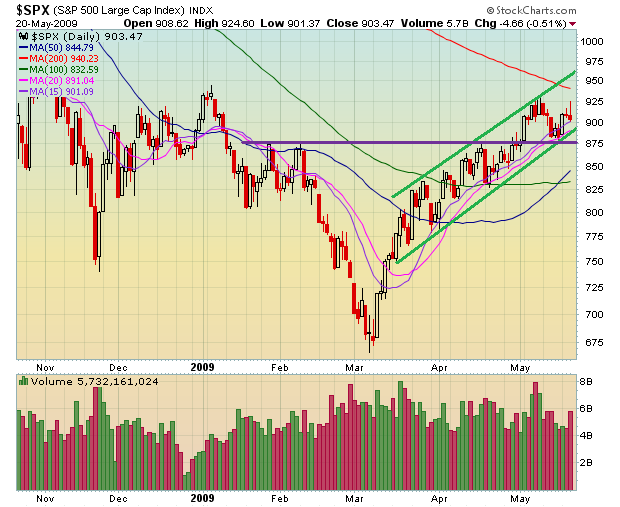

The important matter going forward is to make note of all support/resistance levels. Pay particular attention to the 10-day SPX chart shown below. The designated “green zone”, located between 897-902, is the strongest and most widely used support/resistance area for the past 10 days. When/If the lower band is broken, it is unknown how far the market could correct.

The 1-month chart shows a possible symmetrical triangulation and a possible secondary support area near 885. The 7-month chart clears shows that the market closed above the 15-day MA (901). We can expect to see additional support at the 20-day MA (891), which is also the location of the 2-month+ lower channel line. Final support is indicated at 875. All of this is if the market declines.

As for upside, there first needs to be a breakout above 922, then 930. After this, the market has space to move to the 200-day MA (940). Since no one knows what will happen for sure, you should hedge your portfolio going forward, regardless of what your personal opinions are. Frankly, the market doesn’t give a shit what you think.

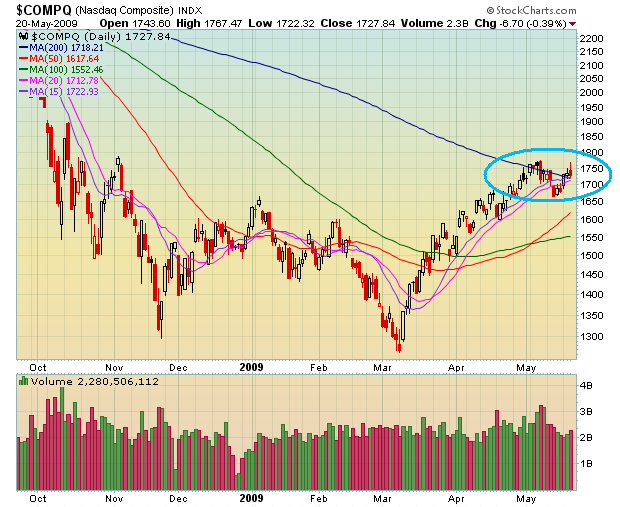

Note the COMP in the circled area. This is the chop zone at the 200-day MA, more reason to get hedged.

My strategy has worked out well for several weeks. At this stage, I am holding onto 6 long positions, all of which are participating in the circus. In addition, I added one more short unit, FAZ, to accompany QID as a hedge for the portfolio. The point is to find long stocks that are not directly correlated with the market while simultaneously protecting yourself against downside.

If you enjoy the content at iBankCoin, please follow us on Twitter

CA-Thanks for all the great work. What do you think of OCNF and LEAR? I made a little on both of them yesterday and am especially tempted to test OCNF today.

I am looking for some cheap stocks for my IRA to hold for long term…any suggestions?

CA,

how about EMKR?

OCNF hit the 200-day resistance and sold off. I own LEA (‘LEAR’ does not exist).

Mimi, I can’t make that decision for you, but you may want to look at more stable stocks. Just because something is cheap does not mean it’s good.

EMKR will be gapping up close to 30% in the morning, so I’m not sure…

CA – What’s with the 8% drop in LEA pre-market? I stopped out earlier this week and am wondering if now would be a good entry. Unless of course you plan to dump it at open 🙂

CA- Thanks I agree it maybe cheap but not good…

i exited my entire qid position. We may go much lower in the coming days but we are also close to the area (SP500 888) where bulls may attempt to reverse it. i am planning on entering again closer to 900 levels.

CA- thanks for the post and early warning about hedging.

Are we still looking at a correction from concerted sell-offs? Or is the market just trading based on poor data?

still gambling –

ATSG 1.00

TLB 3.10

LOCM 3.50

Hi CA,

Would you consider trend/support broken?

Looking to ease out of my longs on any up move and start my short positioning.

Appreciate your opinion.

Z – No idea, but I’m watching all the levels.

Panda – on days like today, the close (or near the close) is the most important aspect of the day’s action.

the market is really difficult to trade…it drives both bears and bulls crazy

Chuan – that’s why you need to take both sides in your portfolio.

Juice is addicted.

financials strong today. out from faz…..holding POT short..no more trades today…

CA,

What is the story with FRZ ? Any insight is always appreciated. If you bought it at the price you did it must be a good buy now? No ?

Great charts Mr Lee!

what’s your stop at for XTEX?

It looks like it might wait to BTFO at it’s 20

FRZ is just a spec dollar stock play. I don’t do stories or fundamentals.

fin – No stop. We have the 15-day at $3.26, 100-day at $3.18, and the 20-day at $3.

How about the uranium miner DNN

It looks pretty ripe to me

MNI B/O IMMINENT (thanks Nap)

—-

Glud – yea, it’s very possible

Bought KV/A $1.62 swing

KV/A – a gambling lotto play fo sho. Low vol and look at all those red bars. G’luck to ya my man.

NGD has been good to me all day…breaking through 200 day…nothing but wide open spaces above…if gold keeps ripping look out…

I’m with you rocketman 🙂

I am also looking to buy some NG if it pulls back and consolidates.

Rock and roll with GDX – gold miners.

I looked at KV/A on Monday and figured we already missed two failed descending triangles (this is based off of the educational post from last week, but correct me if I’m wrong CA).

What is the indicator for your decision? Is there a significance when the 15/20/50 MA’s merge and the price has been able to stay above it? Appreciate your thoughts on this one.

Double bottom formation on srs

Zeratul – KV/A has the 15, 20, 50, & 100-day MA’s underneath. Flat base, multi-month triangle, etc. It’s worth a shot. It’s also pretty insulated from declines in the general market. Who knows..

Many of the iETFs are forming double bottoms.

There goes MNI.

you gotta like NGD here…closing at 200 day MA on big volume…go gold!

MNI dying now…

CA, if NGD closes above it’s 200 day MA at $2.38 on enormous volume, would you view it as very high probability of a gap up open tomorrow?

Still above the secondary support of 885, hope this fuels the symmetrical triangulation. Thanks for the continued updates and inputs CA.

Rocketman… watch for my post tonight. If NGD was not a sub $5 OTB stock, I’d put it in the JCHP right now.

_________

FYI: BKUNA closed by regulators, biggest collapse of 2009!

Odd for a Thurs rather than Friday … Memorial Day plans at FDIC?

Nice move getting out of that one CA!

LOL. nice!

I will be looking to for 898-902 to serve as resistance tomorrow.

long auy at 10.25. looking for more gold/silver stocks and there are plenty to choose from

Bought HEB @ 1.92. great vol.

Also a bio waiting for FDA. What do you think, CA?