I’d like to know what types of traders/investors are out there. You may pick multiple choices if needed:

I nailed the doji day. For some reason, they are the most predictable for me. You can go through my twitter or whatever and see that I called doji days before noon on many, many days. As a swing trader, doji are the most important days for me, despite the fact that nothing really happens on these days. Depending on other factors as well, doji are the most perfect set up for swing traders. It is absolutely the worst day for daytraders to trade. There is absolutely no point in going in-and-out unless you want to waste your time. The key is determining if the day will be a doji well before the day is half way over. I’ll try to write something up about that in near future.

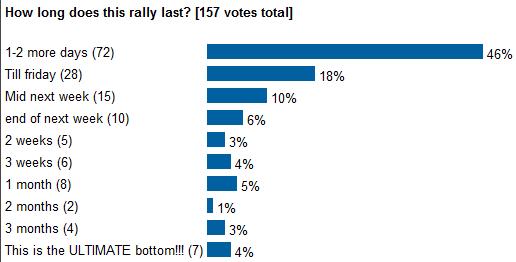

Also, I want to point that there are some divergences among the iBC bloggers. As you know, Fly, Alpha, and RC are hardcore long and Danny is wanting to short the shit out of the market. I am long but have a short hedge so I’m not as hardcore, and Gio just loves to surf with the VIX all day. According to my poll yesterday, 157 people gave their opinions on how long this rally would last. In this market, if you are one day early or one day late, then it’ll be tough for the average trader to sit through the pain. As long as you back up your reasons for any trade, you should stand by your decision unless something dramatically changes.

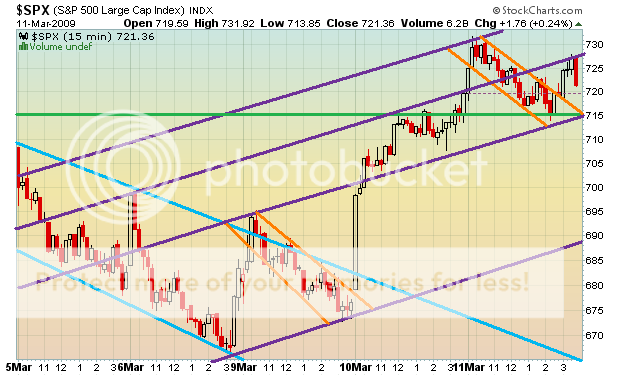

Anyway, the market is boxed in. You’ll also notice that I use the term “boxed in” quite a bit. It is a term that I use to describe a stock that is either entering or is in the middle of a major congestion zone filled with multiple support/resistance levels, channels, and or moving averages, all of which will limit the movement and progress of the market or stock. A good practice is to take out a chart of whatever timeframe you are using, and extend lines as far right as you can to visualize the next day’s support and resistance areas. This way, you’ll never be caught off guard whenever a bounce or pullback occurs. Give it a try sometime.

For tomorrow morning, I will depend on my trusty lines to ascertain direction. After all, a doji suggests indecision and is usually 50/50, so the support and resistance levels become especially important for today’s trading. I will keep an eye on the COMP because that is actually a spinning top, and there’s more weight towards a reversal. Also, several financials are on the “potential reversal” list, and they are WFC, BAC, C, PNC, etc. I’ll just have to see what happens pre-market to make the call.

If you enjoy the content at iBankCoin, please follow us on Twitter

nice post.

those ‘mountain dew’ colored lines should hold the SPX down, chea!!

Puts of Passion. $SPY.

feel like we hit top today and are going down. CA whats your opinion/ entry point on silver and gold. i cant decide where to enter. they seem to be flagging. not sure if i should have bought gld @87 and not sure about silver…. anyone else who wants to comment feel free

Yes, it has been an interesting difference in view.

Some charts you may enjoy:

JPM, BBD

So that was a doji day. nice catch. I took the day off when I saw the sun was out. plus there’s been so much hesitation on the tape I figured the tape would be boring. how about a 5-day chart? thanx.

Yea, most of the financials are showing northern doji (tops). Gap downs are the tell.

Gio – just for you

Thanks again for your work, CA.

I’m mostly in cash with a short bias, expressed in longer dated, in-the-money puts that I have owned for a few weeks. I’m prepared to hold out to S&P 770 or so, but I think this rally will be rather brief, maybe only making it to 740, 750 or so. At that point I will start adding shorts again (or as the market action may dictate.)

Just for the sake of conjecture, I’ll look for a down day tomorrow and a new rally high on Friday (maybe Monday) to cap this possible bull trap. Then next week the suck will be back with a vengeance. Too much trouble in the credit markets. Too much new supply from the treasury. Or pick any number of reasons, like the clowns on CNBC.

By the way, this week has been crazy at the office. It reminds me of last fall, when all sorts of people were beating down our doors wanting to throw money into the market, right before that nasty November cascade.

A little concerned for tomorrow re: the fins and headline, or should I say hearing risk coming out of DC. I don;t think anything important will really happen, but it be choppy as questions and answers are washed, spun, and dried

I built a position in FAZ today on the dips but would have no problem getting out fast if the rally resumes

thanx. I’m just trying to match a technical-chart against a sentiment chart on the short time frames. I guess as Doji days are important to swing traders, I find a multi-day chart before and after a significant relief rally gives me good points for day-trading.

>> “The key is determining if the day will be a doji well before the day is half way over. I’ll try to write something up about that in near future.”

If you could unlock that secret for me, I would be most grateful. I have heard all sorts of theories, but none ever quite work out most of the time.

To know whether a day will be trending strongly or sideways action ahead of time would be very useful.

Good Stuff CA!!

I’m banking that we go up. I think this will start near the close today and continue into the next week

Above the box..will it hold?

Meeting 20-day MA resistance. I am selling half my shit.

doji smoji. there was a long legged doji friday that lacked confirmation, wednesday’s shorty is meaningless. Traders are in charge of the market. Look at monday’s close, short covering, tuesday, same thing, wednesday traders took profits on longs. Today was the first real anomaly, and it is due to a squeeze which may last another day, or another year.

Thank you, Captain obvious.

Think nothing of it.

I consider this blurb significant:

http://www.reuters.com/article/marketsnews/idINBNG46420220090310?rpc=33

If this becomes a trend it would be bad for bears.