I was watching Carmen’s “On The Money” show just now and realized the seriousness of the lack of financial education that the average American possesses. It’s scary. People are relying on advisors and money managers. Chances are, if you have to go to these people, you’re wealthier than them. I don’t understand why wealthy people go to people who are not for “sound” financial advice. It still boggles me. Many (not all) are the same folks that dropped the financial industry to its knees. This is why I stress self-education. No one cares more about your money — than you.

These spikers sure are a great way to start off 2009. I am up +19.2% for the month/year and I have/had stuff like ACAS, ARTC, FIG, GFIG, FTK, and others to thank. Days like yesterday and today do not come often, and usually by the time these stocks are “discovered”, it is time to short. Many names have become so extended that they are now completely outside of their upper bollinger band. I am looking for a bearish gap up/down or a doji to form to execute short trades on the very same names that made me much coin on the long side. Don’t chase during the late stages or you’ll get face fudged.

As for the broad market, we are still consolidating and we are, indeed, short-term overbought. The more consolidation days that we have (while maintaining the 920 level), the better. Why? Because it relieves the overbought situation and brings many of these indicators back to the mean. Volume is still picking up, but we are not at “normal” levels yet. Also, notice the 2nd doji on the 4-month chart. That’s normal. It is possible that we could be testing the 920 level again, so be prepared for that.

On a different note, I think some of you still do not know how to use my charts. You are an idiot, because I’ve explained too many times. Let me give you a lesson that even my 8 year old cousin could understand. The charts are used for 1) identifying support/resistance levels to anticipate the next day’s bounces (so you don’t become the idiot that panics and sells/covers), 2) identifying possible reversal/pivot points via divergences (so you don’t get caught with your pants down), 3) identifying entry/exit points for future trades (so you don’t get killed 5 mins after you place a trade), among others. Don’t be a dumbass, try to look beyond the obvious, captain.

SPX 5-day

SPX 10-day

SPX 40-day

SPX 4-month

Reader’s Requests:

If you enjoy the content at iBankCoin, please follow us on Twitter

once again, very nice post. thanks.

” no one cares more about your money than you”

i always tell my clients and friends the same thing.

that is why i think is important, that if you run a fund to have some skin in the fund. i have a significant amount of skin in my fund. my clients like that, they like the fact that i eat my own cooking.

Chivas, the aphorism I believe is “eating what you kill.”

Although I for one would really enjoy some Cuban cuisine, right about now.

LOL. you will.

“Don’t be a dumbass, try to look beyond the obvious, captain.”

Now you’re just asking too much CTA

Danny, I thought I’d just give it one more time before I lose hope on some people.

Chivas, yes, my own capital makes up roughly 30% of my own fund.

I think the 13/34 ema cross is good for this week and next. Hopefully we get a couple days consolidation and then long accellerate, otherwise it could fall over. I liked how the VIX SPX correlation a month ago came after the VIX’s crossover accellerated it down, the thing was just winging along without a care for what is correct – which is just what the market needs to do to make long legs. 30/50 sma looks like a wed-thurs cross, were last crossing 9/19 at 1260 LOL

50 sma is up two days. Yuppers

I call bullshit…

“I have/had stuff like ACAS, ARTC, FIG, GFIG, FTK, and others to thank.”

Statements like this are meaningless unless you’re gonna make some live entry calls. Not trying to be an asshole, but I’m having some doubts.

aumana – I am watching the 18/34, and yea, the 50-day MA…actually curving up (slightly).

mdawsz – Fuck your stupidity.

1) My post yesterday: http://ibankcoin.com/chart_addict/?p=181

2) Gio’s post: http://ibankcoin.com/gioblog/?p=2636

3) My twitter updates: http://twitter.com/WeeklyTA

If I give out freebies and you don’t take it, you’re a fucking idiot. Asshole.

Dude, your vagina is showing.

You knew that shit was coming.

Next time, do some due diligence before you call “bullshit”. I’ll forgive you because this is your first offense.

You did make a nice call on ACAS.

MDAWZ has an undistinguished history of making false allegations.

TCA,

What do you think of NWD’s chart?

I have been looking through charts to practice setting entries/exits. It looks to me like a descending wedge with a brief break to the downside (similar to early 2003?).

The past 3 months of declining volume with a recent burst looked bullish to me too.

Thanks

That’s one of the ugliest charts ever. You’re still dabbling in those illiquid penny stocks? Take very small risk if you’re going to enter. The volume burst is good though.

up 265% last year,

up 19% this year…

Still haven’t seen a call made in real time.

You are certainly the best trader I’ve ever seen on the internets other than my pet gerbil who is up an astounding 745% in 2009 so far.

You want credibility — make a call. Just one call. That’s all. Charts aren’t too bad.

The bullshit attitude is par for the course for a youngin’ like you. But I guess you may just be the next Jesse Livermore so fuck me, right?

LOL. WOW…someone can’t fucking read.

Thanks for the posts. I check The FLY and now your updates daily.

May I ask how you screen for spiker stocks such as ACAS, ARTC, FIG, GFIG, FTK? I know FTK due to my line of work but I know nada about the others. FTK trades 3-1 to oil price moves – amazing. Yet their business is dull as dirt.

67% cash

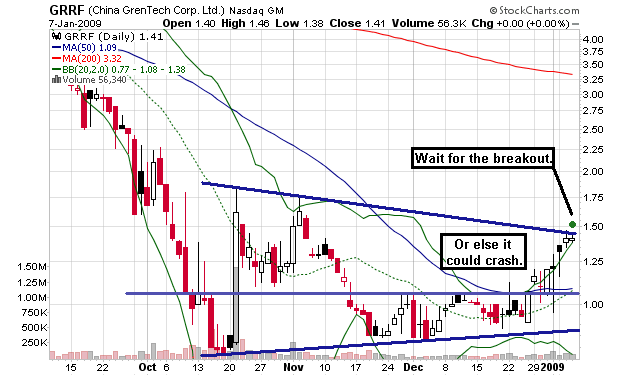

TCA..Great work as always….what are your thoughts on GRRF to the upside?

Indeed, most people really are quite stoopid when it comes to their finances. I see it almost every day, and I work in an area that most people would consider stable and conservative, except for our own little housing bubble of the past few years.

DINK’s in their 30’s with combined incomes greater than 200k, with only 5k in the bank, a crummy 401k, and a house with no negative equity.

Folks about to turn 50 and just starting to seriously think about retirement. Needless to say, low savings.

Ladies with 30k jobs in debt for shoes and handbags.

People who want to pontificate on the economy, yet unable to balance their checkbooks.

Etcetera and so forth. These people really don’r know a damn thing about history either. There is a reason why our forefathers saved for a rainy day.

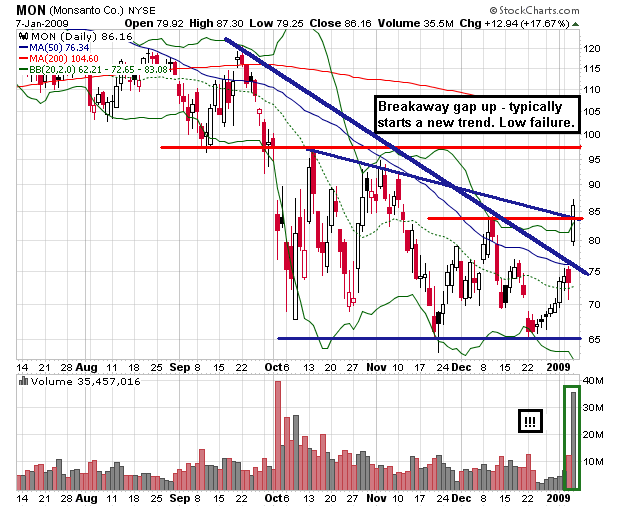

Let’s see some stock charts, how about that one the Fly likes…what is it, The Mosaic Company?

Too Busy – I manually go through hundreds of charts each night to find the set ups. A great way to find stocks that made an initial spike is to go to any site that shows “largest % gainers”. On gap ups with broad market support, they are usually good for another 1-2 days before dumping them. Most of these stocks are crap, only good for trades.

Jacque – I am very wary of GRRF. First, the illiquidity. Second, the 2 dojis that formed today and yesterday. They represent indecision days and may be short-term tops. I would, however, go long if it spiked. That means the market made up it’s mind in force.

Ozark – I’m glad that most of us here do not fit those descriptions. I know a 21-year old girl who filed for bankruptcy last year! Sad, I see it all the time. Either you control money, or money controls you. The savings rate is slowly starting to rise, but it’s kinda too late.

Filthy – I’ll put it up just for you. You must mean MON. The stock formed a breakaway gap on massive volume. They start new trends, maybe not immediately, but over time. Initial resistance: $94-95. Secondary resistance $97-98.

Thanks for the reply. I know the founder of FTK. And just recently met the founder of HNSN, who also is a director at MAKO. I tend to watch stocks like this that I have a good feel for via my job but it’s far too limiting. I’ll miss spikes in an entire sector (e.g gaming/coal).

It’s really difficult to get a good picture on fundamentals by looking at the reported numbers – if they are good it’s too late to buy..or not really telling the full story. If they are poor, it’s hard to predict when the turnaround will come.

So, I’m wading back into charts – hoping the sentiment and market inside info is “baked in”. I was a fan of Stan Weinstein’s approach years ago. But now with the internet, I’m looking for a good stock screener or sector screener to review at night as well. I’ve outgrown YahooFinance.