UPDATE: I don’t want Enola Gay to get into trouble, so I decided to put some clothes on these fine ladies even though they don’t look right wearing clothes. Hope everyone’s having fun!

Hey…Merry Christmas!!!

The market is always boring on Christmas Eve. You can tell if someone may be a trading junkie if they sat through today’s entire 9:30AM-1:00PM session, despite me telling them to occupy their time with important life stuff, such as bartering with desperate retailers. Sometimes, alleged junkies will get hostile towards you if you ever try to stop them in their quest to make a few bucks on one of the lowest volume days of the entire year. I did say ‘go shopping’, didn’t I?

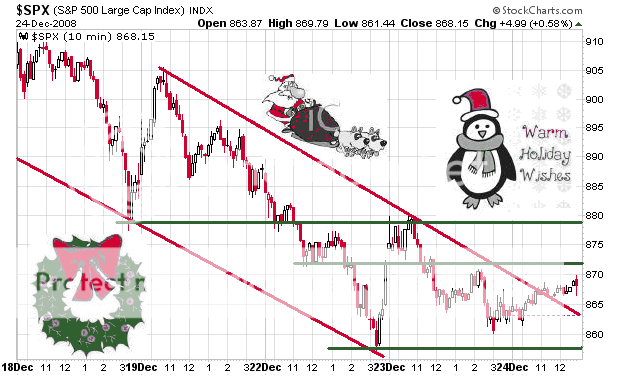

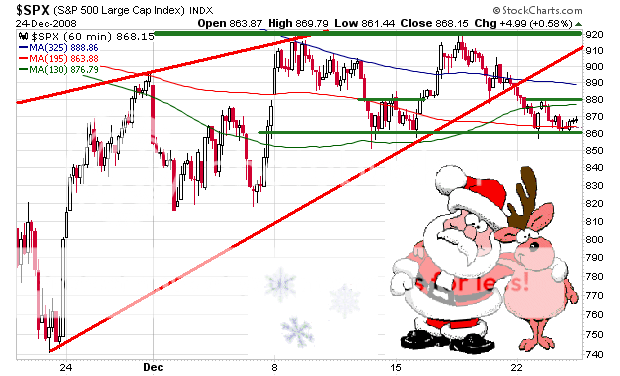

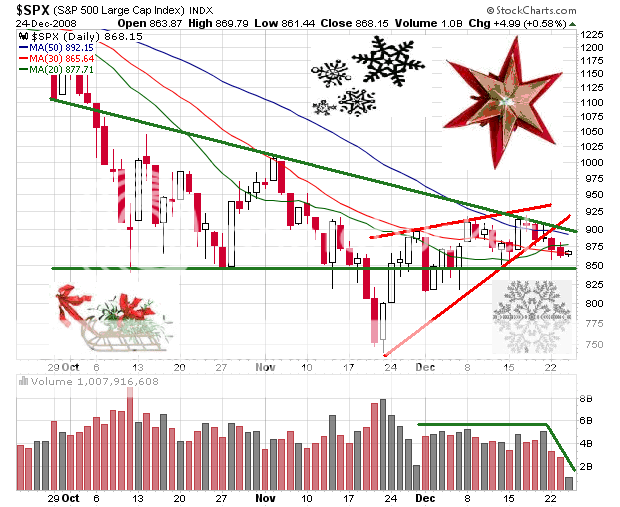

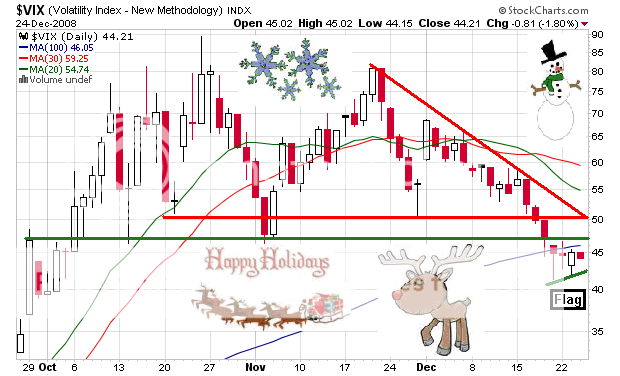

The market struggled as we traded in an upward channel today. It’s nothing special since we’re still in the neutral range that’s bound by 855-880 on the SPX. The wedge is clearly broken, but that doesn’t mean the market cannot trade sideways for some time. We have to wait for confirmation. What’s interesting is that the VIX is forming a flag (so far). This too needs some type of directional confirmation before I get serious.

I think it’s official: retailers are screwed. They usually get 15% of their sales in the 2 weeks after Christmas, with December (plus Black Friday week) usually making up 40% of annual sales for many retailers. I don’t think they’re going to see that 15% and they’re definitely not going to see 40% for December. They’ll be lucky to have 40% sales for the entire calendar year.

Of course, retailers are giving stuff away at huge discounts, but they’re not getting as much traffic as they should be getting. People are actually negotiating at the stores and I hear that deals are being made regardless of stick prices. The worst environment for retail, perhaps since the Great Depression, will mean only one thing: massive closures, liquidations, chapter 11’s, and whatever else you want to call it.

This will weight heavily on commercial real estate. I’ve been a commercial real estate investor for 4 years, so I’ve never actually experienced a downturn, but I can tell you what will happen. Here’s a short lesson on what will happen shortly:

Cap rates and cash-on-cash returns will be horrendous. I think that cap rates will be sub 4-5% for Class A’s, 6-7% for B’s, 8-9% for C’s, and 10% for the crappiest properties on Earth (D’s). Property sub-classes are determined primarily by cap rate, net income, age of the property and location, among other factors.

There are 4 cycles in the real estate market. We are in the Buyer’s Market Stage I, going onto Stage II. If you’re buying stuff, I hope you’re buying for cash flow, and not for capital appreciation. What’s going to happen is that there will be a massive oversupply in commercial real estate fueled by a large % of vacancies. Many investors have millions of dollars in upcoming debt service obligations, but with the lack of available credit and cash flow (or just regular cold, hard cash), they will be forced to surrender their properties.

The value of commercial properties is determined in three different ways: 1) sales comparison approach, income approach, and replacement costs approach. Unfortunately, 2 out of 3 (sales & income) will work against investors. By the way, the cap rate is determined by dividing the net operating income (NOI) by the value (selling price). The cash-on-cash return (CCR) is the cash flow (NOI – debt service) divided by the acquisition costs (down payment + all cash needed for the deal).

The CCR basically tells you that for every $1 you spent, how much of that $1 you’ll get back after the first year. Unfortunately, for those investors that bought all sorts of office space, strip malls, public storage, and other stuff in 2006, 2007, and 2008, their CCR will be terrible because the lack of cash flow will cut the CCR down to the single digits (I look for 15-20% in this stage of the market). After the first year, the return-on-investment (ROI) can be calculated. That is, the NOI – debt service + principal reduction divided by acquisition costs. Unfortunately, this number will be horrible as well because it’s based on the NOI.

This process takes many, many, many months because the commercial real estate market is much slower than it’s residential counterpart. Closed residential sales usually take 30-45 days (if you’re lucky). From due diligence, site investigations, surveys, and everything else until actual closing, a single commercial deal takes between 2-5 months. You can be assured that this shoe will drop well into 2010 and the secondary effects will still be felt in 2011.

And you thought I was just some kinda chart junkie…

Anyway, I hope people didn’t get too depressed by that. Indeed, that was the short version.

I wish everyone here a wonderful, safe, and fun-filled Merry Christmas! See you Friday!

SPX 1-day

SPX 3-day

SPX 5-day

SPX 10-day

SPX 35-day

SPX 3-month

If you enjoy the content at iBankCoin, please follow us on Twitter

Nice HO HO HO’s there buddy.Good work CA.

Chart Master:

I agree on the commercial RE situation.

It is a very sad thought, to think of the urban blight that will be created by the mass vacancies.

I am seeing my local C.R.E. friends here in central Oregon dying a slow, painful death…

The worst part is their belief it will get better soon.

Merry Christmas, folks.

Merry Christmas kid.

I spoke with friends and relatives around the country and they were surpised at the ghost town like feel at the malls Christmas eve.

Not to mention multiple stores for lease within the malls.

Were talking well to do areas…

Can you believe commercial real estate developers are already asking for a bailout.

Peace on earth with much joy to you and your circle of life.

Hey CA,

Merry Christmas to everyone, especially the one who make these amazing charts. Unfortunatly, I am really offended by the HO HO HO graphics. This site should be for market related issues, NOT SOFT PORN!!!!!. I can tolerate the language but not the nudity.. Some folks like the witty banter and humor. But if my wife sees me on a site with this kind of flesh showing I will have the wrath of Mrs. Gay upon my neck. So, in the name of Christman joy,

IBC……….KEEP IT CLEAN!!!!!!!!!

Thank you,

Enola Gay

The pic is PG (not even PG-13). The exposed flesh, mild as it is, isn’t cool on the screen at work, but, then, surfing the net at work can bring grief even without any flesh at all. Limiting the visuals to a G rating is too restrictive, IMO.

Personally, I was hoping that C.A. would introduce the two Ho Hos to the Banana Twins and demonstrate that a Little Debbie snack cake just wouldn’t be the same without the creme filling.

How about now? Merry Christmas, back to the party now.

Damnit, who changed the picture? I have already “read” this post 10 times for its stimulating content. Who knew commercial real estate can be this fun?

I converted the blog to a family site, for now. Use your imagination!