UPDATE: I nominate SEC Chairman Cox for Asshat of the Year:

————————————–

There is nothing new except that we are close to bursting out either up or down. I am guessing that some movement will occur ahead of Tuesday’s 8:30AM GDP report. The consensus is -0.5% with a range of -0.8 to -0.5. The previous reading was -0.5%. I don’t know how the consensus could remain the same as Q3, but whatever, everyone expects negative growth.

We also have Consumer Sentiment, Existing and New Home Sales (all three @ 10AM). The U. of Michigan sentiment index is expect to come in at 58.6 with a range of 53.6 to 60.2. The previous reading was 59.1. Existing home sales are expected to come in at 4.9M with a range of 4.750M to 5.04M. The previous reading was 4.98M. New home sales are expected to come in at 420K with a range of 360K to 490K. The previous reading was 433K.

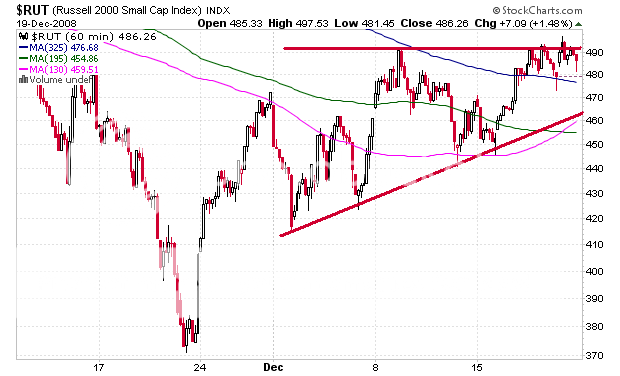

Back to the charts. If we breakout then we formed an ascending triangle. If we breakdown, it’s a bearish wedge. Looking at the 45-day intraday charts, a major move is most likely going to happen before Christmas given the lack breathing room at the end of the triangle/wedge.

The Dow appears to be the weakest. The Russell 2K is the strongest while the S&P and Naz remain ‘neutral’. As for the moving averages, the Russell 2K is above, the Naz is sitting right on top, and the S&P and Dow are both below it. All four indices are bound by the 20-day and 30-day MA’s in some way.

Looking at the VIX, we formed a ‘hammer’ candle, which is usually a reversal, but confirmation is needed. Upon layering it, the VIX is sitting right at the 100-day MA. The VIX tested the 100-day MA on Thursday and on Friday, the VIX managed to recoup most of its losses (notice the tails on both days). We “may” see an upside reversal on the VIX on Monday.

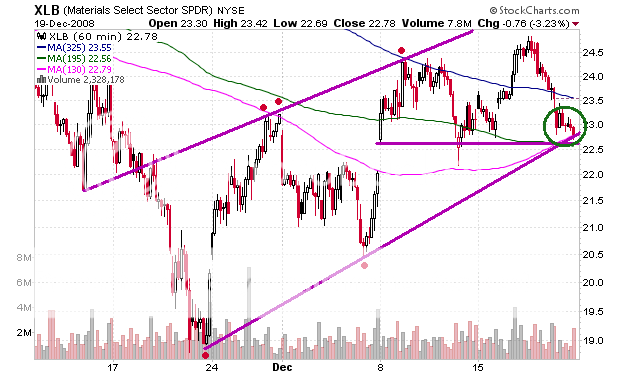

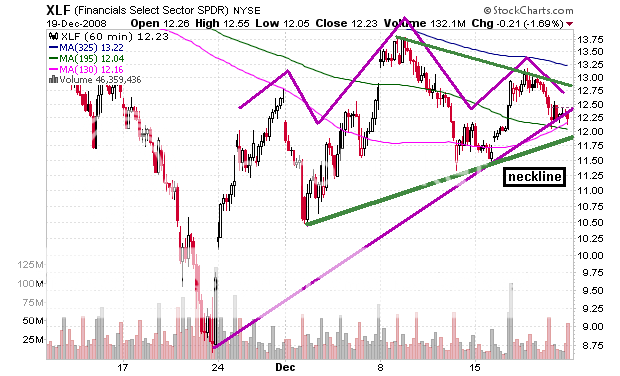

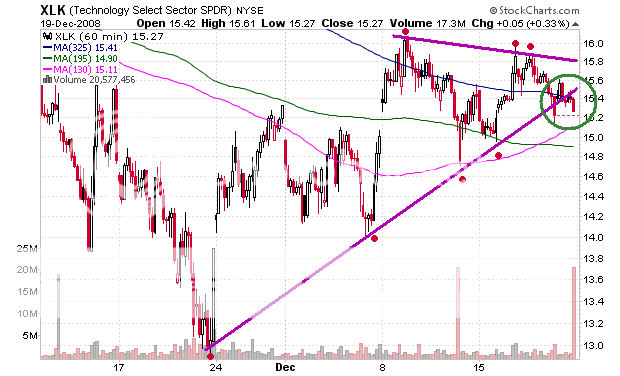

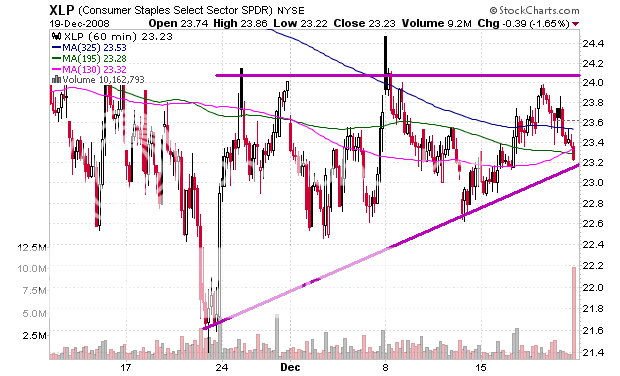

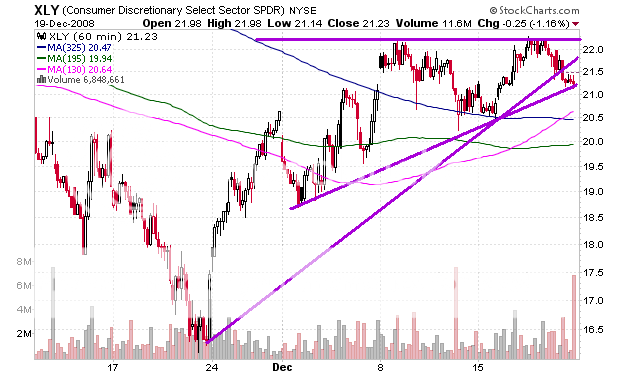

As for sectors, healthcare is the strongest. Utilities remains neutral. All the other sectors have to move up quickly because they are a hair away from breaking through their respective lower trendlines. The financial sector may be forming a head and shoulders. The industrial and technology sectors are forming lower highs (the tech sector technically broke down).

This entire month has been riddled with headache and a lack of reliable direction. I’m sure there was a lot of impulse trading going on. Once we break out or down, it will be easier to determine direction. Until then, traders have to either daytrade (very quickly) or sit tight and be patient (remain hedged), or remain in cash. Use the MA’s and support/resistance as your guides.

For the 45-day intraday charts:

-the BLUE line is the 50-day MA (325p.)

-the GREEN line is the 30-day MA (195p.)

-the PINK line is the 20-day MA (130p.)

SPX 1-day

SPX 3-day

SPX 5-day

SPX 10-day

SPX 45-day

DJIA 45-day

NASDAQ 45-day

RUSSELL 2K 45-day

VIX 6-month

SPDR Select Sectors

If you enjoy the content at iBankCoin, please follow us on Twitter

XLE looks like a great short, I may take that on Monday.

I like XLV for a long.

Everything is at a crossroads. I’m watching the uptrend line from the November low as the most important area for support. IMO, should the indexes spend a day or two beneath it, it will be hard for me to continue being bullish.

It looks like overhead resistance on the indices.

Washington > Philly

I don’t look for clarity until 5 to 7 plus trading days into Jan and we might even drift until the Obamas big day. Mkt is not cheap, earnings visibility is poor at best, some DOW components are junk , C & GM, data will be weak, reaction to weak data – unknown. If the overall strength continues in Asia (most mkts are up at least 25 if not more that 30 percent off their lows) they might lead commodities up (however, dollar value will interact with this in some way) which might begin some hope of reinflation trade. All in all, I have no idea.

C/A thank for the analysis. The sector by sector charts are really cool. XLK short?

Nice charts, kid, thanks.

______

Nice charts C/A. Interesting that many sectors are at critical points but the RUT still looks good and can pull back a bit before the ascending triangle is in jeopardy. If the market can keep it’s wits together into early Jan and the pros don’t murder it, I think small caps are looking really good from a chart angle. Fundies? Eh who cares, the market hasn’t used valuations for 12 months. 😉

Thank you for the charts. Now back to the NY football Giants.

Ahh, Chairman Cox … my former congressman, and an AssHat too. Nice Choice!

8)

we should all get to pick our own AssHat candidates.

Even though I believe this current market is stupid, your SPX 10 day and NDX 45 day are making me hesitant to short aggressively.

Great job on all the charts… i think it’s safe to say i don’t know anyone else who analyze more charts than you. Keep us updated with the energy sector k.

-gio-

I’m very hesitant to take a particular side. I am net short, but hedged with cash on hand.

The XLE brokedown as it’s still caught in that short-term range.

I believe that your Asshat nominee is unqualified for the title. A flunky cannot be the Asshat of The Year, IMO, and Cox is a flunky. He has been doing exactly what he was appointed to do.

He is, however, an asshat.

Too many asshats.

I’m originally from Baltimore, so I have to agree on Fly’s pick. Miller is fucking up the local economy.