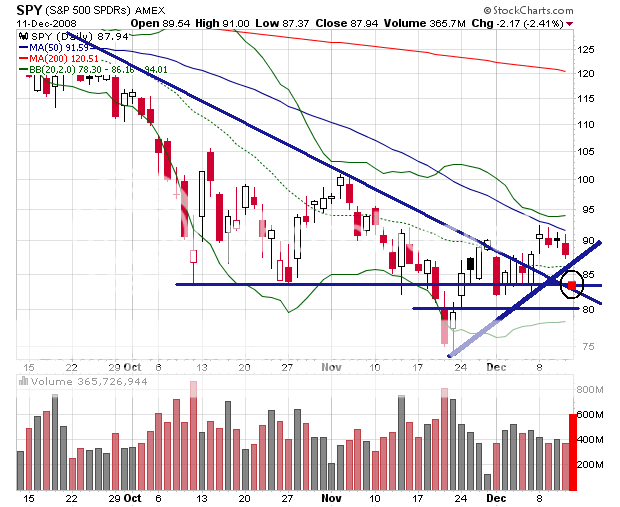

As it stands, it looks like we’re going to gap down pretty close to the 820 level. We may slightly drift down and bounce off of 820 (835 on a smaller gap at the open) and bounce to the 850 level or 835 in the case of 820, or a combination of both. After that, if we don’t start filling the gap within 30 mins, the market is in some serious trouble.

820 is the key support here. After 820, there’s nothing that will hold back from the market from re-testing the 750 lows. The worst thing that can happen is if the market sells off so hard at the open that we cut straight through 820 immediately. In that case, start scaling in short positions immediately.

Otherwise, I suggest waiting at least 20-30 mins to see how the gap will shape up (look at the blue lines and watch if the market is getting boxed in). I would add significant short positions on the first failed bounce. If you have longs, this would be your opportunity to sell out at a slightly higher price.

I would not dump all my money all at once into short positions, but rather scale them in.We could form small flags/wedges, triangles almost immediately for better entry points.

The possibility of a major rally is present if Bush/Hank/Ben decide to manipulate the markets. A surprise press release should be expected. Therefore, it is important to have enough reserve buying power to hedge in case of unexpected bullshit Magic Jack trickery.

If we do appear to be rallying non-stop, then, well, stop shorting lol. If this gap fills, I would be shocked. If you can’t be at the computer all day, then you probably shouldn’t trade. Today is not a day to be casual.

A gap down at the 840 SPX level will immediately break the bear rally’s uptrend. If we continue the momentum, and the market closes down over -6%+, then this gap is likely be a continuation gap. I also expect considerably larger volume today. Obviously.

The difference between this -3% down day is that the market is no where near the lower Bollinger band. We could see an acceleration of sell which will expand the bands, giving room for several days worth of selling.

I already have SMN and SRS, but I’m going to be messing with those 3x ETFs. I think they’ll do well today.

If you enjoy the content at iBankCoin, please follow us on Twitter

Great Charts and insight to what is going to be one hell of a Ride…

Futures look to be improving significantly.

Thanks for the charts – Bush doesn’t really want to help the auto’s unless they are in bankruptcy.

We shall see.

futures heading back down a little now.

Thanks CA – really helps a lot!

ok, we found support at the Oct 10 lows. let this play out the first 20-30 mins.

That was fun! We seem to be hanging around the 20 SMA. Could be bullish Bollinger wise, no?

barely holding. This bounce is really weak.

complete fill or bear flag

off to the races on ^^^^^^^

green closes across the board today…the next down leg won’t start until the next lunar cycle in january.

We are forming a rising wedge now.

trading by the moon, eh? Are the stars lining up or some shit?

Nature is full of cycles… crops are planted and harvested based on cycles…your heart beats to a cycle… the market works in cycles…

you had Larry Pesavento’s book on your list he trades patterns and cycles

http://www.carolan.org

This guy is a CMT for the level 3 he wrote a thesis that won the Dow award for the best TA thesis in 1998.

http://www.mta.org/eweb/DynamicPage.aspx?webcode=CharlesDowAward

CA,

You have to be bullish by now. The world is coming to an end yet the selling is muted. The Dollar will fall and Oil will and sticks will rise.

We held the 20 day on the SPX very well.

anjing bau – lol, fuck. You’re right. I forgot about Larry’s work. I’m doing my CMT work. I’ll take a look at his stuff. Thanks.

anjing bau Says:

green closes across the board today…the next down leg won’t start until the next lunar cycle in january.

December 12th, 2008 at 11:22 am

___________________________________________________________

See you in January

CA, nice twitter call this morning telling longs not to panic … stayed and staying for the entire WaveB … Thanks!

AB – nice call.

Thx Yogi & Boo Boo

comment6,

comment4,

comment2,