Good day for the bulls. We gapped up so hard that we not only filled Monday’s gap (requirement #1), but we also surpassed 11/28’s high (requirement #2). This was an immediate breakout and it was sustained throughout the day and it was a “Buy”. This seems like it’s mostly due to short-covering and the GM bailout. A lot of professional money remains on the sidelines.

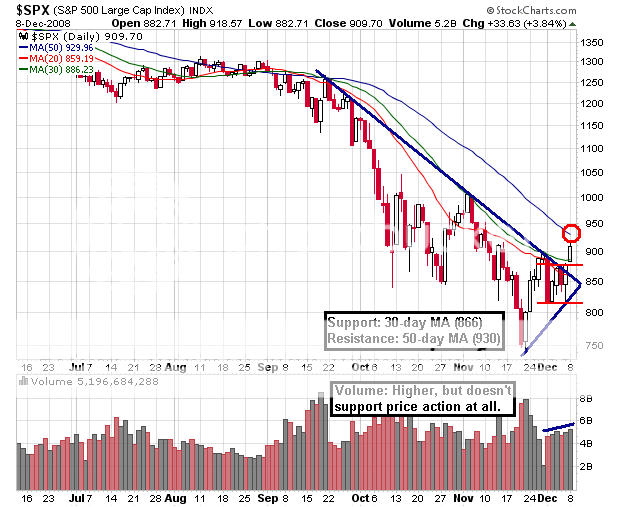

Therefore, the problem is the volume, again. It’s rising slightly higher on a daily basis, but I was expecting much more. This lack of price confirmation has made me cautious and signaled to cut half my long positions and get into cash. It’s only “ok” if the volume is just sustained, but that just means that there are a lack of players in the market.

Some caution — We are only a few points away from the 50-day MA, which is resistance that we last hit in September, and failed. What should you expect tomorrow? A down day is very, very possible. I will most likely sell out of all of my longs sometime tomorrow. Look for 930 SPX. If we do rally above the 50-day MA, then I’ll sell anyway to protect profits in an overbought environment. Keep in mind that the last time we did hit the 50-day MA was right before the October crash.

The 30-day MA has become support after 6 failures. If we do have a down day, I don’t expect the possible decline’s close to exceed the open-close range of yesterday’s action. For swing traders, I’m looking at a decline of no more than -1.5% on volume that does not exceed yesterday’s volume. The 20-day MA is no longer a threat.

All in all, expect a pullback at a minimum. I don’t expect a major breakdown and we may continue to flag at the handle portion of a “cup & handle” formation. We’ve exceed all major short-term resistance levels and they have now become our support. Again, I’d like to see some greater volume to confirm price action. On the 5- and 10-day charts, we see a diagonal channel. I’d like to see no breakdowns from the channel.

If you made some money, you’d be better off taking some of it off the table and waiting for a pullback for a possible re-entry. Look below and write down all the key levels for the next trading session and don’t forget them. It prevents impulse trading.

SPX 1-day

SPX 3-day

SPX 5-day

SPX 10-day

SPX 6-month

If you enjoy the content at iBankCoin, please follow us on Twitter

Nice work on the charts CA. I see an upside down head and shoulders with a move up to about 1000 on the spy, but a pull back to the 875 level first to shake out the longs and bring in the shorts.

Yes Richard, I see that too but the market has to break it’s neckline which is about 20 points above the 50-day. We’ll get a pullback soon.

morning CA…

great charts you have posted… thatnks for sharing your work…

god bless,

Duane

CA – Regarding the state of the 50 MA – one difference between now and before the collapse is the “spread” between the 20, 30 and 50 MA. Then they were all on top of each other, now they are much more spread out. (Real technical huh? 🙂 ) Not a low risk entry point. Yes, I’m still long and looking for higher prices.

IF, we got a break of the neckline at ~960 that would be a measured move to about 1180. Right?

Oh, once again, thanks for the good work.

CA, love the charts and clear explanation. have been learning alot from you and GIO.

Big Fan of the Charts….Great combo between your charts and “The Flys” Human Factoring…

Tucker

mr chart addict.. your insights are much apreciated,

dont let the jealous crowd bug you.

witH your posts had been very helpful on my learning process and had made me some $$$$..

DONT YOU FUCKING DARE TO GO TO REHAB.!!

KEEP THE ADDICTION GOING!

here’s hoping the breakaway gap in the SPX is legit…

a 960 break, then hit 1000 resistance, not sure from there.

we’re getting snagged at the 50-day again right now.

Keep the support/resistance in mind when you’re trading.

So far, so good on the breakaway!

Exactly, CA. Stay away from rehab!

http://tinyurl.com/John-Lennon1

Looks like that gap at 880 will get filled here.

_______

BTW — I think low volume will continue until morale improves.

____

volume sucks even more today than it did yesterday.

The Q’s won’t close the gap…the DIA filled the gap IWM traded a penny above the gap so essentially filled it and the SPY went to partially fill the gap.

Hanging just under the 50 dma and above the 30 ema is cool even if the volume isn’t overly strong because the market needs to build some cause to get over the 50 dma and run for 1007 on the SPX.

the 9 ema is close to crossing over the 20 ema and the 30 ema has flattened out. A close above the 30 ema ( ~89.10) would be two days in a row and the market hasn’t been able to do that sine August.

DRYS is getting the love today as well as X…. bodes well for the commodes.

Chart reading is useless, Technical analysis sucks. if you want to be burned in the market then go for T.A. Warren Buffett once said “”I realized technical analysis didn’t work when I turned the charts upside down and didn’t get a different answer” If you want to make it big in the stock market then go for Value investing.