I have come to the conclusion that the probability of a nice-sized rally next week is pretty high. I won’t abandon the bear camp entirely because I do see at least another leg down sometime in the unknown future. The possibility of the rally extending for some time is on the table, therefore, it’s important to remain flexible.

The bullish case:

1) The tremendous strength displayed after the most important economic report was released is simply astounding. It is unreal, yet the market’s reaction must be fully respected, regardless of opinions. The price action said a lot.

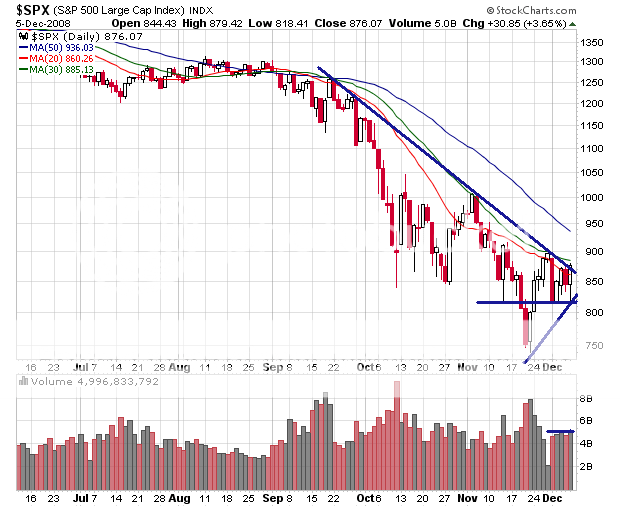

2) We were unable to break SPX 802 after numerous attempts. We also broke through major resistance levels, including a clean close above the 20-day MA. The 820 level is amazingly resilient and an inverse head & shoulders may be underway.

3) We’re forming bullish stick sandwiches on every index. Volume remains steady.

4) We’re actually within striking distance of the 50-day MA, the all important fluid intermediate-term support/resistance level. Before, we couldn’t even get close to this moving average.

5) The health care, consumer discretionary & staples, technology, utilities, financials, and other sectors and industries (minus energy) are showing significant strength and have either broken their primary downtrends or are threatening to. This assessment is significantly different from last week.

6) Shorts who have shorted within the past 10 days will most likely cover their positions if we reach one more solid up day.

7) The VIX broke the 50-day once again, and this has been the 7th test. The VIX is starting to get more down days than up days, signaling more potential downside.

8 ) Various technical indicators are showing large divergences between the indicators themselves vs. price action.

————

The “Iffy” Case:

1) Uncertainty. Anything can happen unexpectedly that can drop the markets faster than you can say, “ohhhhh shiiii”.

2) We are forming a multi-day short-term neutral range, a 10-day symmetrical triangle, and a 1.5 month semi-descending triangle. Any breakdown below SPX 900 is bearish. A major down day on HUGE volume would nearly negate everything supporting the bullish case. The volume is key though.

What I hate:

1) The abundance of pattern failures. Triangles that don’t break, unexpected rebounds, etc. All that crap that doesn’t even allow you to leave your computer just once to take a piss in peace.

I’m going to have to lean toward the bullish side until the trend changes. In my post on Thursday, I stated that we needed to fulfill two steps. We did with the first one, but we were unable to breakdown below 820, or step 2. This was extremely important and it didn’t happen. I’m not going to go bullish unless 1) Monday’s gap fills, 2) we get a nice consolidating base, and 3) we rally strong on volume. If it’s anything less than that, then we’re going to drop back into the range. 875-880 is the ideal bounce off level.

Don’t get too comfortable. This bear is hardly finished tearing off people’s heads. I am neither bull-biased nor bear-biased, I only care about the direction. We may finally be climbing a “Wall of Worry”, but keep in mind that this bear market is far from over.

SPX 3-day

SPX 5-day

SPX 10-day

SPX 6-month

DJIA 6-month

NASDAQ 6-month

If you enjoy the content at iBankCoin, please follow us on Twitter

Hmmm…

…those are some really neat lookin’ lines and stuff…

.

goddamn this market.

Good shit kid.

Keep the mind open.

____

I just make sure to use the restroom before 3.

Couldn’t believe how strong we finished Friday. Maybe Santa is ready to lob some grenades at the bears before xmas is over.

“goddamn this market” …you say !

———————

with all due respect…

…if not for “this market” …you wouldn’t be able to draw worthless lines on charts that mean nada…and yap endlessly on this blog as though you ACTUALLY “know” what’s going to happen next !

———————-

…“goddamn this market” … indeed !

Wash your mouth out, son !!!

.

you take shit way too seriously

You were so confident in your thesis all week, and Friday changed that? I appreciate your caution, but I think this bear market is really just getting started.

I mean, call me when the S&P hits the 200 day – I don’t think it did between 1929 and 1932 despite some ferocious rallies.

But 533K jobs lost will probably be revised to 700+. A guy who made 50% for his clients in October alone thinks the next report could be one million.

Obama’s shovel plan won’t see an economic impact for a year at least, if it shows one at all.

For me, the bottom line is that anybody riding the week long on the S&P should feel lucky to have gotten out alive at -2.5%. Santa came early, but he’s cancelled the return policy, because if even the most bullish commentators expect another big drop at some point, they haven’t adequately explained why it shouldn’t 30 hours from now rather than 1-4 months out.

In other words, anything can happen, and it probably will.

Thanks for the good stuff up there.

I don’t agree with your line drawing on the SPX 6 month. The trendline down, should look more like the Nasdaq downtrend line which was broken slightly by Fried-days action.

The market won’t get to the 200-day MA, but the 50-day? Sure. We’ve failed at the 50-day this entire time, so we just have to take the market day-by-day. Friday appears to be a temporary turning point in favor of the bulls. I looked at too many stocks last night forming solid uptrends and too much multi-sector leadership. I can’t wait to short the hell out of the market again.

look better, juice?

The Dow hit the 200 day in May. I would not be surprised to see it do it again.

I feel strongly that we need a huge rally to suck in everyone who has thought they were a genius, for sitting on the sidelines. All those who were lucky, or maybe even a tad skillful, and who have avoided the worst of the bear so far, need to get sucked back in.

In my opinion, when that happens, that will signal the beginning of the true 3rd and final leg of the bear.

We may have to rally has high as the 200 day average to suck those people in.

Alfie, where’s your Covestor account! You sound like you’ve been killing it in this market, son!

IMO the “easy money” has been made, both bull and bear.

Oh SHIT! Chart Addict was BEARISH all last week as I reaped coin on my longs- which I still hold.

Now he is turning BULLISH – and I hope I can sell out Monday at current or higher levels, keep my profits, and move back to the sidelines!

Thanks, CA and Shed. Getting to the 200 day will not be good for the heart unless I change a few positions…

I’m not too worried given the headline from the industry rag below:

http://www.retailerdaily.com/entry/nov.-sales-the-worst-in-35-years/

First things first…

Prolly was a little harsh on the “ChartAddict” in my last post. Was meant to be “tongue-in-cheek”…but, upon re-reading it this morning…prolly just a bit too harsh. Sorry for that !

Secondly, “woodie” asked about (albeit sarcastically) Covestor. Well, woodster…there ain’t no “Covestor account” ! In fact, if it weren’t for your (almost daily) mentions of Covestor…I wouldn’t even know it existed. I DID read your interview however.

.

Last week turned from bearish to neutral quickly and we’re in this neutral holding pattern that’s making it difficult for both bulls and bears. Weak hands are definitely getting shaken out throughout each day on both sides.

If we bust through the 50-day MA, they’ll start to get sucked in quick + mad short covering.

Yep —

starts posting with all that bravado…. market going to zero…

4 days later…. after a surprise rally “I’m bullish now”

just as I suspected on day one. Here’s all you have to say for now on:

If the market goes up, I’m bullish. If the market goes down, I’m bearish.

And try to keep the rest to yourself. It’s not helping you or anyone else.

If you noticed, I have requirements that need to be met on nearly every post. If they’re not met, then it’s a key reversal. It’s funny how you post dumbass irrelevant comments after 4 days goes by.

Comment on my blog one more time and see what happens. I ain’t fucking around with your bullshit.

I feel strongly that we need a huge rally to suck in everyone who has thought they were a genius, for sitting on the sidelines. All those who were lucky, or maybe even a tad skillful, and who have avoided the worst of the bear so far, need to get sucked back in.

… good one Wood. When I was taking a shower this morning I was thinking the same thing. (Note: some of the best ideas come when you’re not planning on thinking about them)

BTW Addict, looking at those SPX charts makes Ragin’s 840 on the 5-day that much more significant. One problemo… volume.

I expect level volume during consolidation. It’s steady and not declining. There’s also more volume on up days vs. down days which is a first. Most sectors are also seeing increased volume on this rally vs. declining volume on most other rallies this entire year. I’m still deciding to day trade, swing trade, momentum trade, or position trade this. Maybe a combo.

Gotta get some complacent suckers back in to support the volume.

Chart Addict, do not let these pikers get to you. How can they argue with the end results? 100% annually for the last three years? Keep up the great work.

Everything comes down to performance, but I still don’t take shit that isn’t backed up by facts.

For example: “starts posting with all that bravado…. market going to zero…”

Who the fuck said that? Not I.

-or-

“4 days later…. after a surprise rally “I’m bullish now””

What this fucking douchebag doesn’t know is that I issued my Pre-Market Update at 9:08AM on Friday to my subscribers in exact words: “I am thinking that the market may possibly rally off of this news. If you want to be safe, just cover at the open.”

Therefore, the rally wasn’t much of a surprise, much to the douchebag’s chagrin. People like that need to stop the fucktarded kindergarden shit and learn to make some money.

However, people can give me all the shit in the world if I deserve it.

If my criteria are met on Monday, I’m going long the shit retailers trading in the single-digits. They all have some very strong bullish patterns.

Criteria-

1) Monday’s gap is filled

2) Monday’s opening peak is surpassed

so, you’re playing the formula. My plan as well. Good show.

Talk about money on the sidelines….in treasuries alone, which are paying what….0000001%?

Watching the primary stocks in my portfolio, it is very clear that the fund managers have started serious accumulation over the past few weeks.

Those are the “up-trend charts” that Chart Addict is talking about.

We had a fizzled turkey day rally, at that party, no one really got to “shoot a load” as it were.

The coming Santa Claus rally will be much more intense, finally everyone will get to blow their wad…

I think that then, and only then (Jan-Feb), the market goes to hell in a hand basket.

Honestly, so many traders are totally worn out and depressed. They want to have a party between Christmas and New Years, and by god they’ll have it….come hell or high water.

That is the “emotional state” of the market.

Woody sez:

We may have to rally has high as the 200 day average to suck those people in.

I’ll do you one better. Parabolas to the downside meet their equivalant going the other way (and vice versa).

I suggest… we break the 200 day MA!

______

Asia is on a happy happy, joy joy opium mission

Hang Seng up 8%

Nikkei up 5%

Dow Futures up 150

This market love you longs long time!!

you guys are so off base with that.

we dont HAVE to do anything. I think the idea of rallying to sucker in bulls is great, but be cautious basing an investment plan off of a GUESS. There is NOTHING to suggest that that would happen, yet.

Jake, what would get institutional money flowing into stocks such that we would break the 200-day, a modest 8 million percent higher?

yep. Low risk entry points. I’m not going to take unnecessary chances.

The 200-day MA has indicated the end of bear markets throughout history. A clear way to know the end is the initial flat line leveling of the MA and the curve up which usually happens when a higher low is made.

I’d be stunned at a move to the 200 day. Is the market pricing in this shit? Check the real unemployment #s out (U-6):

http://www.bls.gov/news.release/empsit.t12.htm

Don’t we need an indicator like improving unemployment numbers and expanding credit before we can even begin to really rally? Credit card companies are cutting credit lines, people are having to actually use cash to buy goods, and unemployment rates are heading higher still.

Chart Addict, you mentioned our local Chevy Chase Bank being bought out by Cap One. Apparently, C was working on a takeover for something like $12B a month or two ago. Cap One gets them for $500M! Chevy Chase was heading straight to BK. A friend of mine that had been banking with them for 9 years (great credit and no mortgage) was just notified that they were shutting his checking account down. Not sure about your local branch, but his had a run last week. Huge lines all withdrawals.

I agree about the 200-day MA. Somewhere many, many months down the road, when we see the 200-day MA catching “down” to the market, we’ll know that a potential bottom will be close. I expect some type of initial failure at the 50-day MA.

Which branch was this? Those son of a bitches need to tell their customers what’s going on. I’ve been with them for about 8 years now. All I get is this bullshit Q&A pop up whenever I log into my online banking.

U-6 is pretty scary. The BLS likes to leave certain groups out to form U-3, even though all the people in the stats between U-6 and U-3 are still “unemployed” persons by any simple definition.

Bear market secondaries don’t need any of that. We’re gonna have some nice shorting opportunities later.

CA, he lives in Herndon. I just tried to log in to my account online–no go. System down. Fucers.

U-6 is friggen high indeed. Going higher.

Agreed about the shorting opps later.

Have an excellent week, Sir.

dammit, I just tried to log in and I got this:

“Chevy Chase Online Banking is not available at this time. We apologize for the inconvenience. Please try again later.”

Hope it’s not permanent lol.

OEW wave count for the current Major Wave B:

“Thus far we have labeled the rally from the SPX 741 low into the 896 high as wave A. The pullback into mon/tues at 816/818, the thurs high at 876, and pullback to 818 again on friday, we have labeled wave B. From the friday low we should now be rallying in wave C. This entire abc rally should complete a larger wave A of the next uptrend. The degree of the waves will be determined as the rally (expected uptrend) unfolds. Since wave A was 155 points, and wave B bottomed at 818. Wave C will equal wave A at SPX 973, and will be 1.618 wave A at SPX 1068. We have on OEW pivot at 961 and another OEW pivot at 1061. So both levels are in play at this point in time. Let’s see how the rally unfolds.”

Just another tool in the toolbox if you will ….

You could castrate a few bears with that tool…

thanks for the info E8

Volume drives the market….. as long as the up days and the crossing of swing points takes place on higher volume then the rally sustains.

I believe the markets QQQQ SPY DIA IWM all want to trade to the Nov 4/5 th area. Volume at those areas will dictate what trade to take next.

GE hurdled the 50 dma today it looks like its setup to run to 21.00 …. thats another 10 % from todays price… note its got a huge supply line @ 22 from Oct 2 nd……

Jake, what would get institutional money flowing into stocks such that we would break the 200-day, a modest 8 million percent higher?

Stupidity, and a break in the dollar index down to the 80’ish level.

_______

EMP 8 if you get a 1:1.618 ABCD structure then it will cue a change in trend …..

AB: OEW (Tony) has been fairly accurate with his predictions and says that the ABC wave is consistent for bear market wave counts. 1068 is the “wave a” prediction for this uptrend with “wave c” taking us to 1107 (a 50% retracement of the entire bear market loss) or 1179 (a 61.8% retracement) …. wave b pullback could take back 38%, 50% or 62% of this wave up but the rally should last a few months … of course within each wave there could be minor waves, extended waves, zig-zags etc but an ABCD without an E is highly unlikely based on my understanding of OEW. If you were to interpret a D as a change in trend most likely Tony @ OEW would call it the first wave of the dangerous WAVE C down to the bottom.

Thx Employee 8…. I believe that there is some upside to this move but ultimately we have to head back down in time.

The global markets crapped the bed big time the week of October 6-10 th…the SPX lost 260 points in one week! So i am looking for an ABCD structure to play on the daiilies ending this week somewhere between 970 and 1007.

I take it one day at a time but I am looking at a weekly scenario where we could trade up to the Sep 29 th candle which is where the markets broke down from we dropped a 100 snp points that day the range there is 1209 to 1106. The weekly cahart pattern would be and AB=CD type of structure