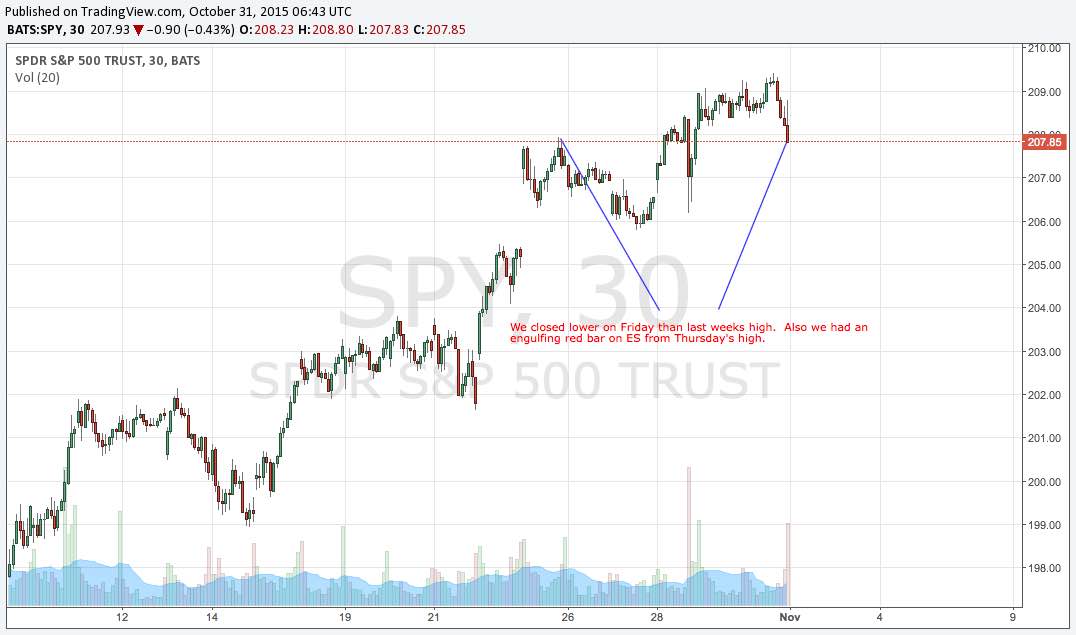

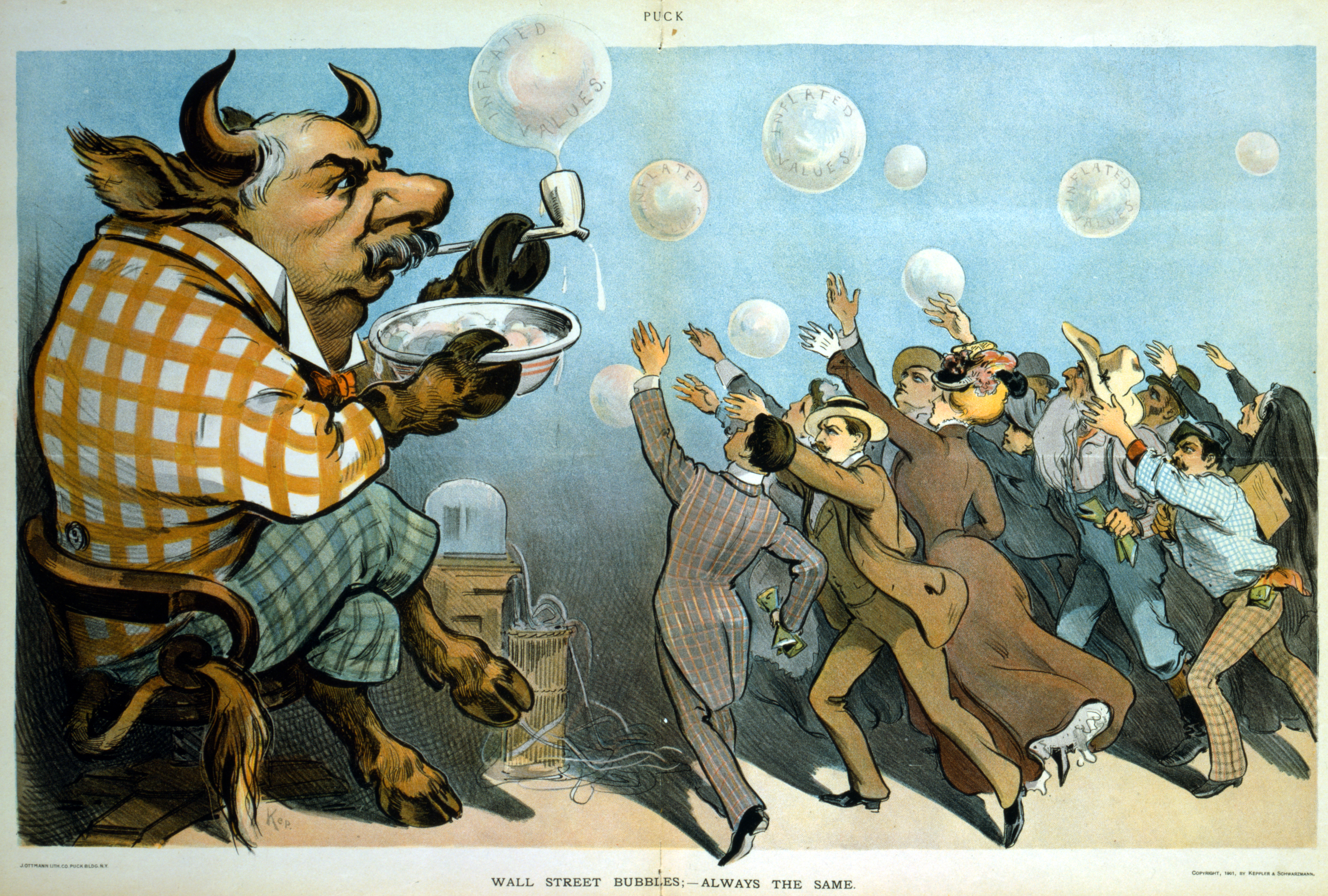

In my opinion nothing has changed fundamentally from the September lows. In my second to last post, I talked about last Tuesday as potentially being the top of this rally. So far we have compelling evidence that this is the case. I have added some exposure this week and I will likely add some more if we don’t gap down tomorrow. The high yield complex is rolling again and most of this week had a distinctly risk off tone with stocks cratering left and right except for the few chosen FANGS. We are entering the part of the bear market where most will realize it is a bear market. I had thought this phase would have occurred sooner but I did not expect the bear market rally that we saw.

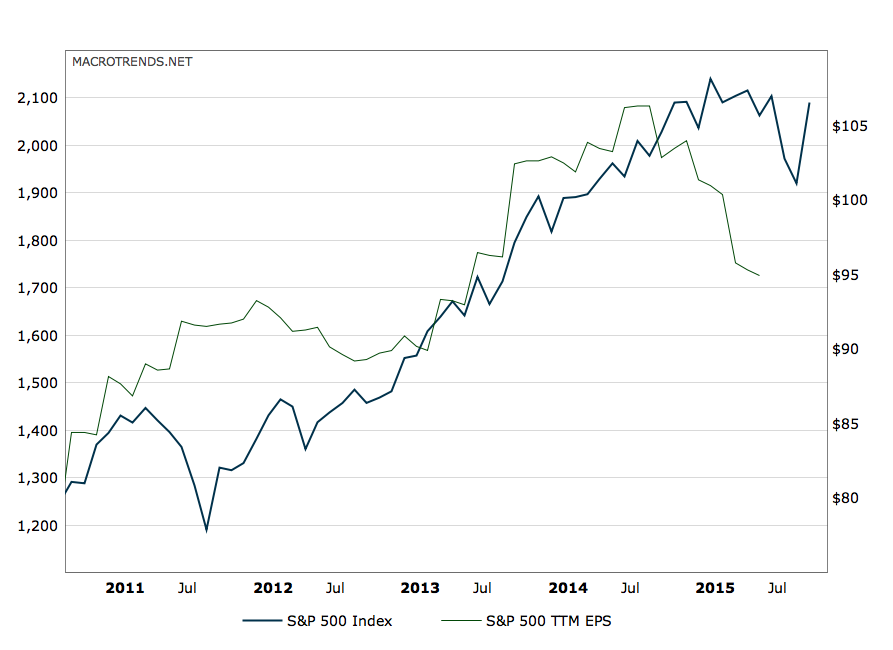

The indices are being held up by air and I expect this sell off to gather steam barring any central bank intervention. Underneath the hood is a disaster as evidenced by the out performance of mega caps versus small caps and mid caps. The global economy is slowing very quickly as can be seen by the commodity recession that is showing up in earnings of the industrial, energy, mining, enterprise tech and semiconductor companies. The malaise is spreading to the US consumer as corporate layoffs from the previously mentioned sectors and Obamacare’s 25% premium increase next year are both coming into the collective consciousness of the masses. The reports by Macy’s, Nordstroms, Walmart, Wholefoods and others suggest the consumer is tampering spending way down. What is interesting is that the high end retailers are having issues as well. Bottom line is that inventories are high and sales and earnings are down which suggests a very poor x-mass and serious discounting and no reordering over the next couple of months. Essentially we are about to have an old fashioned inventory liquidation recession. Wholesale inventories versus sales have not been this high since the Great Recession.

In addition to the rapidly weakening economy we have a Fed that is hell bent on raising rates. They are either stupid, bluffing or there is some other geopolitical consideration going on here that I may talk about at a later date. Clearly they have amped up the rhetoric and the bond market for the time being is believing them. This is clearly not helpful to the liquidity situation and the deflation that is raging across the globe.

We also have the lifting of the veil and by that I mean the capital markets are slowly shutting down frauds and questionable business models that rely on the capital markets to grow. In very short order we have had both Valeant and Theranos, Hedge Fund and VC darlings, completely implode. These revelations are withdrawing capital from the markets at an alarming rate and the Tech Unicorns and other financial engineering stocks are likely to implode in very short order. Fidelity has written down their Snapchat holding by 25% and the Square IPO is coming in 30% below their last private round. There is a perfect way to play this implosion through a certain bubble stock. I will be writing on this soon.

Finally I believe many institutions are waking up out of their QE induced slumber and don’t like what they see. The Matrix is being revealed. QE does not work and deflation is the result. This is showing up in revenues and earnings. Trust me the buy-side will not ignore lower earnings and revenues for long. Half of my friends on the buy side knew this was bullshit from the get go and have one foot out the door. The other half truly believed there was a recovery and refused to listen to my warnings. Interestingly enough many of these true believer folks are calling me and are no longer hostile to my bear thesis. The risk is that the non believers who played the game and the believers who are awakening to the Matrix of QE both head for the exits at the same time. Liquidity is non existent and if this selloff gathers steam we could see a repeat of August. I am fairly certain that the August lows will be retested. In my mind the question is how quickly it happens?

Comments »