An internet researcher has uncovered what appears to be proof that the FBI was investigating the Uranium One deal back in 2015 – months after the Peter Schweizer book Clinton Cash exposed the scheme, along with an article in the New York Times which laid out allegations of criminal malfeasance by the Clintons, their charitable foundation, and several associates.

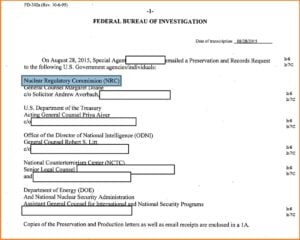

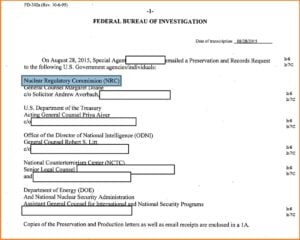

Twitter user Katica (@GOPPollAnalyst) – who notably discovered Hillary Clinton’s IT guy ‘Stonetear’ asking Reddit users how to strip Clinton’s name from archived emails – discovered several Preservation and Records requests sent by an FBI special agent to various agencies involved in the approval of the Uranium One deal on August 28th, 2015, as first published by The Conservative Treehouse. Katica found the requests buried in an FBI file released via the Freedom of Information Act (FOIA).

Revealing Timeline

While the Clinton email investigation was launched in March of 2015 after it was revealed that Secretary of State Hillary Clinton used a personal server and non-approved email accounts to conduct government business, reports from August, 2015 revealed that the FBI investigation was actually a criminal probe – though most assumed it was simply covering Clinton’s mishandling of classified information and not the content of her emails.

While the Clinton email investigation was launched in March of 2015 after it was revealed that Secretary of State Hillary Clinton used a personal server and non-approved email accounts to conduct government business, reports from August, 2015 revealed that the FBI investigation was actually a criminal probe – though most assumed it was simply covering Clinton’s mishandling of classified information and not the content of her emails.

What Katica discovered is that weeks after the criminal probe began, the FBI sent notices to nearly every agency involved in the Uranium One approval process to preserve records.

This is huge…

The agencies which received the request included the Nuclear Regulatory Commission, the U.S. Dept. of Treasury, the Office of Director of National Intelligence (ODNI James Clapper), The National Counter Terrorism Center, and the U.S. Department of Energy (DOE).

Five days after the initial request, the same FBI agent sent another round of notifications to the same agencies, adding the National Security Agency (NSA) and the U.S. Secret Service (USSS).

The next day, September 3rd, 2015, three more agencies were added to the preservation request: The CIA, the Defense Intelligence Agency (DIA) and the Department of Defense (DOD)

At this point, every single member of the Committee on Foreign Investment in the United States (CFIUS) which signed off on the Uranium One deal was served with a notice to preserve records.

As The Conservative Treehouse notes:

It would be intellectually dishonest not to see the very likely attachment of the special agent’s action. That is to say an FBI probe originating as an outcome of information retrieved in parallel to the timing of the “criminal probe” of Secretary of State Hillary Clinton’s email use.

The sequence of events highlights a criminal probe starting [early August 2015], followed by notifications to the “Uranium One” CFIUS participants [late August 2015].

If you consider the larger Clinton timeline; along with the FBI special agent requests from identified participants; and overlay the Nuclear Regulatory Commission as the leading entity surrounding the probe elements; and the fact that the CFIUS participants were the recipients of the retention requests; well, it’s just too coincidental to think this is unrelated to the Uranium One deal and the more alarming implications.

FBI Mole

Let’s not forget a bombshell report from The Hill two weeks ago which revealed that as early as 2009, the FBI – led by Robert Mueller at the time, had a mole in the Russian uranium industry, and that the agency had evidence that “Russian nuclear officials had routed millions of dollars to the U.S. designed to benefit former President Bill Clinton’s charitable foundation during the time Secretary of State Hillary Clinton served on a government body that provided a favorable decision to Moscow” – a deal which would grant the Kremlin control over 20 percent of America’s uranium supply.

The mole was forced to sign an iron-clad non-disclosure agreement (NDA) which threatened criminal penalties for revealing information, even to Congress. After a request was made by Reps Ron DeSantis (R-FL) and Chuck Grassley (R-IA) calling for the Justice department to invalidate the NDA, the gag order was lifted, and the FBI informant was authorized to speak with congress.

Tony Podesta and Uranium One

While one-time Trump campaign manager Paul Manafort turned himself in to the FBI a week ago on charges of money laundering, let’s not forget what a former Podesta Group executive interviewed by Special Counsel Robert Mueller told Tucker Carlson Tonight: the FBI probe is now focusing on people in Washington who have worked as de-facto operatives on behalf of Russian government and business. To that end, he had quite a bit to say about his former boss Tony and his relationship to the Uranium One deal.

- In late 2013 or early 2014, Tony Podesta and a representative for the Clinton Foundation met to discuss how to help Uranium One – the Russian owned company that controls 20 percent of American Uranium Production – and whose board members gave over $100 million to the Clinton Foundation.

- In 2013, John Podesta recommended that Tony hire David Adams, Hillary Clinton’s chief adviser at the State Department, giving them a “direct liaison” between the group’s Russian clients and Hillary Clinton’s State Department.

- “Tony Podesta was basically part of the Clinton Foundation.”

As far as the current state of the FBI investigation, “They are more focused on facilitators of Russian influence in this country than they are on election collusion,” Carlson’s source told Fox.

Tying it together – previous reports of Federal investigations into the Clinton Foundation:

Katica’s FOIA discovery corroborates a New York Times report from November 1, 2016, which asserts that an FBI investigation was kicked off based on revelations of pay-for-play in the book “Clinton Cash” written by Peter Schweizer:

The investigation, based in New York, had not developed much evidence and was based mostly on information that had surfaced in news stories and the book “Clinton Cash,” according to several law enforcement officials briefed on the case.

The book asserted that foreign entities gave money to former President Bill Clinton and the Clinton Foundation, and in return received favors from the State Department when Mrs. Clinton was secretary of state. Mrs. Clinton has adamantly denied those claims. -NYT

The Wall St. Journal also reported last October that five FBI field offices were investigating the Clinton Foundation; New York, Los Angeles, Washington, Little Rock and Miami, and “were collecting information about the Clinton Foundation to see if there was evidence of financial crimes or influence-peddling, according to people familiar with the matter.”

The FBI field office in New York had done the most work on the Clinton Foundation case and received help from the FBI field office in Little Rock, the people familiar with the matter said. –WSJ

And in November, as tweeted by Wikileaks and reported on by the Dallas Observer, the Clinton Foundation has been under investigation by the IRS since July of 2016, after 64 GOP members of Congress received letters urging them to push for an investigation. The investigation has been notably held at the Dallas IRS office – far away from Washington.

The Earle Cabell Federal Building in downtown Dallas is an all purpose office complex, a bastion of federal bureaucracy located at 1100 Commerce St. Most people come for a passport or to get business done in front of a federal judge. But inside, a quiet review is underway that has direct ties to the raging presidential election: The local branch of the IRS’ Tax Exempt and Government Entities Division is reviewing the tax status of the Bill, Hillary and Chelsea Clinton Foundation.

So – while the FBI investigation into Hillary Clinton was sold as a simple matter of mishandling of classified material, we now have proof that the FBI set their sights on the Uranium One scandal weeks after they began looking into Hillary Clinton’s emails. We also know that five FBI field offices and the IRS have been investigating the Clinton Foundation on accusations of pay-to-play and other criminal acts.

Bets on who’s indicted next?

Flashback to October 27, 2016

Comments »

Facebook is asking users in Australia to send the social media giant nude pictures in order to test out a new system designed to prevent revenge porn.

Facebook is asking users in Australia to send the social media giant nude pictures in order to test out a new system designed to prevent revenge porn.