Hugh Hendry, the feisty bearish Scotsman who posted a 31% gain in 2008 betting against banks is shuttering his firm, Eclectica Asset Management, following a 15 year run that ended in loss.

Hugh Hendry, the feisty bearish Scotsman who posted a 31% gain in 2008 betting against banks is shuttering his firm, Eclectica Asset Management, following a 15 year run that ended in loss.

Hendry’s flagship fund, Eclectica, dropped 9.4 percent this year through August, with assets of $30.6 million.

Via Bloomberg:

“It wasn’t supposed to be like this,” Hendry said in an investor letter seen by Bloomberg. The fund “became strongly correlated over the short term to maelstrom of President Trump and the daily news bombs emanating from the Korean Peninsula,” making it impossible to manage small amounts of money, he said.

After a killer 2008, Hugh made headlines in 2009 talking shit about all the empty real estate in China, posting YouTube videos and whatnot showing darkened office buildings with no tenants.

Hendry’s joining a long list of vanquished fund managers for 2017

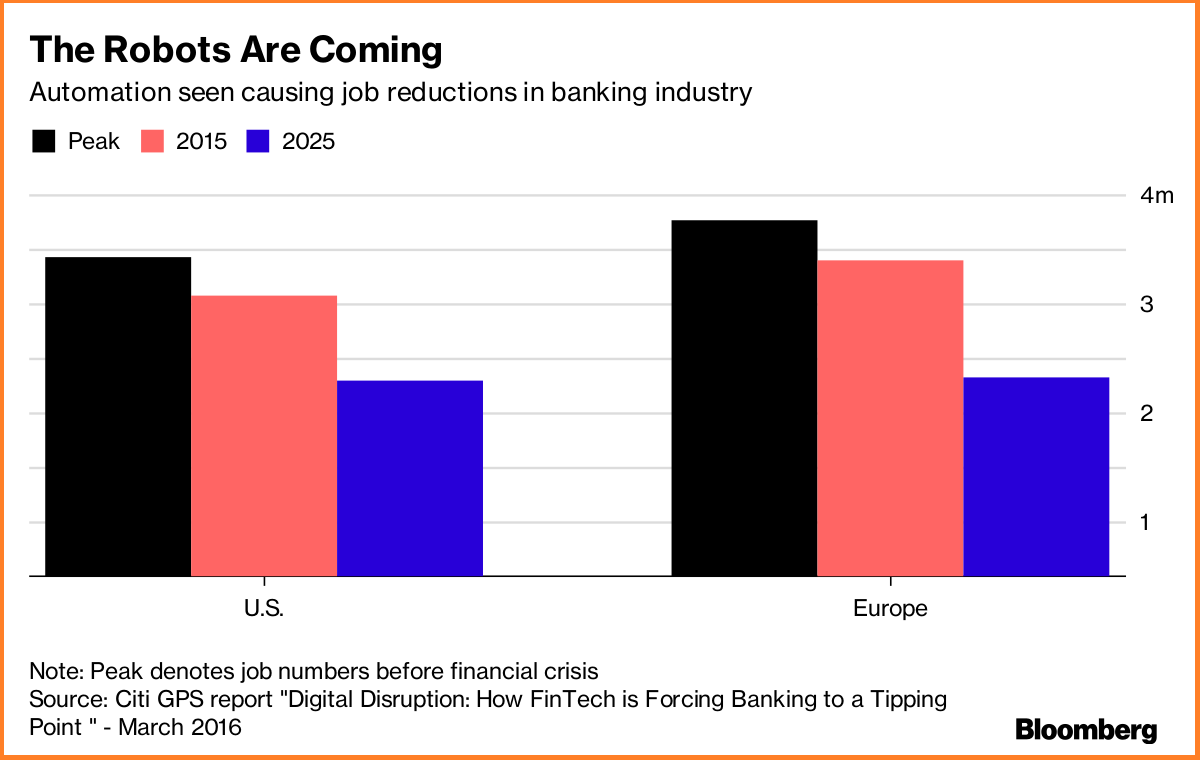

With the closing of Eclectica, Hendry joins a long list of hedge fund managers who have folded up shop this year – including Eric Mindich, Leland Lim and John Burrbank. Just shy of 260 funds liquidated in Q1, which followed a record number of closings in 2016 – with more managers liquidating funds than any year since the financial crisis.

What’s Hugh gonna do?

Hendry told investors he’s going to sit out the next major market inflection, though he said he’s optimistic about the global economy and recommends investors stay long.

“For the first time in an age all parts of the world are enjoying synchronised economic momentum and I can’t see it ending for some time,” he wrote in the letter. Hendry added that he doesn’t envision an abrupt rise in interest rates that would interrupt the equity rally.

Full letter here (via ZeroHedge)

CF Eclectica Absolute Macro Fund

Manager Commentary, September 2017

What if I was to tell you I wasn’t bearish on anything? Is that something you would be interested in?

It wasn’t supposed to be like this and it is especially frustrating as nothing much has gone wrong with the economy over the summer. If anything we feel more convinced that our thesis of a healing global economy is understated: for the first time in an age all parts of the world are enjoying synchronised economic momentum and I can’t see it ending for some time. It’s just that our substantial risk book became strongly correlated over the short term to the maelstrom of President Trump and the daily news bombs emanating from the Korean Peninsula; that and the increasing regulatory burden which makes it almost impossible to manage small pools of capital today. Like I said, it wasn’t supposed to be like this…

But let me bow out by sharing my team’s views. For the implications of a sustained bout of economic growth are good for you. It’s good because it should continue to underwrite a continuation in the positive performance of global equities. I would stay long. It’s also good because I can’t see interest rates rising abruptly to interrupt the upward path of equities. And commodities have already acknowledged the upturn in the fortunes of the global economy and are likely to trend higher still. That’s a lot of good news.

But it is bad news for me because funds like mine are required to demonstrate negative correlation with risk assets (when they go up like this I go down…), avoid large drawdowns and post consistent high risk adjusted returns.

Oh, and I forgot, macro fund clients don’t like us investing in the stock market for the understandable fear that we concentrate their already considerable risk undertaking. That proved to be an almighty puzzle for a fund like mine that has been proclaiming the stock market as a “safe-ish” bet ever since 2013.

Let me explain the “markets are wrong and we boom now” argument. To begin with, and for the sake of clarity, I think we have to carefully go back and deconstruct the volatile engagement between capital markets and central banks for the last ten years for an understanding of where we stand today.

The first die was cast by the central bankers in early 2009: having stared into the abyss of a deflationary spiral in 2008 the Fed and the BoE announced a radical new policy of bond purchases named Quantitative Easing. The bond market hated the idea as it was expected to cause a severe inflation problem.

Thankfully Bernanke, a student of the great depression knew better.

Markets primed themselves for inflation yet even with a ripping stock market in 2009/10 they were disappointed. QE rescued the financial system but the liquidity created was distributed to the very rich who have a very low monetary velocity and so the expected inflation fillip never materialised as the liquidity injection came to be stored rather than multiplied by the banking system.

Several years later, in 2013, the Fed suggested a reduction in the pace of its QE program. They wanted to tighten credit conditions gradually. However, capital markets beat them to it and the ensuing “taper tantrum” tightened monetary policy on their behalf. Within four months the market had taken 10 year treasuries from a yield of 1.6% to 2.9%, a move of far greater impact, and much more rapid, than anything the Fed had contemplated doing.

Markets initially thought the US could cope with this higher level of rates, but with a slowing economy, an unfortunately-timed oil price crash, and persistent ghosts in the machine (like the substantial Yuan devaluation fear which never materialised) they were proven wrong. Back then, with a 7.6% national unemployment rate and tepid wage inflation, this tightening always looked a little premature to us and so it proved with the rate of price inflation inevitably sliding lower to present levels.

And so last year, following many years of berating the Fed for its easy monetary policy regime, investors collectively threw in the towel. This rejection of the basic tenets of the business cycle by those who direct the huge pools of real money is proving particularly onerous to attack as it seems that the basic macro fund model is broken: there are just not enough “coins in them pirates’ chests” to challenge the navy of this flawed real money doctrine. Managers, and I must count myself in this camp, feel compromised by our poor absolute returns since 2012 and we find ourselves unable to put up much resistance to this FAKE NEWS.

Why should you fight it? Well let’s look at the last few times American unemployment dipped below 4.5% like today. I would largely ignore 2000 and 2006 when monetary policy was tightened and the economy buckled under the duress of the dramatic reversal in what had been credit fuelled misallocations of capital in the TMT and property sectors. No, for me 1965 is far more illuminating. Then, like today, there was no epic bubble or set of circumstances whose reversal could cause a slump; people forget but recessions don’t come out of thin air. No, in 1965, economic growth got choked by a tight labour market; a market as ominously tight as today’s.

In the middle of 1964, CPI core inflation was running at 1.7% and indeed dropped to just 1.2% in 1965; unemployment was 4.5%, the same as today. And yet by the end of 1966 inflation had essentially got out of control and didn’t dip below 2% again until 1995, almost 30 years later.

It seems to me that wage or cost push inflation is far more difficult to prevent and contain than asset price inflation. It tends to bear comparison with how Hemmingway described going broke: slow at first and then devastatingly quick. It may prove especially potent right now as the labour market is tight and there are no catalysts to generate a self-correcting US recession with both central bankers and markets now united in their desire for loose policy.

Look at the graph below, the unemployment rate (red) is at lows, job openings (blue) have increased beyond the hiring rate (teal) and are now approaching the unemployment rate for the first time since the Job Openings and Labor Turnover Survey data began. Ultimately robust GDP growth plus this labour tightness will lead to wage hikes and conceivably a self-sustaining inflationary cycle.

This is all the more ominous as the Fed has been reluctant to unwind its balance sheet. The largesse of this program fell to those already wealthy (“the global creditor”) and who had a low propensity to spend:

financial markets boomed, less so the real economy. However the legacy of QE plus wage gains would turn this equation on its head. It would distribute incremental dollars to those with a much higher propensity to spend. The boost to monetary velocity from widespread wage increases would start to look much more like the helicopter money that Chairman Bernanke promised back in 2002 and subsequent central bankers dared not distribute.

The macro shock would not necessarily be the subsequent inflation but, that by waiting to respond until later, higher policy rates might fail in the first instance to induce a recession setting off a loop begetting higher and higher rates. Let me explain: companies will continue to employ staff, and with wages increasing, it is likely that sales will hold up and, depending on whether they achieve productivity gains or not, corporate profitability might also remain firm. So companies will commit to pay staff more whilst raising prices to meet higher wage and interest payment demands where possible. Like I said, wage or cost push inflation is a very different beast to contain.

I have to say that should this scenario unfold then capital markets will be as culpable as the Fed. This year, bond investors have aggressively flattened the US yield curve. The clear message is that 1.25% overnight rates threaten to pull the US economy into recession. I disagree. I think they are undermining the ability of the Federal Reserve to respond proactively; the Fed is simply not going to hike rates under such conditions having learnt the hard way back in 1999 and 2005. But what if such flatness has more to do with the commercial investment pressure brought on by QE rather than a genuine recession threat? Could it be that the bond market’s cautionary recessionary indicator is stuck flashing RED whilst the US economy goes from strength to strength? I fear so.

Clearly of course no one knows. However if an inflationary path like 1966 is gestating then I fear there is very little chance that anything timely will be done about it. Rate hikes will continue to be sparse, we only have one quarter point hike predicted between now and the end of 2019, which if fulfilled will be highly unlikely to spark a severe recession. Most likely the US economy will continue to grow and the labour market will tighten making a larger adjustment to rates in the future inevitable.

And so QE could conceivably end up doing what it was always supposed to do in the first place: find its way through the financial system to increase, not decrease, interest rates. This scenario would diminish greatly if bond curves steepened a lot now and gave the Fed the credibility to hike. Sadly I just don’t see this happening. They will steepen of course but I fear only after the virus of cost push inflation is released into the global hothouse.

This potentially leaves us in a strange environment. In the absence of any recognisable asset bubble set to burst, and the Fed grounded, the US economy is unlikely to slip into recession. China continues to rip. And now the European continent is recovering. Risk assets should continue to trend positively. And with the bond market, wrongly in my opinion, infatuated with the likelihood of an approaching US recession, the Treasury market is unlikely to move much. This is simply not a good time to offer a risk diversifying portfolio.

However, perhaps being long fixed income volatility isn’t such a bad idea. It has not been persistently lower than this for almost three decades. And unlike equity volatility it does not tend to trade in lengthy and definable regimes; it is never a great idea to go long equity volatility just because it happens to be low. The same cannot be said of its fixed income counterpart.

The collapse in volatility since 2012 seems to resonate with the drawn out process of QE in the US and its slow spread across the world. However that era is clearly now abating as this year’s synchronised global growth gradually shifts the debate from looseness to gradual global tightening. And yet fixed income volatility resides on the floor…

Looking at the one year implied volatility on 10 year swaps, the cost of entry seems reasonable even compared to the narrow trading range we have seen this year. That is unless you expect volatility to crash and the trading range to contract even further. With only one Fed hike priced in until the end of 2019 any further contractions are likely to be driven by outright recession. In that case volatility will rise across all asset classes. On the other hand, if our thesis is right, and the market and Fed are too complacent on inflationary pressures, then it is likely that we see more hikes from the Fed alongside yield curves steepening from their currently very low levels. Fixed income volatility will surge. When the status quo priced in is this boring, fixed income volatility really has only one direction it can go.

With inflation still weak and government bond prices unlikely to crack just yet it is too early to seek a short fixed income trade in disguise. In the past, correlations have, just like in the stock market, typically been negative between the price (SPX or Treasury) and the implied volatility (VIX or swaption vol.). Now however the correlation is mildly positive. So being long fixed income volatility is not necessarily the same as being short fixed income. My contention is simply that fixed income volatility has over shot to the downside, that such moments are fleeting and that you are not necessarily dependant on a correction in treasury prices.

Sadly I will be unable to participate with such trades during the next upheaval in global markets with the Fund but I hope that this commentary has at least roused you into contemplating scenarios that are presently deemed less plausible.

It remains only that I thank you for the great honour of having been responsible for managing your capital and to wish you all great financial fortune.

Hugh Hendry and team

Comments »