Things could get interesting for Bitcoin and its crypto-peers as central banks begin to enact long-threatened regulations on digital currencies.

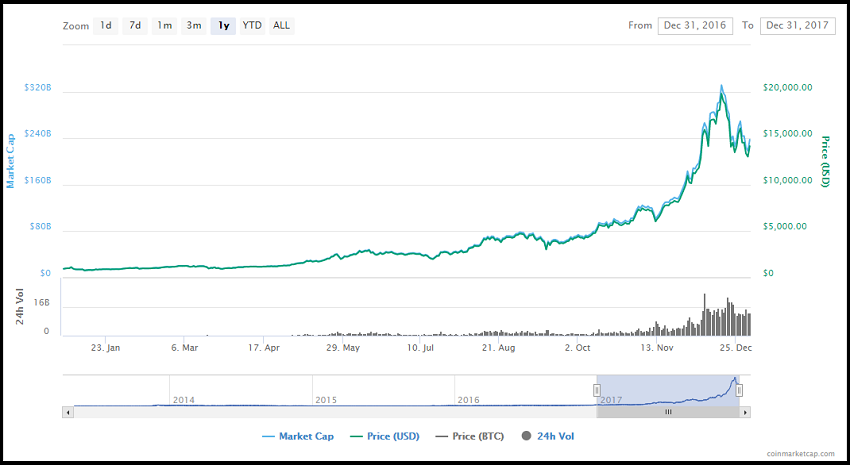

Bitcoin fell more than 11 percent last Thursday after sweeping regulations were announced in South Korea – a country thought to account for around 20% of global bitcoin transactions, though the virtual currency appears to be staging a last minute New Year’s Eve recovery for YTD gains exceeding 1,400 percent.

The new foreign regulations are said to target money laundering and other financial crimes, and include the closure of anonymous accounts next month, a ban on new anonymous accounts, the ability for regulators to close virtual currency exchanges at will.

“Officials share the view that virtual currency trading is overheating irrationally … and we can no longer overlook this abnormal speculative situation,” Hong Nam-ki, the South Korean minister for government policy co-ordination said. Anonymous accounts currently in use will be closed next month, it added, without explaining how it planned to do this. –The Telegraph

South Korea’s announcement comes on the heels of Vietnam’s central bank banned bitcoin as a “lawful means of payment” in October – adding that the “issuance, supply, use of bitcoin and other similar virtual currency as a means of payment is prohibited.”

When the law goes into effect on January 1, 2018 – illegal use of cryptocurrencies will result in fines between 150 million and 200 million Vietnamese dong ($6,600 – $8,800 USD).

Meanwhile, India’s Finance ministry issued an official statement Friday cautioning against trading in cryptocurrencies – likening them to “Ponzi schemes” and suggesting that participants in digital currencies do so “entirely at their risk and should best avoid participating therein.”

“There is a real and heightened risk of investment bubble of the type seen in Ponzi schemes”, which could result in a sudden and prolonged crash, the ministry said, adding that encrypted cryptocurrency transactions were likely used in things such as “terror-funding, smuggling, drug trafficking and other money laundering acts.”

And as we reported on Sunday, Australian banks are reportedly freezing the accounts of Bitcoin investors.

Bitcoin investors are claiming Australia’s banks are freezing their accounts and transfers to cryptocurrency exchanges, with a viral tweet slamming the big four and an exchange platform putting a restriction on Australian deposits.

Due to the Australian banking issues, crypto exchange CoinSpot said it was putting a “temporary restriction on all forms of AUD deposits” that would remain in place until at least the first week of 2018 as a result of issues with Australian banks.

“We assure you we are just as unhappy with the situation as you, but unfortunately Australian banks have been so far unwilling to work with the digital currency industry which leads to frequent account closures and strict limits on accounts whilst they remain operational, in effect debanking our industry,” it said.

In the United States various Central Bank members have cast doubts over digital currencies, while the SEC warned investors on December 11 against putting money into cryptocurrencies.

In May, Minneapolis Fed President Neel Kashkari took aim at Bitcoin, expressing concerns over how easy cryptocurrencies are to create. When asked about the Fed’s position with digital currencies, Kashkari listed the following points (via coindesk):

- The Fed is watching: “This is a topic a lot of people across the Fed are paying attention to and watching how it evolves.”

- His issue is with ‘inflation by altcoin’: “The problem I have [with bitcoin] is while it says, by design, you’re limiting the number of bitcoins that can be created, it doesn’t stop me from creating NeelCoin or somebody from creating Bobcoin or Marycoin or Susiecoin.”

- Blockchain ‘has more potential’: “I would say the conventional wisdom now is that blockchain, the underlying technology, is probably more interesting and has more potential than maybe bitcoin does by itself.”

- The waiting game continues: “I think it’s too early to know where this is going to go … we’ll see – we have a lot to learn.”

In September, Philadelphia Fed President Patrick Harker told a conference that he doubted Bitcoin would ever undermine the U.S. dollar.

“The paper that’s in your pocket, that we call money, only has value because we believe it has value, because we believe the government stands behind it. It’s all trust issues,” said Harker, adding “And so, when cryptocurrencies and other forms of currency emerge, I think the basis of that has to be how do they create that trust?”

Also in September, a trash-talking JP Morgan CEO Jamie Dimon likened Bitcoin to a “fraud” that’s “worse than tulip bulbs,” while also dissing his daughter for “thinking she’s a genius” (buying Bitcoin thousands of points ago).

The only good argument I’ve ever heard … is that if you were in Venezuela or Ecuador or North Korea.. or if you were a drug dealer, a murderer, stuff like that, you are better off dealing in bitcoin than in US dollars, you are better off bypassing the system of your country even if what I just said is true.

There may be a market for that but it’s a limited market” –Jamie Dimon

In November New York Fed President William Dudley said that the Fed is exploring the idea of its own digital currency, while he slammed Bitcoin as “more of a speculative activity,” not a stable store of value.

And when you can’t beat ’em, join ’em – as Goldman Sachs and Silicon Valley elite team up for early adoption of a crypto-future. Last week, Goldman Sachs is in the process of setting up a trading desk to make markets in digital currencies such as bitcoin. The bank aims to get the business running by the end of June, if not earlier, two sources said. A third said Goldman is still trying to work out security issues as well as how it would hold, or custody, the assets.

Meanwhile, Twitter founder Jack Dorsey’s credit card processing venture, Square, announced in November that they are exploring adding Bitcoin to their platform – releasing a beta program for the digital currency on their “Cash” app, and Craigslist recently began allowing sellers to advertise that they accept cryptocurrency as a form of payment – something now illegal in Vietnam, under penalty of up to 200 million dong.

If you enjoy the content at iBankCoin, please follow us on Twitter

If all cryptocurrency investors/traders pledged to buy as much physical gold and silver they could afford and pull all bank deposits if the Government were to shut down cryptocurrency exchanges or hinder peoples’ ability to buy or sell cryptocurrencies in any manner, that might help to prevent them from doing something like that.

D Gartman calling for bitcoin 5K may trump worldwide government regulation. 😉

The financial (((mafia))) does not like competition, obviously.

@ sac the financial (((mafia))) which also stands behind trusts and companies that give you the access to the market to the products like keybord mobile phone or screen from which your typing ,is saying that bitcoin and other coins are created by anyone from nowhere without any kind of history trust -and meaning , aside the blockchain technology – which eventually will be integrated in some other forms of control

its obvious that btc&co is a speculative bubble of thing that have close to novalue .. aparte the aforementioned tech ..which doesn’t imply any creation of money from nowhere and for no reasonable reasons ( 2-3000 digital currancies around as I type )

Inflation is a tax: no new laws are required to make it happen, very convenient, that. Hard assets like gold/silver were the traditional way to combat it, but as is evident from the past, such holdings are easily outlawed with the stroke of a pen.

Enter crypto. No customs official can confiscate it, as they don’t even know where it is. Governments can outlaw it, but only within their borders. Unless ALL governments outlaw it, crypto will always be worth something, somewhere.

The idea of an asset that they cannot control is anathema to government everywhere. They have to trap the citizenry in order to plunder it. A good case study, of precisely that process: http://ferfal.blogspot.com/2009/08/royal-scam.html