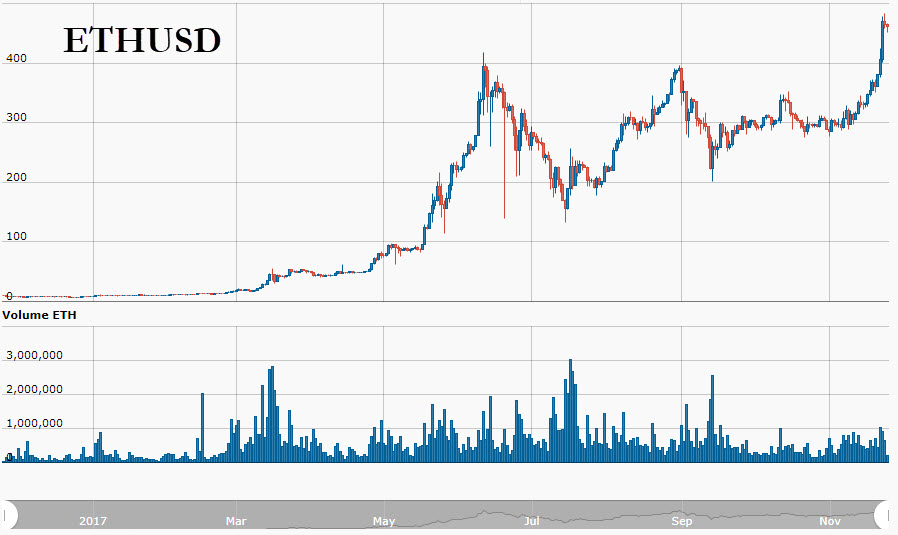

As Bitcoin reaches hyperbolic levels of insanity and smug crypto investors at coffee shops across the nation let everybody know about it, signs are emerging that we’re approaching a blow-off top.

I've been watching charts for some time now but haven't seen a slope as vertical as Bitcoin's. Price just cleared $9,500 pic.twitter.com/oQbd8aZrVN

— David Ingles (@DavidInglesTV) November 27, 2017

Demand for the crypto currency is being fueled in part by news that Mark Zuckerberg’s Square payment gateway is exploring adding Bitcoin to its platform, while the Chicago Mercantile Exchange (CME) rolls out Bitcoin futures – opening the door to Bitcoin-tracking ETFs.

Signs of a top?

Not one, but two aging baby boomers in my extended family emailed me over the weekend about buying Bitcoin. Historically, this has been an excellent sell signal for whatever Porter Stansberry type of investment they’ve just been spooked into.

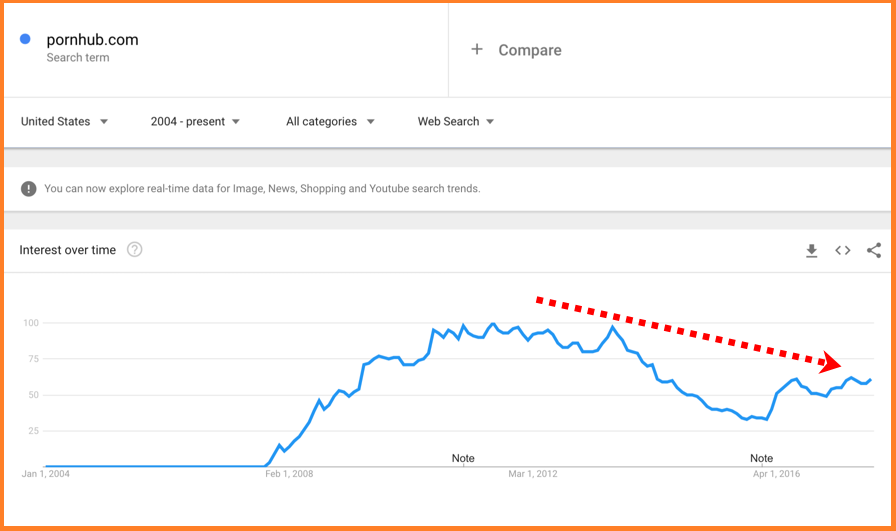

Aside from that, CNBC’s Jeff Cox reports that the google search term “buy bitcoin with credit card” has reached historic highs.

The quest to find whether cryptocurrency bitcoin is in a bubble could be found on search engines, where one bubbly sounding term is on the rise.

Google Trends says the search term “buy bitcoin with credit card” is around its historic peak, notes Nick Colas, co-founder of Data Trek Research and the first Wall Street analyst to take the digital currency seriously. –CNBC

In other words:

CNBC continues:

Other search trends show that bitcoin holds a solid lead in Google quests for digital currencies, even though it has a growing list of competitors. In all, 15 cryptocurrencies now have market valuations above $1 billion, according to CoinMarketCap. At $162.4 billion, bitcoin is more valuable than the next 70 or so competitors combined.

Colas said bitcoin “still holds a strong lead in terms of global attention in crypto-land.”

Bitcoin also has come in from the shadows in terms of the attention it’s getting on Wall Street. Investing heavyweight Michael Novogratz, head of Galaxy Investment Partners, thinks bitcoin will hit $10,000 before the end of the year, and Tom Lee at Fundstrat has a mid-2018 price target of $11,500, nearly double what it was in mid-August.

But Mitchell Goldberg, head of ClientFirst Strategy, told clients he’s skeptical and sees the bitcoin craze as analogous to the dot-com bubble and a sign that “we’ve entered the final and stupidest part of the bull market.”

Comments »