With the S&P at record highs and volatility in the doldrums, Reuters reports that U.S. equity options data suggests that investors are becoming more cautious.

Via Reuters:

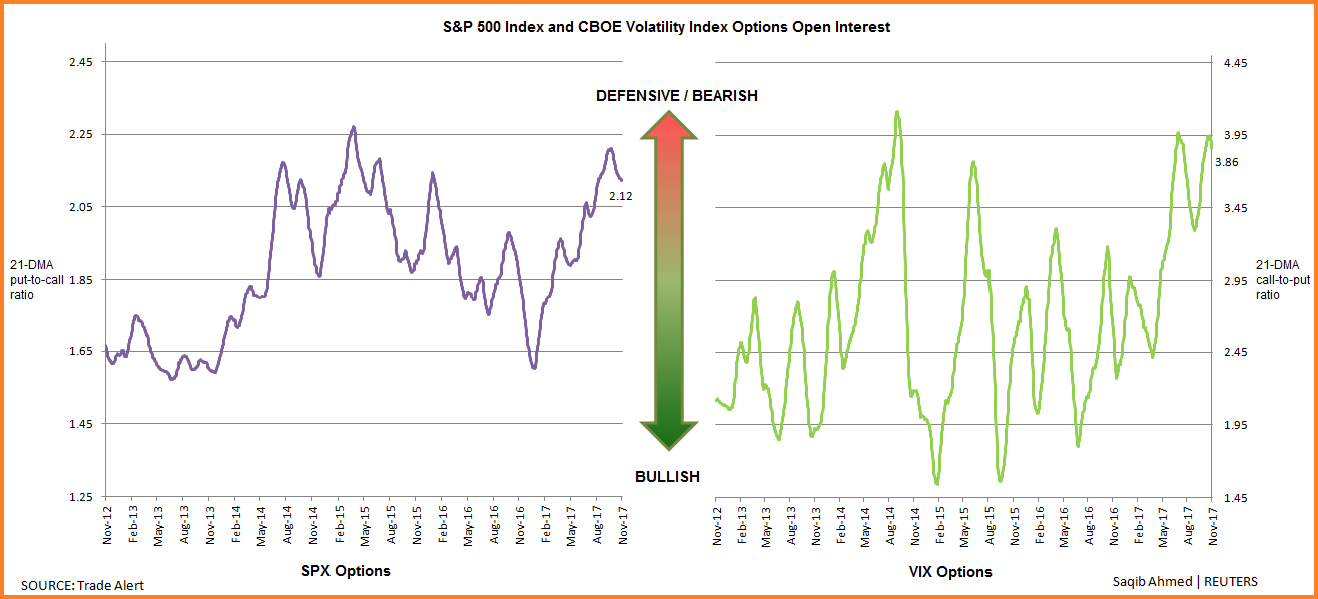

Positioning in options on S&P 500 index .SPX and CBOE Volatility Index .VIX shows investors have been gradually adding to hedges over the last few months.

“We didn’t see it on our desk and no one seems to care much about hedging but somehow it’s happening,” said Jim Strugger, derivatives strategist MKM Partners in New York.

The S&P 500 index .SPX has climbed 16 percent this year and is on pace for its eighth straight month of gains, the longest such streak since just before the 2007-2009 financial crisis.

Some investors warn that heightened reliance on strategies that profit from continued calm in stocks, and months of frustration over hedges that have gone to waste while the market powered on, have left the market extremely vulnerable to a shock.

Reuters notes that the put/call ratio for S&P 500 index options is at 2.1 – approaching the highest it’s been in years. Meanwhile, the call/put ratio for VIX options are once again at Aug 2014 levels.

VIX options also show similarly elevated positioning in out-of-the-money VIX calls – contracts that are not profitable yet would reap gains if volatility spikes.

“When open interest on VIX out-of-the-money calls is really high, I would tend to think that the market is more aggressively hedged,” said Aashish Vyas, director of portfolio strategy at Durango, Colorado-based Swan Global Investments.

“To me, that matters more than the absolute level of the VIX,” he said. –Reuters

Don’t get complacent

Participants at the Reuters Global Investment 2018 Outlook Summit in NY said one of the largest worries that should on on investors’ minds is boom-time complacency.

“I don’t think the market is complacent,” said Joe Tigay, chief trading officer at Equity Armor Investments in Chicago.

That is a departure from the pre-crisis period when investors demanded relatively similar returns for taking on one-year and one-month volatility risk, essentially betting that the state of calm would persist into the future, the researchers said.

They added that the shift in the pricing of risk, despite the low level of the VIX, showed that investors may not be so complacent after all.

I dunno why everyone’s so worried; considering that the Fed is going to buy stocks and Corporate debt the next time SHTF, plan on everything going up forever. You can think about how the Fed saved the world over your $50 hamburger.

They should take those tech companies out of the sp500 and see what happens. or just rename the sp500 fagman 5.

>You can think about how the Fed saved the world over your $50 hamburger.

True, the Fed was there after 9/11 and 2008 to basically save the world as Americans know it.

Next recession/slow down will likely not be that gnarly, Fed may cut rates at leave it at that.

Solid post, looking forward to reading more from you