Originally published by ZeroHedge

Update: Bitcoin has continued to soar intraday – now topping $9,300 – with a total market cap over $156 billion, leaving the cryptocurrency worth more than Merck, Disney, and GE.

Coinivore notes that the digital currency, once a toy for computer nerds, is now soaring in price, triggering a new gold rush. Is it just another bubble, or a glimpse into a radically different financial future?

As Rick Falkvinge, CEO of BitCoin Cash and founder of the Swedish Pirate Party, warns “bitcoin is an extinction-level event for banks” and probably governments too…

* * *

As we detailed earlier, less than 24 hours ago, we noted that Bitcoin had broken above the recent resistance level around $8,300 and hit a fresh all time high of $8,650, observing that the world’s biggest cryptocurrency by market cap is now rising at a pace that has put the $10,000 price target by both Mike Novogratz (and Jose Canseco) firmly in its sights. It didn’t take long however for bitcoin to find a new round of eager buyers, and in early Asian trading, a burst of buying out of Korea’s Bithumb exchange, has sent bitcoin surging another several hundred dollars higher, and around midnight ET bitcoin had surpassed $9,000, sending its market cap to $150 billion, making it more valuable than corporations like Siemens, Mastercard or McDonald’s.

The sharp gains come as the combined market capitalization for all cryptocurrencies also peaks at new highs – currently standing at just shy of $300 billion.

At this rate of appreciation, the crypto may hit the key psychological level of $10,000 in under a week. Needless to say, the long term chart is about as exponential as it gets, so as usual, buyer beware.

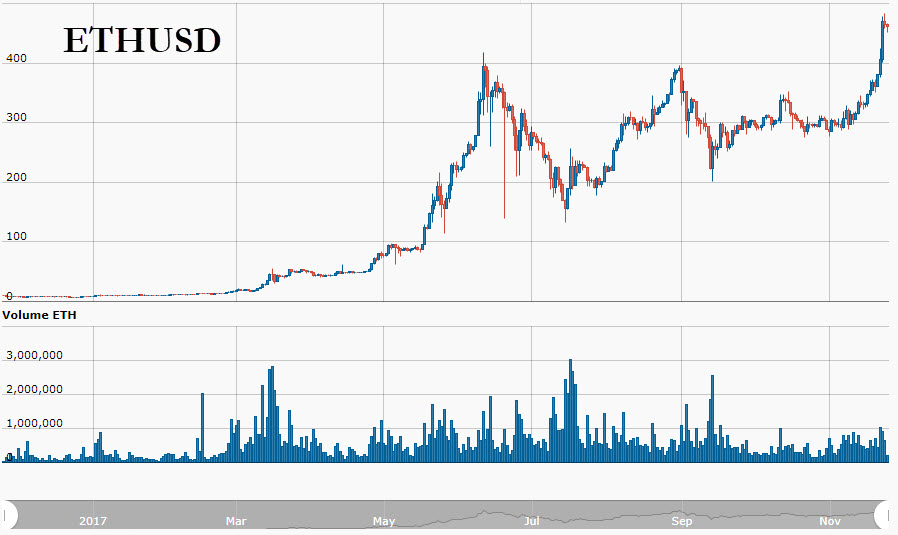

Bitcoin started the year just above $1,000, and the YTD gain is now over 900%, which however pales in comparison to Ether’s nearly 5,000% YTD return and Litecoin’s 20x.

However, it’s not just Asian demand as CoinTelegraph reports that in a sign of growing mainstream acceptance, digital currency exchange Coinbase now boasts more accounts than brokerage firm Charles Schwab.

According to its website, Coinbase has 13 mln users while the number of Schwab brokerage accounts stood at 10.6 mln as of the end of 2016. These numbers don’t paint a complete picture, since the amount of assets controlled by Schwab certainly vastly exceeds those of Coinbase users. Nevertheless, the actual number of users indicates a massive volume of adoption, as the public begins to dabble in cryptocurrencies. Coinbase user numbers have grown by 167% this year.

One month ago, Mike Novogratz was the first to predict a $10,000 price in 6 to 10 months. It may come in that many weeks instead. As a store of value, Novogratz likened bitcoin to digital gold, and said the technology is beginning to make “more and more sense” as we move increasingly into the digital. Novogratz continued to say that, while bitcoin is a bubble, the mania is justified, because it is a technological advancement that promises to fundamentally alter our lives.

“I can hear the herd coming” Novogratz said.

And bubble or not, Novogratz concluded eloquently on the extreme nature of cryptocurrencies’ potential…

“Remember, bubbles happen around things that fundamentally change the way we live,” he said. “The railroad bubble. Railroads really fundamentally changed the way we lived. The internet bubble changed the way we live. When I look forward five, 10 years, the possibilities really get your animal spirits going.”

Bitcoin is set to become “the biggest bubble of our time,” he added, and could reach $10,000 very soon due to fast-building interest. In retrospect, he may be right much faster than even he anticipated.

If you enjoy the content at iBankCoin, please follow us on Twitter

Never give your money to someone already richer than you.

This is click-bate.

How the hell is this and “extinction” level event” for banks?

Answer = It’s not

Bitcoin is stupid & people predicting shit about it are morons.

Butthurt much, ProBucks

this is the stage of the tulip, ehm, bitcoin mania when dumb money pours in.

Useless. was 3500$ 90 days ago. expect it to get crushed back down any time now.