Originally published by ZeroHedge

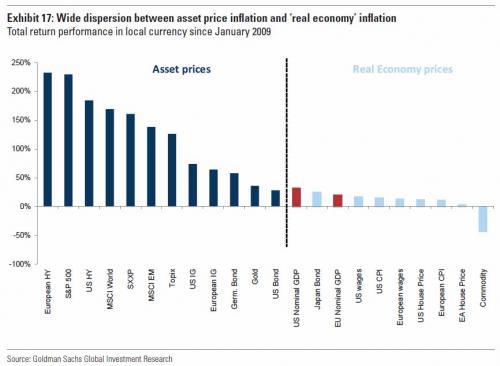

While the Fed may still be confused by the lack of inflation, if only in the “real economy”, if not in financial assets, increasingly more analysts have realized that what the Fed has done is tantamount to blowing an roaring inflationary bubble, if largely confined to the realm of asset prices. And while we used a Goldman chart to demonstrate this divergence a little over a month ago…

… now it’s JPMorgan’s turn to undergo the proverbial epiphany.

In a note from JPM’s Jan Loeys, titled “Financial overheating a problem yet?”, the strategist writes that “growth-sensitive assets, such as equities, credit, cyclicals, and commodities continue to gain and outperform, keeping us comfortably in the Growth Trade. Growth prospects have been rising and accelerating over the past two months from the only slow and dispersed upgrades of the previous 12 months. By now, we are in a full-fledged and globally synchronized move up in growth optimism.” Perhaps, but there is a catch as JPM unwillingly concedes:

The speed of these upgrades and asset price rallies is both exhilarating and scary. The faster we rally, the greater the joy, but the more one should be worried about the eventual reckoning. How far from now is that and what should we do about it?

JPM’s answer to this rhetorical question is ambivalent: while the largest US bank says that the current rally still has upside, it quietly advises its clients to start selling.

We stay in the Growth Trade as we believe that the steady upgrading of growth prospects and asset price moves is still benefiting from greater positive feedback loops and that the negative feedback from economic and financial overheating are both still too weak or too far off. At the same time, the speed of the rally is inducing us to start trimming slowly, through going neutral on HY.

Going back to the top chart, JPM then distinguishes between economic and financial overheating:

Economic overheating to us means that as companies start spending more, they eventually push up input prices – wages, resources – and the cost of borrowing, which all eat into profits and then future capital spending, making the economy vulnerable to the downside. The good news here is that so far, these negative feedback forces remain quite weak with even today’s US Jobs report showing no wage pressures. Corporate bond yields are down on the year, oil is flat and only industrial metals are up a lot, but that is too narrow to drive company costs.Financial overheating, in contrast, is well advanced and feels so late 90s, that it merits monitoring a lot more closely for signs of bubble-trouble.

JPM then goes so far as suggesting that the asset bubble is closest to bursting in the US: “The country to focus on for signals of financial bubble risk is the US, because its expansion is much further advanced than that in other large countries, and because dollar assets make up half of all investable assets in the world.”

Here’s why JPM, along with everyone else, is worried the financial bubble is on the verge of bursting:

The signs of financial overheating in the US can be seen from elevated equity multiples, which for the S&P500 reached 24 on a trailing reported GAAP basis, the same as in 1997; new cycle lows on HG spreads and lower than the last cycle lows when adjusted for maturity and ratings changes; HY yields below 6%, which cannot be called high yield anymore; US Households with a higher share of equities in their financial assets than anytime except 1999-2000; and US household confidence back to the highs of the 90s, and their unemployment rate back to the lows then.

JPM eases client concerns, claiming that at least for now, the feedback loops of the bubble’s melt-up phases are self-reinforcing in a positive feedback loop:

The immediate impact of asset price inflation, and rising confidence and risk investing is to actually boost the positive growth shock that started it, reinforcing and providing positive feedback which in turn feeds risk asset prices further.

However, this benign initial state is unstable:

The reason we monitor financial overheating closely, despite its initial reinforcing impact, is that the last few cycles have shown that it leads to excesses that eventually make the markets and economy vulnerable to any setback, innocuous as the setback may be initially. The low vol and easy money environment of the current cycle, both at historic extremes, are a perfect breeding ground for financial excess. Simple leverage and low risk premia signals are to this analyst not the most worrying areas.

And then the best phrase perhaps ever penned by a JPM analyst, one who may have been watching Stranger Things a little too much in recent days: beware the shadow world.

It is instead the stuff we can’t see, hidden in the shadow world, outside the control of the regulators, as well as the economic and financial innovation that in the end leads to extremes.

Following these rather explicit warnings from JPM about the risk of “financial overheating”, the bank has some advice for clients on what they should do next:

What should investors do about the risk of financial overheating? There are in principle three options: i) full speed ahead with risk assets, but run fast away at the first sign of serious trouble; ii) start trimming and hedging risk asset positions; or iii) cut now and move to cash as the eventual correction will be ugly. We choose the middle road, and have started trimming, despite remaining net long the growth trade.

- The first approach – pedal-to-the-metal and then brake all you can when trouble is in sight – requires ultimate timing, is vulnerable to head-fakes, and is challenged by the fact that is analyst did not react fast enough in 2000 and 2007.

- The last option – to cut and run fast now – faces the risk that the market and economy may still only be in 1997, and could thus miss the doubling of the equity markets that was still coming.

- Hence, our preference to dollar average over the next year or so into a more neutral, and eventually defensive risk position. Some of that can be done by slowly building downside protection through 3-year out options, during

periods of extreme volatility and good liquidity. Another way is to sell some of the longs in risk assets that do not always perform well late cycle and that are at their most extreme valuation now. For that we selected HY bonds. US HY yields fell this week to under 6%. From these levels, in the past the next 12-month returns were only just positive.

In conclusion: “The rolling fundamentals of earnings and default rates remain positive for HY, but these data are backward looking and do not tell us that much about the future. Our bullish view on growth and the rising odds of US tax reform keep us long and OW US risk assets, but the challenging value of HY make us prefer equity to credit longs. Go neutral on the HY asset class.”

Be that as it may, it is – as Loeys poetically puts it – all about the “shadow world” from this point on…

If you enjoy the content at iBankCoin, please follow us on Twitter

You want “bizarre”. A small town where people leave the keys in their car. With it running. And the front door wide open. Pedos welcome mats at every front door. Thirty miles from a big city. Fuck that bullshit. Then again. The Fake News loves small towns. No fuck all about them. But love them fake small towns.

Global big money that is in the political “know” is moving their money into the safety of US equities and financials. The 10-yr 2008 contracts expire next year. They are not being rolled over. Big war in ME comes in 2018. Buckle up.

Must’ve been a slow weekend for news huh? JPM financial outlook is pretty BIG IF TRUE. MAJOR. BIG. DEAL.