Despite Jamie Dimon’s best efforts to talk shit about bitcoin – calling the digital currency a ‘fraud, worse than tulip bulbs‘ which governments will undoubtedly shut down, the world’s largest exchange, CME Group, said it plans to introduce bitcoin futures within 60 days.

The move will allow institutional investors a brand new way to tap into the digital currency, as current options are limited.

Bitcoin surged over 4% to record highs on the news before backing off:

Bloomberg reports:

The CME contract will settle in cash and use a daily price from the CME CF Bitcoin Reference Rate, which is supported by digital exchanges Bitstamp, GDAX, itBit and Kraken. Missing from that list is Gemini, one of the other large global exchanges, which struck a deal with Cboe.

A functioning derivatives market could help professional traders and investors access the incredible volatility inherent in bitcoin without having to trade on unfamiliar venues that may risk anti-money laundering and know-your-customer rules. It will also allow traders to hedge their cash positions in the digital currency, which to date has been difficult to do.

“As the world’s largest regulated FX marketplace, CME Group is the natural home for this new vehicle that will provide investors with transparency, price discovery and risk transfer capabilities,” Terrence Duffy, CME’s chief executive officer, said in a statement today.

Bitcoin Investment Trust

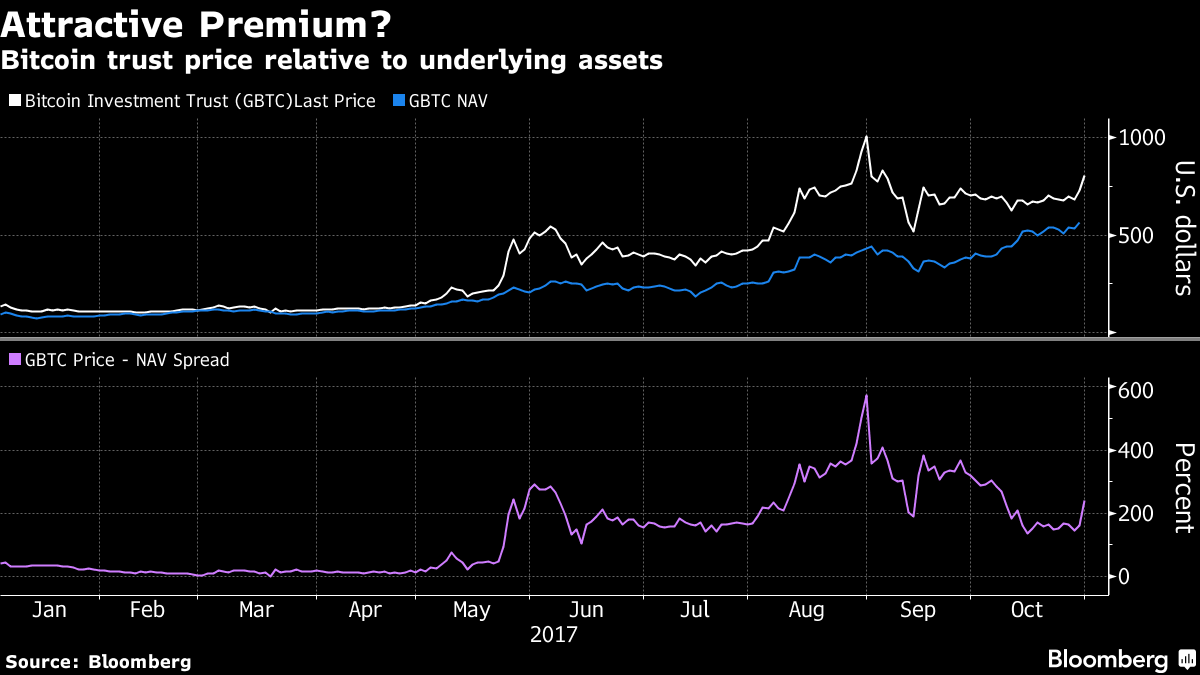

As one of the only bitcoin-backed securities on the market, Bitcoin Investment Trust (GBTC) – which holds actual bitcoin and is a “physical” fund, trades at a 30% premium to NAV.

With the introduction of CME futures, it opens the door to bitcoin exchange-traded funds (ETFs). The SEC rejecte4d a proposal in March by Tyler and Cameron Winklevoss – co-creators of the Gemini exchange – stating that the necessary surveillance was too complicated since “significant markets for bitcoin are unregulated.”

CME is a giant in trading with products including futures on the S&P 500, oil and gold, and customer connections all around the world. The timing of the decision is a bit of a surprise. Just a month ago, CME President Bryan Durkin said on

Bloomberg Television that “I really don’t see us going forward with a futures contract in the very near future,” writes Bloomberg.

Looks like the CME has come to its senses.

CME won’t be the first…

In the race for bitcoin derivatives, both CME and Cboe have lost to a startup. LedgerX won CFTC approval to offer swaps and options on bitcoin and began trading earlier this month. Volumes have been light so far. Yesterday, 103 bitcoin swaps traded on LedgerX, while nine options contracts changed hands, according to the exchange. The LedgerX options trades are physically-delivered, giving investors who hold a contract to maturity the ability to own bitcoin outright.

That said, the CME’s introduction of bitcoin futures is one of the largest, most significant step by a major institution towards legitimizing the digital currency as a store of value – Dimon be damned.

If you enjoy the content at iBankCoin, please follow us on Twitter

People know way more than me on this, but at first glance I’d say this is a game changer. Allowing retailers an ability to hedge future expected bitcoin exposure is a huge step towards making it a legitimate currency.

I can only assume the NAV gap on GBTC will close before these launch. No way they let us plebs in on a guaranteed arbitrage.

Nobody knows how this will end. Nobody. There’s a lot of hype around this. It’s a total gamble.

That NAV gap closing aint a gamble. Free money if you have the ability to pick it up.

Is this the birth of paper bitcoins? And is this a channel for manipulation as per gold. If so expect massive knock-downs from time to time.

@soup, I’m glad you went there. That was my first and initial thought. I just was not sure how that might work with the distributed ledger where all BTC are accounted for. Not like “pretend” gold on Comex and elsewhere.

Now that Wallstreet will be involved in a big way look for a short term blow off top.

Tonka

Could you give a little more info on the NAV gap.

oldmantrader,

Right now there are three ways to get exposure to bitcoin:

1. Buy bitcoins

2. Buy GBTC

3. Buy the equity of a company involved in crypto currencies

Those are in descending order of how well they track the price of bitcoin.

For the average person, bitcoin is difficult to buy, GBTC is very easy to buy, and equities of crypto companies don’t track very well at all (MGTI). Due to the ease of purchase, the price of GBTC is much more expensive than the price of bitcoins. GBTC has traded anywhere from 30% to 100% greater than the value of the bitcoins it currently holds. At a 30% premium, if the bitcoins were sold and the fund shut down, you’d get 70% of your money back.

Enter bitcoin futures. If the futures end up being liquid and accurately track the price of bitcoin (remains to be seen), there would be very little reason to pay a premium to own GBTC. This is especially true if the futures allow an ETF to be created that just holds the futures that accurately track bitcoin.

If all this plays out, the NAV premium on GBTC has to close. There’s no reason to pay a premium if everyone can easily pay less. If you can short GBTC and buy the bitcoin futures, it would basically be free money.