After Bridgewater was called by Jim Grant out for being a potential fraud, the algo-driven hedge fund run by Ray Dalio (who incorrectly predicted markets would tank if Trump won the election) has accumulated a “713 million wager against Italian financial stocks, its biggest disclosed bearish bet in Europe.”

After Bridgewater was called by Jim Grant out for being a potential fraud, the algo-driven hedge fund run by Ray Dalio (who incorrectly predicted markets would tank if Trump won the election) has accumulated a “713 million wager against Italian financial stocks, its biggest disclosed bearish bet in Europe.”

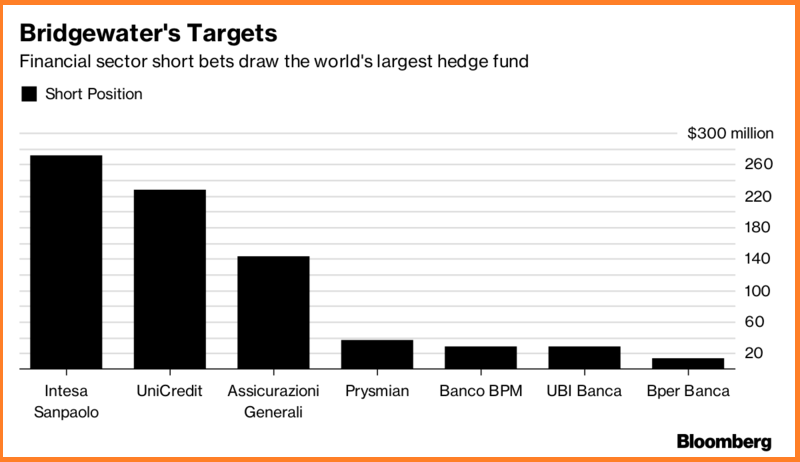

This bet – against five banks and one insurance company, includes Intesa Sanpaolo, Unicredit, and insurer Assicuraziono Generali.

Bridgewater hasn’t disclosed their reasoning for the short positions, however as ZeroHedge notes:

it likely has to do with recent proposed revisions to the ECB’s treatment of bad debt held on bank balance sheets. Under the ECB’s new proposal, banks will have to provision against the entire potential loss on newly-classified nonperforming loans that aren’t backed by collateral after two years. While details are still scarce and the ECB has promised to publish plans for existing bad loans, including “appropriate transitional arrangements,” by the end of the first quarter, Italian banks are expected to be hit hardest by the revised treatment of NPLs.

Why Italy? Because the country’s banking industry remains saddled with €318 billion in bad loans – a third of Europe’s total. Indeed, concerns about the impact of the ECB’s bad-loan proposal on the earnings of European banks, prompted a 7% percent drop in an index of Italian banks in the six days through Tuesday, pulling Italy’s FTSE MIB Index down from two year highs. Italy’s FTSE Italia All-Share Banks Index has dropped 4.5 percent since the ECB’s Oct. 4 announcement that it plans to revise bad loan provisioning standards.

Let’s not forget

Italy’s largest bank, Monte Paschi received special permission from the Italian government and the EU to tap Italy’s Treasury instead of the European Central Bank for an 8.8 billion bailout.

So while the ECB has mandated that banks will need to be able to absorb losses from newly-classified nonperforming loans not backed up by collateral, no guidelines have been issued for existing bad loans – which the European Central Bank has promised to publish.

Scammy Bridgewater?

Jim Grant of Grant’s Interest Rate Observer told Bloomberg he was “bearish” on Ray Dalio’s $160 billion Bridgewater, because the fund has become “less focused on investing, while the firm lacks transparency and has produced lackluster returns.”

More specifically:

- Bridgewater has directly lent money to its auditor, KPMG, to which KPMH’s response is that “these lending relationships . . . do not and will not impair KMPG’s ability to exercise objective and impartial judgment in connection with financial statement audits of the Bridgewater Funds.”

- Bridgewater has 91 ex-employees working at its custodian bank, Bank of New York.

- Only two of Bridgewater’s 33 funds have a relationship with Prime Brokers. In these two funds, Bridgewater Equity Fund, LLC and Bridgewater Event Risk Fund I, Ltd., 99% of the investors are Bridgewater employees.

- Opaque ownership concerns: “Two entities—Bridgewater Associates Intermediate Holdings, L.P. and Bridgewater Associates Holdings, Inc.—are each noted as holding 75% or more of Bridgewater.”

- Why the massive, and expensive, ETF holdings: “The June 30 13-F report shows U.S. equity holdings of $10.9 billion. The top-16 holdings, worth $9.5 billion, or 87% of the reported total, come wrapped in ETFs, including the Vanguard FTSE Emerging Markets ETF, the SPDR S&P500 ETF Trust and the iShares MSCI Emerging Markets ETF. Beyond the fact that Bridgewater reports holding few U.S. equities, you wonder why such a sophisticated shop would stoop to such a retail stratagem. Surely the Bridgewater brain trust could replicate the ETFs at a fraction of the cost that the Street charges.”

- And perhaps most troubling, is the SEC in cahoots with Bridgewater? “Lorenz asked the SEC how Bridgewater’s answers comply with the requirement to “[p]rovide your fee schedule.” Via email, the agency replied, “Decline comment, thanks.”

With its new short on Italian banks – even if Bridgewater redeems itself performance-wise, there are still many troubling aspects of the fund’s relationship to KPMG and the SEC.

If you enjoy the content at iBankCoin, please follow us on Twitter

A hedge fund will not be short w/o having its bets hedged on the long side. What are these long bets? The disclosure of short bets on Italy appears to be intentional.

They have $160b AUM, so yeah – definitely a hedge. Since Italy sucks cock and has had to bail out their largest bank like 3x in the last 18 mos, makes sense.