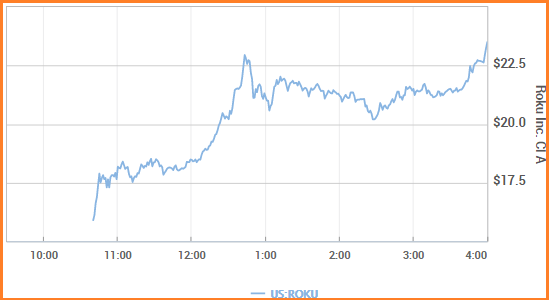

Streaming device manufacturer Roku ($ROKU) sprinted higher in its Thursday IPO. Priced at $14, the company raked in at least $219 million. Shares jumped as much as 68% to close at $23.50, leaving the company with a $2.23 billion valuation.

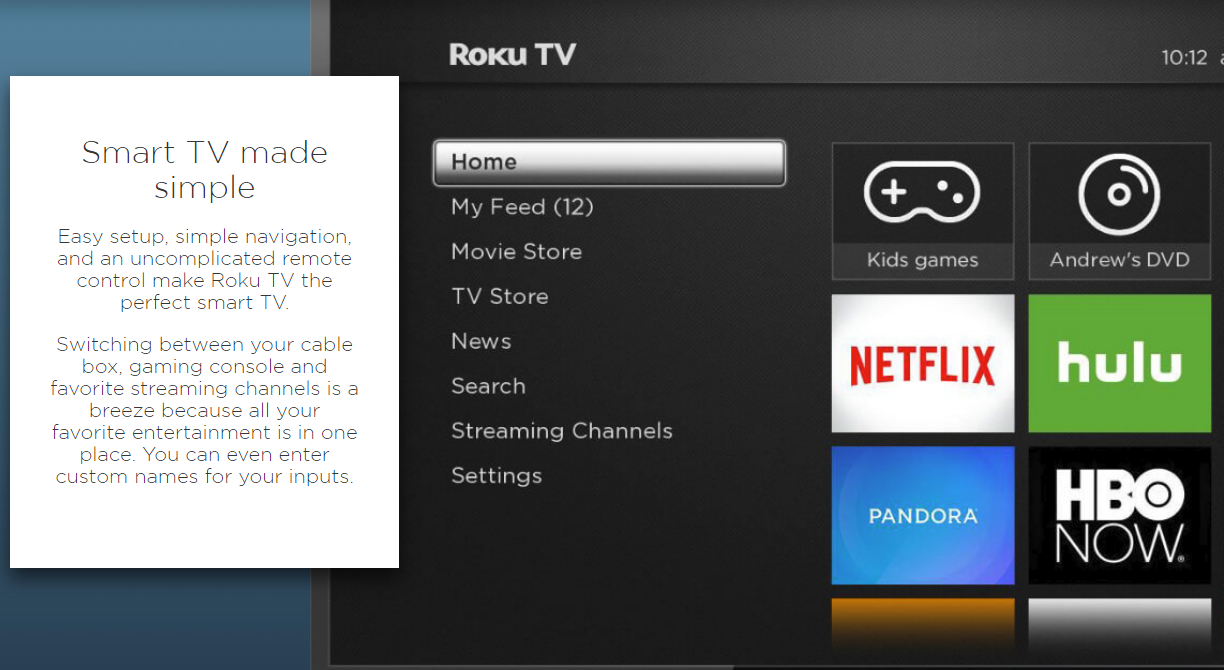

The company which started out as a secret Netflix hardware project, which they still carry, is now directly integrated into next gen televisions from Sharp, Hitachi, RCA, TCL, and several other brands – one of which I just bought two weeks ago to use with an Amazon Firestick and over-the-air antenna.

After firing up the TV – I no longer need the firestick, as the Roku user interface is app-based and can launch Netflix, Hulu, Amazon Prime Streaming, as well as a ton of other ala carte apps such as HBO-Go.

Enough about hardware…

Roku’s software side of the business is growing at nearly a triple-digit clip.

Their operating makes money in three ways – selling ads, revenue-sharing agreements with content providers, and subscriptions purchased via its operating system. They company also makes 5% licensing the technology to others.

“[Licensing fees are] probably the place that has the most significant revenue recognition around it,” said Roku CFO Steven Louden, adding “Our licensing fees—we have multiyear deals with TV brands as well as service operators through our Roku Power program. We actually have almost $70 million in deferred revenue on the balance sheet, which is a lot of value.”

Roku Chief Executive Anthony Wood said in an interview that the company will keep riding the wave of television content moving online and away from the cable bundle.

“When we sign up a customer to a subscription service or Hulu or Netflix, we get a revenue share as well,” Wood said.

Filings with the SEC show sales growth of 91% in the first six months of 2017 vs. last year.

“What’s important in the evolution of the company is the platform business is becoming a greater and greater portion of Roku,” Louden told MarketWatch in a telephone interview Thursday. “It’s now 80% of our gross profit and I think it’s great proof-point for investors about really what the Roku business model is about.”

Industry experts agree – software is where it’s at

With hardware margins shrinking, Roku executives have received praise for recognizing that software and licensing is where it’s at:

“What [executives] were able to do was recognize their hardware business model was not a long-term smashing success and manage to change, and not to have a giant dip in the process moving from the hardware to the platform and have some decent margins along the way,” said Barrett Daniels, Chief Executive of Nextstep, a San Francisco company that helps private firms go public. “The good part of the business is really growing.”

Solid Execs?

Daniels told MarketWatch he was ‘pleasantly surprised’ that according to Roku’s S-1 filing, Roku executives didn’t stuff their pockets with massive stock grants, and the company’s financials appear to be ‘well-managed,’ adding that he thinks the company went public at the right time.

“Unlike Evan Spiegel at Snap—large stock grants are actually pretty common—the executives don’t seem to be robbing the place. I think they’ve done a very responsible job.”

Roku Chief Executive Anthony Wood said in an interview that the company will keep riding the wave of television content moving online and away from the cable bundle.

“When we sign up a customer to a subscription service or Hulu or Netflix, we get a revenue share as well,” Wood said.

Current conditions

In the six months ending June 30, Roku had around 15.1 million active accounts, according to Yahoo Finance, with around 6.74 billion hours of content streamed.

That said, the company has been pumping massive amounts of cash into R&D – posting a net loss of $15.5 million vs. $14.1 million in the same quarter last year.

“I don’t like that they are losing cash, but if you wait for a cash flow positive tech company, you may have to wait for a full solar eclipse to come around again,” said Brian Hamilton, founder of data firm Sageworks.

If you enjoy the content at iBankCoin, please follow us on Twitter

I thought they would be killed a few years back with all the competition from Amazon, Apple and Google. But here they are and they seem to be doing well. Very impressive.

Only in a perverted and inverted market where debt is (((money))) enterprise that is bleeding cash can be successful. This company, along with others in similar position, will not survive the impending crash and debt defaults. Trade accordingly?

one trick pony company. just like fitbit and gopro. the money will be in the short after the pump.