After what may be the largest data breach of sensitive information in history, Equifax is now coming under fire for allegedly scrubbing the background of its (now former) Chief Security Officer’s background, which reveals she had zero formal training in security.

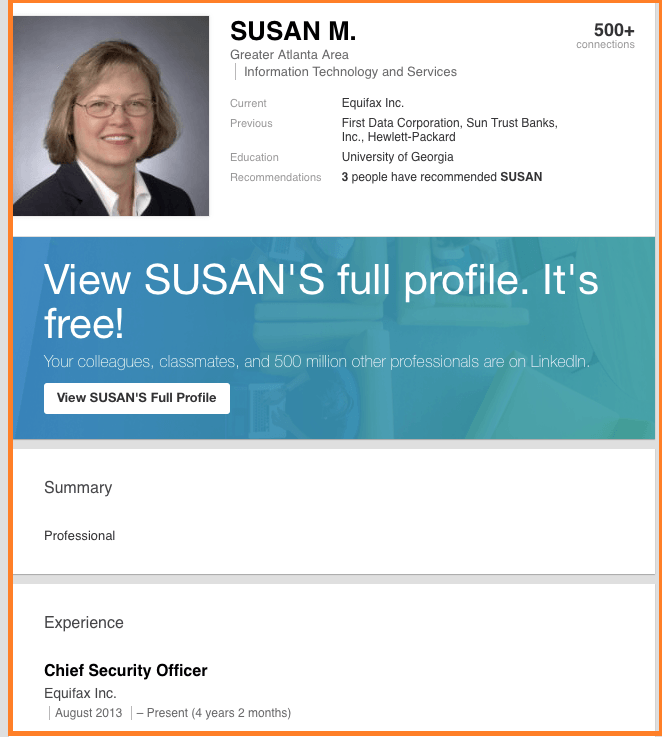

Susan Mauldin, who was fired today, was Equifax’s CSO / CISO since 2013. Prior to that, she served as Senior VP and Chief Security Officer for First Data – and before that, she was a VP at SunTrust Bank from 2007 – 2009.

While Mauldin had been involved in security since 2009, her educational background contains no security or tech credentials. In fact, the woman in charge of safeguarding the information of over 100 million Americans has a bachelor’s degree in music composition and a Master of Fine Arts degree in music composition from the University of Georgia.

Furthermore, ZeroHedge catalogs attempts by “someone” to scrub Mauldin’s background from Linkedin:

As MarketWatch’s Brett Arends writes, “there has been very little coverage so far of Susan Mauldin’s background and training. Given the ongoing disaster of the hack and Equifax’s handling of the affair, the media spotlight has so far been elsewhere.” It now emerges that someone was very keen on keeping as little information about Mauldin’s background in the public domain as possible.

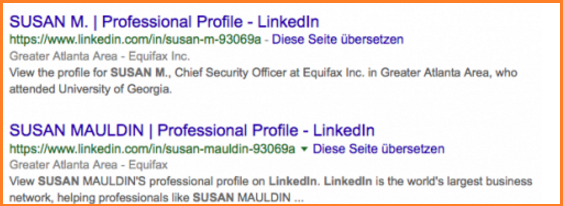

Shortly after the Equifax scandal broke, Maludin’s LinkedIn page was made private and her last name replaced with “M.” Below is a screengrab showing Susan Mauldin’s old and current LinkedIn pages in Google search results as of 9/9/2017.

Mauldin’s original LinkedIn page was on this url before it was made completely private: linkedin.com/in/susan-mauldin-93069a (now a 404 page not found)

A few days after the news of the data hacking broke, the following page reappeared a with a different url, with the specific detail that her degrees were in Music Composition removed. Also, her surname Mauldin was replaced with the initial letter M. to complicate profile discovery.

Additionally, two videos of interviews with Mauldin have been removed from YouTube. A podcast of an interview has also been taken down. As Hollywoodlanews.com reports, in March 2016, Mauldin was interviewed on camera by the CEO of the big-data company Cazena.

The videos featuring parts of an interview with Susan Mauldin, which were embedded on this page, have been taken down as of the afternoon of September 10.

https://www.youtube.com/watch?v=3O-VB09IdHU

https://www.youtube.com/watch?v=w_2ABbwSYbs

A partial transcript of her remarks during the interview have been archived for posterity by a third party. http://archive.is/6M8mg

The full interview videos went far in explaining what may have been the eventual cause of the massive leak of information now gravely affecting 143 million Americans.

The audio-only version of the interview that was publicly available on Soundcloud has also been scrubbed from the web.

If you enjoy the content at iBankCoin, please follow us on Twitter

Old women. What are we to do.

White privilege this time, fer sure!!!

White Privilege is a psyop. Dindu Nuffin is a constitutional crisis.

…but she was a banker, a VP at SunTrust Bank. That explains it.

VP is an entry level position at banks.

Regardless of whether she had formal training in security or not, the fact that they chose to wipe away her history with the company makes this look much worse.

The folks calling the shots at the head of this company are idiots, first for hiring her, then for insider trading on the data breach, and now for hiding her past.

They would have been better off defending her for her experience and acknowledge her success in all of her previous positions. Companies with properly trained and educated security professionals have data leaks and breaches but the way they are going about handling this is fatal.

This company is toast. Short at will. They will never ever recover.

I agree, but they will find an out…

America should never have permitted credit ratings agencies. Three nails in the coffin of freedom: (1) Federal Reserve Bank, (2) Federal Income Taxes and (3) Credit Ratings Agencies. Nothing could be more invasive; a prog murder of Constitutional protections by the 1950’s.

The Supreme Court has found that the Constitution implicitly grants a right to privacy against governmental intrusion from the First Amendment, Third Amendment, Fourth Amendment, and the Fifth Amendment.

Internet surveillance is just a real time manifestation of the illegal privacy invasion that has been ballooning since 1914.

You can of course opt out of credit agencies by simply not borrowing money. After a few years of that your “credit score” goes to zero.

Also, bear in mind you are not the customer of a credit agency–businesses are. You can certainly argue they have no right to your personal information, but O think this is spelled out clearly enough in credit agreements when you sign up for a credit card, take out a mortgage, etc.

Another easy way to stick it to credit agencies is to freeze your credit. In one fell swoop you make it very hard for someone to do much useful with your stolen information, and deprive the credit agency of the revenue from selling your information. If you have been a victim of identity theft / a data breach, if you follow the right procedures you should be entitled to freeze your credit for free, otherwise there is a small fee to freeze it and each time you want to unfreeze it to take out a loan or otherwise apply for credit.

Hell, in their position, I’d try to hide her educational background too. Wouldn’t it be hilarious if it turned out she had the job because of some kind of push to fill her position, or certain high-level positions, with women (not just the general push all companies face to do so, but some kind of internal “lean in” bullshit policy)?

It’s almost as if there are consequences to these policies to hire, promote, and retain people based on identity groups instead of qualifications or skills, where not only do the “wrong” people (white guys) suffer, but so do shareholders in the companies that engage in that crap.

My company by all appearances is putting women in every big leadership position that comes up. Not so convinced it’s based on the best person for the job.