Google parent company Alphabet, Inc. ($GOOG) is reportedly in discussions to invest a cool $1 billion in Lyft, a move which signals support for Uber’s main U.S. competitor – and very likely designed to go hand-in-hand with the Mountain View, CA tech giant’s investments in autonomous vehicles.

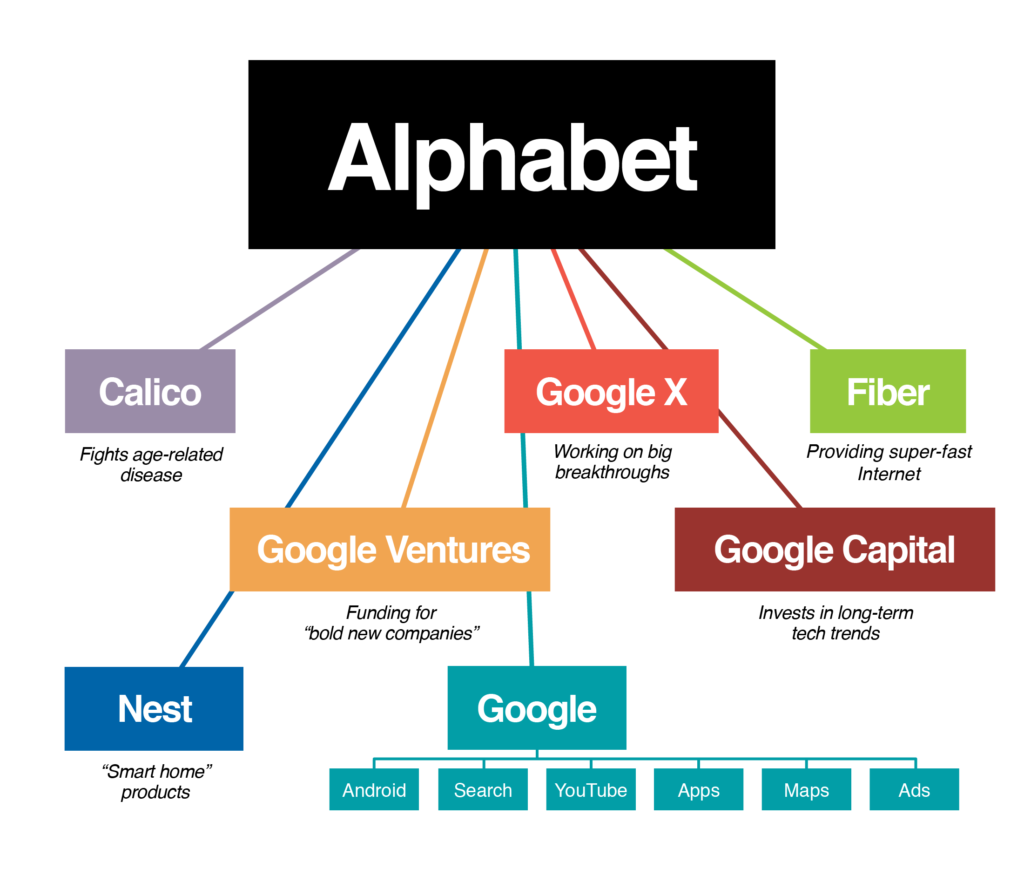

‘People familiar with the matter’ tell Bloomberg said the discussions are private, and the investment may come from Google or Alphabet’s private-equity arm, CapitalG.

E-Cab

Waymo, an Alphabet subsidiary, has signed an agreement with Lyft to test autonomous vehicles together. Although Alphabet is an Uber shareholder through it’s GV venture capital arm, Waymo is currently suing Uber over self-driving technology.

Waymo, an Alphabet subsidiary, has signed an agreement with Lyft to test autonomous vehicles together. Although Alphabet is an Uber shareholder through it’s GV venture capital arm, Waymo is currently suing Uber over self-driving technology.

Via Recode

The self-driving technology arm of Google parent Alphabet, filed the lawsuit in February, alleging theft of trade secrets that Uber planned to use in its autonomous vehicles. The case centers around engineer Anthony Levandowski, who Waymo claims stole 14,000 documents before leaving the company and founding Otto, a self-driving trucking company which Uber later acquired.

If at first you don’t succeed…

Lyft failed to find a taker for a $9 billion buyout in 2016 after shopping themselves to GM, Alphabet, Amazon, Microsoft, and even Apple, according to recode.

While not exactly what they were looking for, Lyft can use an extra $1 billion to pursue more aggressive growth – offering subsidies to drivers, discounts to riders, and marketing. Lyft kicked off an ad campaign this month starring Jeff Bridges.

Lyft co-founder John Zimmer has said financial independence is a priority, however some investors have suggested Alphabet would be a natural home for the ride-hailing startup. Lyft held informal talks with Alphabet and other potential acquirers last year but didn’t pursue a sale.

If you enjoy the content at iBankCoin, please follow us on Twitter

The more Goolag strays away from its core competency (data collection and spying) the sooner the financial hemorrhaging starts.

Sarc – the GOOGL spin off solved for that.

Zero – going back a few posts, what fixed income products? I need to manage a good amount and have nowhere to go other than the obvious. Even more difficult if you need any liquidity. My bond people tell me it is difficult to even find inventory.

It already seems like uber could be the next MySpace in that people are seemingly using it less in favor or Lyft. Folks in SEA consider uber creepy, etc. Lyft is chill if you ask me

Fry, I am having the same problem. I loaded up on a ton of 10yr paper 10 years at great yields and a lot of it’s starting to mature. Inventory and yield both suck right now.

A few ETFs to explore: PZA / EIM / MAB / MFL (insured munis, OK yields), DMB (uninsured munis), NBB / GBAB (build America bonds), PCN (Pimco corp / income, nice yield).

Here are a few cusips you might be able to find, though with dick sucking yields.

Short term

34540UAA7 Baa2 /BBB /BBB Ford Motor Credit Company Sr Nt 2.375%18

40428HPH9 A2 /A /AA- HSBC USA Inc New Sr Glbl Nt 18 1.625 1/16/2018

38141GFG4 A3 /BBB+ /A Goldman Sachs Group Inc Sr Nt 5.95%18, Cond Call

Medium term

26054EAT6 Baa2 /BBB /BBB Dow Chem Co Med Trm Nts Bk Ent Fr 7.75%091520

494550BV7 Baa3 /BBB- /BBB- Kinder Morgan Energy Partners Sr Glbl Nt 24, Cont Call 06/01/24@Par, Make Whole Call

124857AM5 Baa2 /BBB /BBB Cbs Corp New Sr Glbl Nt3.7%24, Cond Put Change Of Control, Cont Call 05/15/24@Par, Make Whole Call

865622BN3 A1 /A /- Sumitomo Mitsui Banking Corp Fr 3.4%071124

I’ve also been shuffling in a few healthcare REITs too – mostly elder care / medical space. Easy pitch to old folks who are paying $5K / month for assisted living. Those places are ATMs and have decent yields.

HCN, SBRA, LTC, HCP, CHKT

Thank you! Will take a look at those cusips.

Last few years, some structured CDs did pretty well, but don’t want to press too hard on those given the equity kicker and where we are.

I like a few of the pimco managed funds and what they are doing with negative duration hedges.

But yeah, not much. Thanks again.

I backed off of Pimco funds after Bill Gross / Mohammed left, but a lot of their products are still kicking ass.

Some of those structured CDs were amazing and unbelievable. I remember a few UBS products were just making weird bets against random indices that had nothing to do with the underlying instrument. I also remember some of the Bear Stearns products ppl got trapped in.

Please let me know if you come across anything decent.

Been in some PE controlled stuff too. MRCC is very well managed and gets you exposure to solid middle market senior and unitranch debt. TCRD is another one. Obviously need to be comfortable with non investment grade. Must have comfort with management teams.