The UK House of Lords just dispensed with the stalling on #Brexit and passed the EU Withdrawal Bill. All that’s left to leave the European Union is for the Prime Minister to invoke Article 50 – which could come as early as tomorrow, though sources at Downing Street say that’s unlikely to happen until the end of the month.

“Parliament has today backed the government in its determination to get on with the job of leaving the EU,” Brexit Secretary David Davis said. “We are now on the threshold of the most important negotiation for our country in a generation.” –BBC

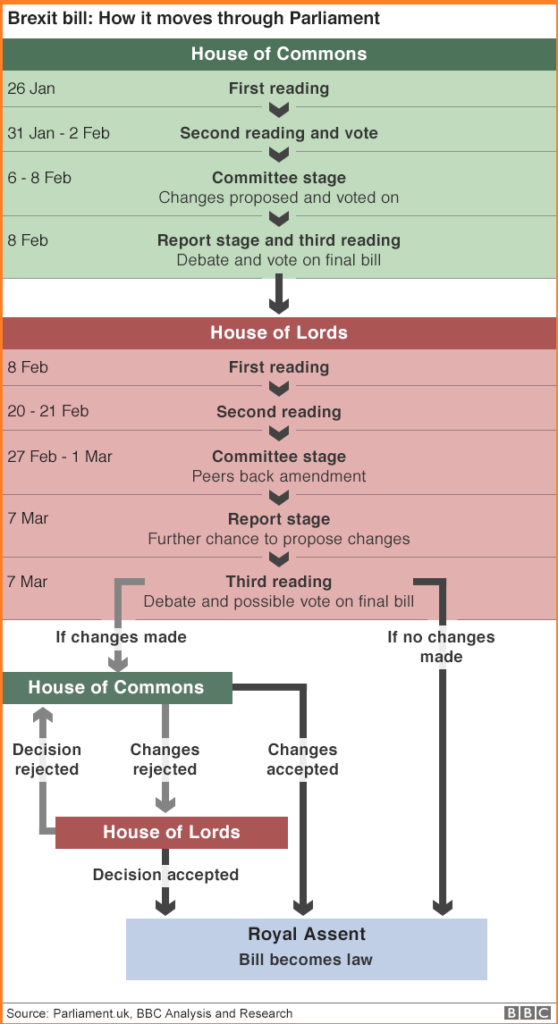

Handy flowchart – we are at the “no changes made” —> Royal Assent stage:

When do we start discussing the realistic implications of Brexit and the potential for Le Pen winning the French election, as it pertains to certain EU death? If you’ve been watching European happenings, Italy voted late last year for a state bailout of it’s lagest bank, bypassing the ECB. Germany’s largest bank ($DB) just announced an $8B Euro cash raise & are folding units into each other – which was supposed to be their “last resort,” again, bypassing the ECB.

If Le Pen gets in, Frexit happens, which will render the ECB limp dicked – along with the Euro.

Also note that Iceland just announced the removal of capital controls put in place after recovering from the 2008 Credit Crisis which wiped out their three largest banks, crashed their stock exchange, wiped out 50,000 Icelander’s savings, and resulted in a shallow economic depression – resulting in the resignation of it’s government.

With the new Rules, the restrictions on foreign exchange transactions and cross-border movement of domestic and foreign currency have largely been lifted. In general, households and businesses will no longer be subject to the restrictions that the Foreign Exchange Act places on, among other things, foreign exchange transactions, foreign investment, hedging, and lending activity; furthermore, the requirement that residents repatriate foreign currency has been lifted.

Iceland’s official reason for the new policy is that their economy is robust enough to withstand another buttfucking, but do you think maybe they’ve been getting calls from nervous rich Europeans looking for currency conversion and a mattress under which to stash their at-risk funds?

Just a guess – if Brexit goes smoothly and Le Pen becomes the president of France in May, I would expect all of this talk of rate hikes to evaporate, and this current yield in US Treasurys and other “safe” paper to be a short lived gift before scared money comes flooding into US assets (best house in a bad neighborhood and all, plus reserve currency status). Nothing in life is free, and the shift from debt-fueled globalist expansion to bilateral trade and nationalism is sure to cause a ton of dislocations. Consider it the price of preserving borders, language, and culture.

If you enjoy the content at iBankCoin, please follow us on Twitter

How come they never flow-charted the Magna Carta Libertatum?

Put Magna Carta on table>

If King John bends over> he lives and Bill becomes law.

If King John doesn’t bend over> we give it to him anyway, and Bill becomes law.

This whole Brexit thing makes no sense. But not much does. House of whores says what. It is Chinatown.

The EUR currency was doomed from the day of inception. That doesn’t mean it won’t trade a lot higher against the dollar before it is pulled from circulation. How this plays out, will be one for the history books.