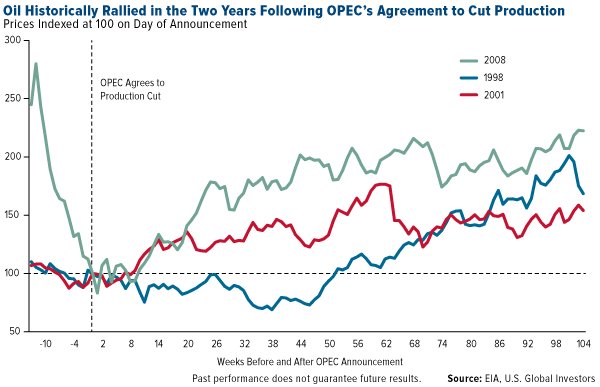

Last week, for the first time since 2008, the Organization of Petroleum Exporting Countries (OPEC) agreed to a production cut of 1.2 Million barrels / day starting in January, sending oil to 18 month highs over $50 / bbl. While it’s excellent to see OPEC working together, it should also be noted that output spiked to record highs right before agreeing to the cut. A bit lame.

In order to encourage non-OPEC oil producers to voluntarily make less money in the short run via limiting production, 14 oil producing nations have been invited to OPEC’s headquarters in Vienna for a hot chocolate and strudel sleepover – the first such sleepover since the infamous production cut of 2008 when those dicks from Algeria and Libya hogged the Xbox ALL FRICKIN’ NIGHT playing Rainbow Six (Gadhafi was coincidentally pwning everyone). So far just four of the 14 non-OPEC countries have RSVP’d for the sleepover: Russia, Oman, Bahrain, and Azerbaijan. Mexico and Kazakhstan are also expected. Putin is expected to officiate the Xbox tournament this time so everyone gets to play a few rounds.

In order to encourage non-OPEC oil producers to voluntarily make less money in the short run via limiting production, 14 oil producing nations have been invited to OPEC’s headquarters in Vienna for a hot chocolate and strudel sleepover – the first such sleepover since the infamous production cut of 2008 when those dicks from Algeria and Libya hogged the Xbox ALL FRICKIN’ NIGHT playing Rainbow Six (Gadhafi was coincidentally pwning everyone). So far just four of the 14 non-OPEC countries have RSVP’d for the sleepover: Russia, Oman, Bahrain, and Azerbaijan. Mexico and Kazakhstan are also expected. Putin is expected to officiate the Xbox tournament this time so everyone gets to play a few rounds.

Per the Wall St. Journal:

“On Saturday, OPEC plans to press its rivals to agree to specific cuts and allow production to be monitored by a committee with three OPEC members and two non-OPEC members.

Their participation is crucial, OPEC officials say. Without it, the oil-price gains of the past week would be imperiled, and the OPEC production deal itself could be severely undermined, OPEC officials said.

Saudi Arabia “absolutely” expects non-OPEC producers to reduce their output, one of these officials said. The kingdom helped orchestrate the first OPEC production cut in eight years by promising that non-OPEC producers would join in.” –WSJ

If oil producing nations fail to reach an agreement and oil falls back into the abyss below $40, expect all hell to break loose as defaults devastate the industry (and it’s huge mountain of debt). Around 20% of high yield bonds are oil & gas related, spread throughout all sorts of pensions, mutual funds, annuities, and other financial instruments, and defaults in the sector are growing.

“Fitch Ratings Inc. released a report Tuesday that said that nearly 60% of unrated and below-investment-grade energy companies are likely to have loans labeled as “classified,” or in danger of default under regulatory guidelines. “It’s grim,” said Sharon Bonelli, senior director of leveraged finance at Fitch.”-WSJ

And

“As of 30 September, the global speculative-grade default rate for the energy and natural resources sector rose to 18.96 per cent – the biggest month-to-month increase in energy and natural resource defaults since May 2016 – driven by an increase in energy and natural resource defaults with seven of the 13 defaults, 54 per cent.” –City AM

Those kind of defaults in a $2 Trillion junk bond market would devastate high yield, along with the little old ladies who were tricked into buying it to boost their very fixed incomes.

Take a look at the effects previous OPEC cuts have had on the price of oil:

Fingers crossed that that those spawn campers from Kazakhstan don’t piss everyone off and ruin the sleepover.

Fingers crossed that that those spawn campers from Kazakhstan don’t piss everyone off and ruin the sleepover.

If you enjoy the content at iBankCoin, please follow us on Twitter

This will stick imo. They’re only semi-idiots and they’re time is not done yet.